It was a big week on the economic front last week given the latest developments on three areas that are critical to future U.S. economic growth: trade, monetary policy, and jobs.

As you may have seen, the latest round of trade negotiations between the U.S. and China didn’t go well last week, prompting the President to announce new tariffs on Chinese imports. As the Wall Street Journal reports, “President Trump overruled advisers to ramp up tariffs on China after a heated exchange in which he insisted levies were the best way to make Beijing comply with U.S. demands… Barring a break in the impasse, the U.S. is now poised to impose 10% tariffs on roughly $300 billion in Chinese imports that aren’t currently taxed starting Sept. 1. Battle lines are hardening in Beijing as well—raising prospects that a deal may be put off until after the U.S. presidential election next year.”

The impacts of higher trade barriers on U.S. and global economic growth has been a major source of concern for central bankers. Last week, the Federal Reserve lowered the target Federal Funds rate by a quarter point, indicating: “In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 2 to 2-1/4 percent. This action supports the Committee’s view that sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain. As the Committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective.”

Investors were less than exuberant at the Fed’s announcement as a few brave souls were expecting a half-point rate cut and others were mostly concerned the Fed will not be cutting rates again anytime soon. The Fed is in a bind here. Not only is the Fed’s independence under political assault, but the high degree of uncertainty on the trade front makes for especially difficult economic forecasting. In light of last week’s unsuccessful trade talks and threat of new tariffs, the Fed’s rate cut might appear to be prescient. But absent the global trade uncertainty, it would be much harder to justify why a rate cut is necessary now.

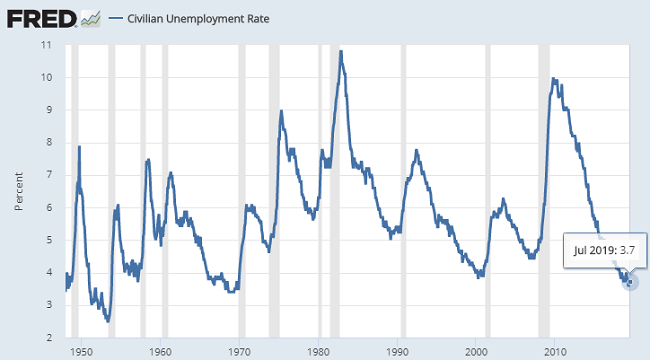

The U.S. Labor Department reported last week that U.S. nonfarm payrolls rose by 164,000 in July while the headline unemployment rate remains extremely low by historical standards at 3.7 percent. Here’s the U.S. civilian unemployment rate going back to 1948, which not only shows how low unemployment is today, but also how consistently recessions (in grey bars) occur following periods such as this:

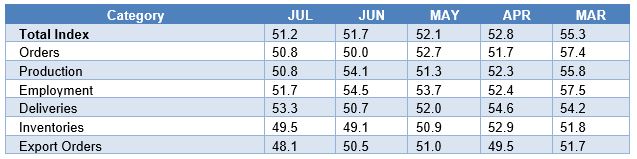

U.S. manufacturing front, the Institute for Supply Management reported last week that their manufacturing PMI reading dipped to 51.2 in July, down from 51.7 in June and the fourth consecutive month of deceleration in manufacturing sector sentiment:

Here’s what some of the ISM survey respondents had to say:

- “General business trends are continuing to show signs of weakness resulting from tariffs and cost impacts of importing and exporting.” (Electrical Equipment, Appliances & Components)

- “All aspects of business remain strong, but we’re starting to see the frictional effect of tariffs on exports.” (Plastics & Rubber Products)

- “We are a third-tier supplier to [a major aircraft manufacturer], and it appears its production slowdown of [an aircraft] is having a direct effect on our slowing orders.” (Miscellaneous Manufacturing)

- “Business has slowed, but it is still steady and expected to pick up next month.” (Machinery)

- “There is a drop in demand for steel products, which has had a major impact on steel prices and the domestic scrap market.” (Fabricated Metal Products)

- “[Automotive] sales continue to decline, and forecasts have been reduced due to softer predicted demand. Attention to product cost — not sales price — is increasing.” (Transportation Equipment)

- “China tariffs continue to be a concern. The uncertainty of future tariffs involving China, Canada, and Mexico is also a concern. China tariffs for electronic parts are averaging 17 percent.” (Computer & Electronic Products)