Perhaps the most exciting commodity news out last week was the opening of registration for the 2019 ISRI Commodities Roundtable Forum to be held in Chicago from September 11-13, 2019.

You are not going to want to miss this opportunity to join professionals and experts from around the world as they share their views and insights into the global scrap markets. Please join us for in-depth discussions and networking opportunities in order to gain a better understanding of where regional and global scrap markets are today, and where they are headed going forward.

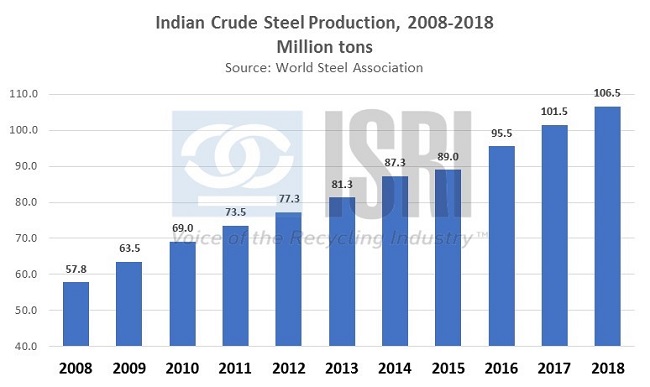

Ferrous – For iron and steel market participants, India, and south Asia generally, has become a key market. Here’s the recent trend in Indian steel production according to figures from the World Steel Association:

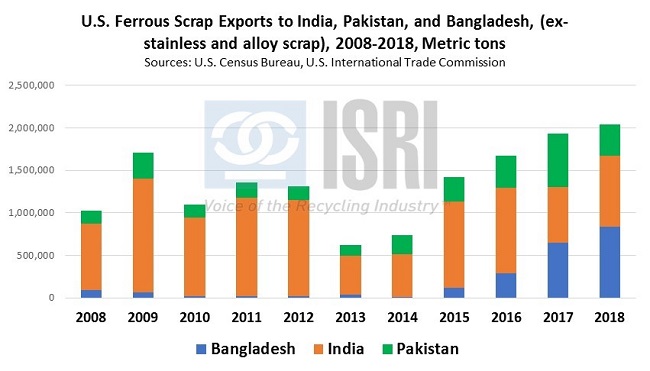

While Indian steel production has increased sharply, Indian demand for U.S. ferrous scrap has been somewhat more volatile. In 2018, U.S. ferrous scrap exports to India were up 27% to more than 830,000 metric tons. But according to the latest trade data from the Census Bureau, U.S. ferrous scrap exports to India during Jan-May 2019 were down 49% year-on-year to around 265,000 metric tons. Meanwhile, ferrous scrap shipments to Bangladesh have surged 22% higher so far this year to more than 347,000 tons through May. In 2014, the U.S. shipped less than 9,000 tons of ferrous scrap to Bangladesh. By comparison, U.S. ferrous scrap shipments to Bangladesh in 2018 approached 834,000 metric tons. Here’s the trend in U.S. ferrous scrap shipments to the major south Asian markets going back to 2008:

Clearly, south Asia is going to be a growth market for ferrous scrap as steel production in the region ramps up. ReMA looks forward to working with our counterparts in the region to make sure that our scrap specifications help to facilitate the trade of high-quality iron and steel scrap between buyers and sellers.

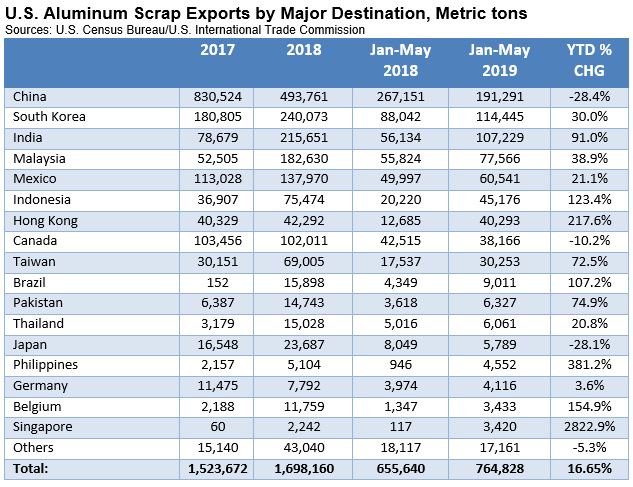

Nonferrous – As reported by Reuters and others last week, “The China Solid Waste and Chemicals Management Bureau, a unit of the Ministry of Ecology and Environment, issued import quotas for another 124,450 tonnes of high-grade copper scrap and 306,930 tonnes of high-grade aluminum scrap. The quotas included allocations for the key metal-recycling province of Guangdong, which had previously received no quotas, as well as quotas for 5,500 tonnes of steel scrap.” (We told you there’d be more quotas coming.)

More remarkable has been how the global flow of aluminum scrap has outpaced the movement of material to mainland China (-28%). Aluminum scrap exports to India are up more than 90 percent this year, along with significant gains to South Korea (+30%), Malaysia (+39%), Indonesia (+123%), Taiwan (+73%), and Mexico (+21%). Overall, U.S. aluminum scrap exports are up nearly 17% this year:

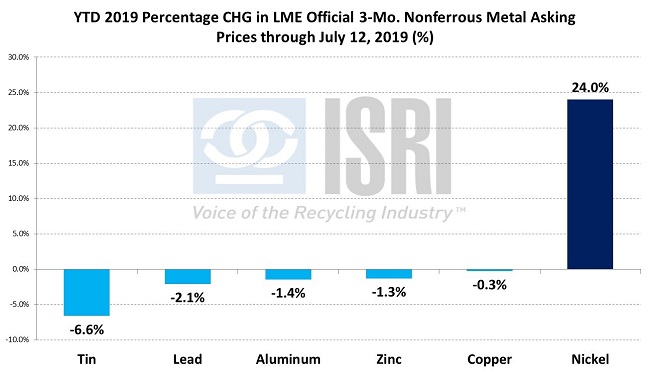

For the year-to-date, only nickel prices are in positive territory in London, with the LME official 3-mo. nickel asking price at $13,300 per ton on Friday, up 24% from the start of the year. Looking forward, Macquarie is bearishly forecasting average 2020 prices of $5,600 per ton for copper, $1,803 per ton for aluminum, $2,063 per ton for zinc, $1,725 per ton for lead, and $13,250 per ton for nickel.

Paper and Plastic –

Far West Recycling is testing out the viability of a secondary MRF system that will take their residuals, and those of four other area MRFs, to run through additional sorting to try and capture more of the difficult materials in their stream. The secondary MRF equipment is being provided by Titus MRF Services, based in Los Angeles, CA. Potential developments out of this type of relationship may include capturing enough marginal profit to help MRFs upgrade their facilities and dispersing risk more evenly throughout the system.