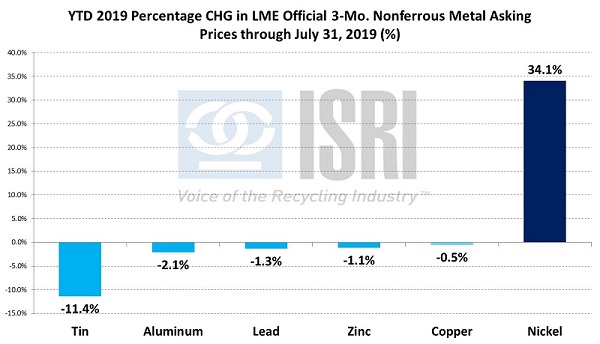

Among the major base metals, only nickel prices were in positive territory for the year-to-date at the London Metal Exchange. So far this year, tin prices have had the worst performance (-11%), while nickel prices have soared 34% higher as compared to the end of 2018.

Nickel futures at the London Metal Exchange traded as high as $15,115 per metric ton in July but have subsequently pulled back below $14,400/mt. But that’s still up significantly from the beginning of the year when nickel prices were trading around $10,500/mt and the best performance among the major base metals so far this year:

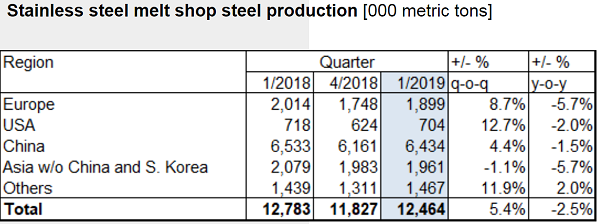

The recent rise in nickel prices comes despite reports of lower stainless steel output in China and globally early in the year. According to figures from the International Stainless Steel Forum, global stainless steel melt shop production declined 2.5% year-on-year in the first quarter of 2019 to 12.46 million tons as Chinese production slipped 1.5%, output in the rest of Asia was off 5.7%, and stainless production in the U.S. was reportedly down 2.0% Y-o-Y in the first quarter.

Looking forward, Macquarie expects “…a stabilization of growth to follow from a Chinese economic stimulus before the end of the year and the normalization of industry stock levels still remains on track to occur over the next 18 months as total market stocks continue to track lower. … A recovery in the stainless market from 2020 onwards, combined with ongoing strong growth in nickel use in batteries for electric vehicles, should push the market back into deficit during 2020-24, leading to higher nickel prices.” They’re projecting average nickel prices of $13,250/mt in 2020, $15,550/mt in 2021, and $17,375/mt in 2022.

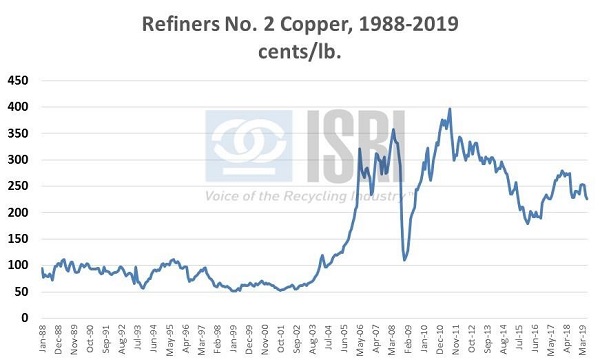

As with other commodities, the current outlook for the copper market is being determined in no small part by the inability to resolve the current U.S.-China trade war. Along with refined copper prices, the trend in domestic copper scrap prices has been somewhat less than overwhelming this year. According to Fastmarkets AMM, the spread for No. 2 copper delivered to refineries has widened from around 32 cents per pound at the beginning of the year, to around 41 cents per pound recently.

Of note, the International Copper Study Group reports that global secondary refined copper production (from scrap) during Jan-Apr 2019 was up slightly (+0.5%) over the corresponding period last year to 1.362 million metric tons.

Here’s a synopsis of the trends in nonferrous metal markets:

- While aluminum has generally been trending downward, there are notable regional differences in pricing, as prices at the Shanghai Futures Exchange prices rose in the first half of the year due to a Chinese inventory drawdown.

- Support for lead prices has been impacted by the US-China trade war as well as subpar car sales. The price status of lead is projected to remain bleak for the near future due to these concerns. Mine incidents and closings in China have only furthered uncertainty.

- Despite two recent multi-year growth periods, the price of zinc began to fall in the last few months and is projected to sink even more. Slower zinc smelting and ingot output rates in China in response to environmental concerns continue to weigh on market sentiment.