Ferrous – The correction in iron ore futures continues, with the benchmark SGX iron ore 62% contract having plunged from more than $110 per dmt in July to around $85/dmt recently:

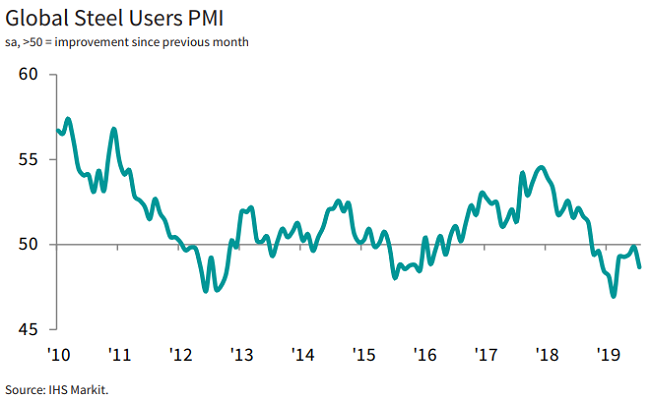

The sell-off in iron ore prices comes at a time of deteriorating steel users PMI. According to IHS Markit, “The start of the third quarter saw a renewed drop in output levels among global steel-using firms, as the rate of deterioration in overall business conditions accelerated for the first time in five months. Demand fell at a solid pace, leading to weaker input buying and lower stock levels. However, selling charges rose at the quickest rate since last October. The seasonally adjusted Global Steel Users Purchasing Managers Index™ (PMI) – a composite indicator designed to give an accurate overview of operating conditions at manufacturers identified as heavy users of steel – fell from 49.8 in June to 48.7 in July, signaling a quicker deterioration in operating conditions, albeit still modest overall.”

On the ferrous scrap front, the U.S. Census Bureau reports ferrous scrap exports from the United States (excluding stainless steel and alloy steel scrap) during the first half of 2019 fell 3.8% to 7.66 million metric tons as compared to the first half of 2018. While ferrous scrap exports to Turkey reportedly rose 6.6% in the first half of the year and demand improved in S. Korea, Bangladesh, Vietnam, Malaysia, and Saudi Arabia, this was more than offset by reduced trade with Taiwan (-15%), Mexico (-36%), India (-28%), China (-92%), and others.

Fastmarkets AMM reports their “assessment for the steel scrap No1 busheling, index, delivered Midwest mill, settled at $297.25 per gross ton on Monday August 12, up by 8% from $275.27 per ton in July. The steel scrap shredded, index, delivered Midwest mill, increased by 9.5% to $277.85 per ton from $253.67 per ton, and the steel scrap No1 heavy melt, index, delivered Midwest mill, rose by 8.2% to $242.08 per ton, from $223.68 per ton in July.”

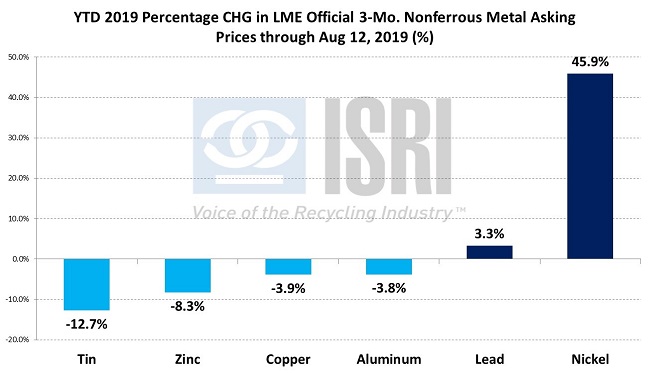

Nonferrous – LME 3-mo. nickel prices surged as high as $16,145 per ton (=$7.32 per pound) yesterday amid continued concerns about Indonesian nickel ore exports. The AME Group reports that “Indonesian nickel miners have raised concerns regarding the government’s consideration of whether to bring forward from 2022 a planned ban on nickel ore exports. The country’s Ministry of Energy and Mineral Resources is in the process of assessing the impact of banning ore shipments earlier than currently planned. Nickel miners have raised concerns regarding the impact on their development plans based on the current 2022 deadline, with upfront investment in mines to generate export cashflows followed by downstream capacity development and that it may see them with essentially stalled smelter developments if they are not completed before any revised deadline. Indonesia is currently limiting ore shipments to companies who demonstrate active development of domestic downstream capacity to increase the level of value add being undertaken in-country to boost the value of exports. Nickel prices have been rallying on speculation the ban could be brought forward.”

