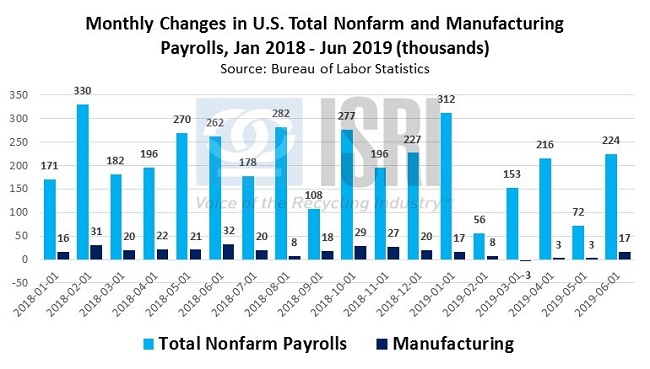

The U.S. jobs report for June came in much better than expected as total nonfarm payrolls rose by 224,000 (against the consensus forecast for a gain of 160,000 jobs) while the unemployment rate was little changed at 3.7 percent.

The Bureau of Labor Statistics reports “Employment growth has averaged 172,000 per month thus far this year, compared with an average monthly gain of 223,000 in 2018. In June, notable job gains occurred in professional and business services, in health care, and in transportation and warehousing.” On another positive note, manufacturing payrolls rose by 17,000 in June following 4 months of stagnant job growth.

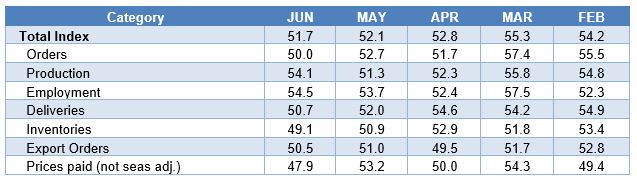

The uptick in manufacturing employment last month comes on top of some mixed manufacturing reports. The Institute for Supply Management reported last week that their reading on manufacturing PMI eased from 52.1 in May to 51.7 in June as weaker readings on manufacturing orders, deliveries, prices, and inventories were offset by employment and production growth:

Here’s what some of the ISM survey respondents had to say:

- “China tariffs and pending Mexico tariffs are wreaking havoc with supply chains and costs. The situation is crazy, driving a huge amount of work [and] costs, as well as potential supply disruptions.” (Computer & Electronic Products)

- “Tariffs are causing an increase in cost of goods, meaning U.S. consumers are paying more for products.” (Chemical Products)

- “Demand for the remainder of 2019 has softened significantly, due to issues in the aerospace industry. The 2020 outlook is looking stronger. Overall, state and local economies remain strong. Recruiting for open positions still requires time to find the right candidates.” (Transportation Equipment)

- “Global demand remains very strong. [We] shifted shipments to China from our U.S. plants to our Canadian and European plants because of tariffs.” (Food, Beverage & Tobacco Products)

- “Tariffs continue to adversely impact decisions and forecasting. Our increasing fear is that current trends will weaken the global economy, influencing our ability to grow in 2020 and beyond.” (Fabricated Metal Products)

- “Business is still strong. Pricing on raw materials has stabilized.” (Plastics & Rubber Products)

- “Business has slowed in the last 30 to 60 days. The last 30 days have tracked 4 percent below plan, but still 6 to 8 percent above the previous year to date.” (Miscellaneous Manufacturing)

We’ve seen lackluster manufacturing reports in other key economies lately, including China. As we reported last week, the Caixin manufacturing PMI fell from 50.2 in May to 49.4 in June, falling below the 50 threshold separating expansion from contraction for the first time in 4 months. According to the IHS Markit press release, “June data highlighted a challenging month for Chinese manufacturers, with trade tensions reportedly causing renewed declines in total sales, export orders and production. Companies responded by reducing headcounts further and making fewer purchases of raw materials and semi-finished items. At the same time, selling prices were raised following another increase in input costs, though rates of inflation were negligible. Business sentiment was broadly neutral at the end of the second quarter, with firms mainly concerned about the US-China trade dispute.”

Despite the U.S. restrictions on Chinese imports, the Census Bureau reported last week that the U.S. trade deficit widened to -$55.5 billion in May while the goods trade gap with China increased to -$30.1 billion. Diminished U.S. scrap export sales to China have not helped the trade deficit: through the first 5 months of 2019, scrap exports to China have been cut in half to less than $950 million, a drop of nearly $1 billion as compared to the first 5 months of 2018:

Of note on the trade front, the EU and Mercosur (Argentina, Brazil, Uruguay, Paraguay) have reached a trade deal to lower commercial barriers and reduce tariffs. Duties on EU exports to Mercosur countries are projected to be cut by $4.5 billion annually. This deal covers a market relationship of 780 million people. According to Eurostat data, the more commonly traded scrap commodities between these markets are corrugated/board and news grades of paper, stainless steel, copper, and aluminum.