So far at the LME this year, nickel prices have outperformed all of the other major based metals, surging 46% higher through August 12th. Of note, the Nickel Institute has estimated that nickel could end up being as much as 80 percent of the battery cell substrate. In comparison to nickel, tin (-12.7%) and zinc (-8.3%) prices have had the worst performances so far this year, followed by copper (-3.9%) and aluminum (-3.8%).

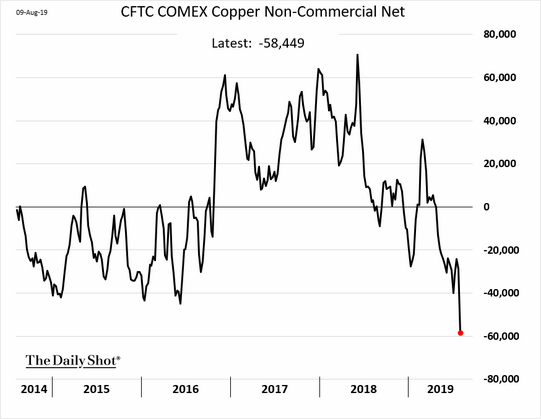

The WSJ’s Daily Shot reports that copper’s subpar performance this year comes amid increasingly bearish net non-commercial length at the COMEX:

Looking forward, Metal Bulletin reports that “German copper refiner Aurubis Group has forecast a continued weakening of the European copper market in its financial statement, reporting a significant drop in earnings as a result of the subdued copper demand across Europe. "Demand for flat-rolled products, especially in the European automotive sector, has been declining since autumn 2018. This is expected to continue for the rest of the fiscal year, [October 1, 2018 to June 30, 2019]," the company said in its half-year earnings statement.”

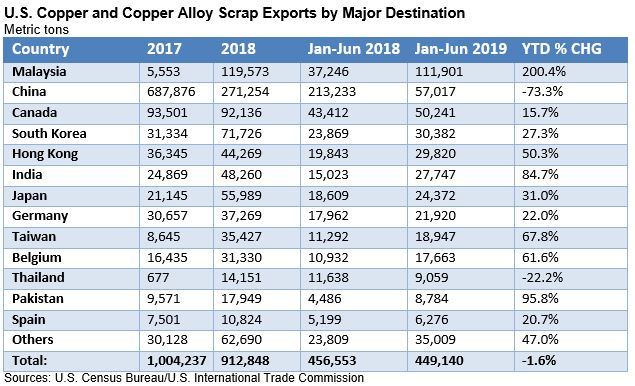

As for the global copper scrap market, the latest Census Bureau data show that the plunge in U.S. exports to mainland China has been largely offset to gains to virtually every other major market this year including Malaysia (+200%), India (+85%), Taiwan (+68%), Belgium (+62%), and Canada (+16%).

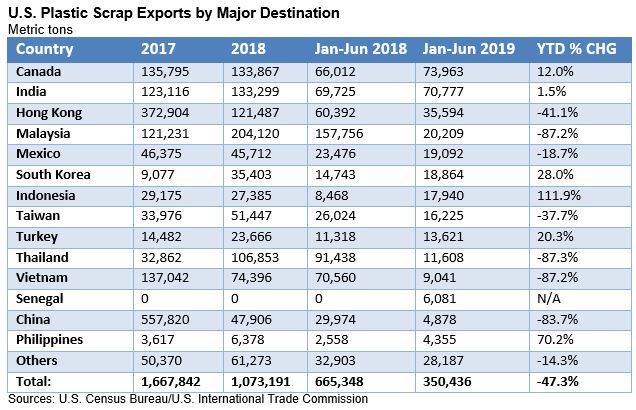

Recycled Plastic – Rounding out the first half 2019 scrap export data for this week’s report, Census Bureau data show U.S. plastic scrap exports plunged 47% lower to just over 350,000 metric tons as shipments to mainland China fell to less than 5,000 tons in Jan-Jun 2019. For comparison’s sake, the U.S. shipped nearly 558,000 tons of plastic scrap to China in 2017. Other significant market losses have been to Malaysia, Thailand, and Vietnam, all down around 87% for the year-to-date. As a result, Canada and India are now the largest export markets for U.S. plastic scrap, each taking in more than 70,000 metric tons in 1H 2019.