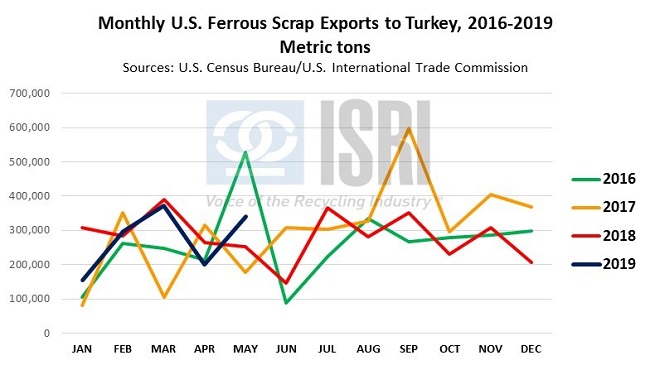

Ferrous – The latest U.S. trade data show that ferrous scrap exports to Turkey rebounded to more than 340,000 tons in May, up from just over 200kt in April. But for the year-to-date, U.S. ferrous scrap exports to Turkey are still down nearly 9 percent.

As a result, U.S. ferrous scrap exports (excluding stainless and alloy steel scrap) were down 11 percent year-on-year during Jan-May 2019. While sales to Turkey, Taiwan, Mexico, and India have all deteriorated this year, those losses have been partially offset by gains to South Korea, Malaysia, Bangladesh, Greece, Italy, Saudi Arabia, and Vietnam.

Here in the U.S., the American Iron and Steel Institute reports that “In the week ending on June 29, 2019, domestic raw steel production was 1,851,000 net tons while the capability utilization rate was 79.5 percent. Production was 1,815,000 net tons in the week ending June 29, 2018 while the capability utilization then was 77.4 percent. The current week production represents a 2.0 percent increase from the same period in the previous year. Production for the week ending June 29, 2019 is down 1.2 percent from the previous week ending June 22, 2019 when production was 1,873,000 net tons and the rate of capability utilization was 80.5 percent.”

Nonferrous – After having opened the week at $2.75 per pound, most-actively traded COMEX copper futures drifted lower over the course of the holiday week to close at $2.661/lb. on Friday. A stronger dollar and rising stock levels were widely cited as sources of weakness late in the week. Closing copper stocks in LME are up by around 170,000 metric tons so far this year:

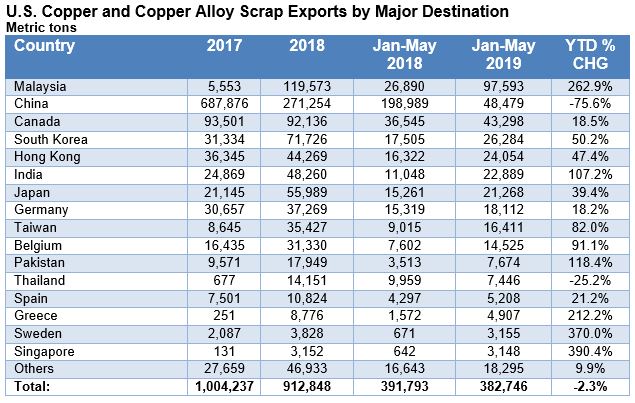

For U.S. copper scrap market participants, China continues to complicate already challenging market conditions. According to Census Bureau trade data, U.S. copper scrap exports to China averaged 12,000 tons per month in Apr-May, up from just over 5,000 mt in January as shippers moved more material ahead of the July 1 deadline. But for the year-to-date, copper scrap exports to China are down more than 75 percent and shipments overall are down 2 percent despite expanded trade with Malaysia, Canada, South Korea, India, Japan, and others. Of note, copper scrap exports to Hong Kong were reportedly up 47 percent during the first 5 months of the year.

As for July, our good friend Ed Meir is projecting copper will trade in a range of $5,800-$6,090 per mt.

Paper and Plastic – BioPappel’s McKinley Paper has made a stronger push into the US box market through the acquisition of a majority share of US Corrugated. RISI Mill Intelligence estimates that that this acquisition makes McKinley Paper the 14th largest U.S. producer in North America with a containerboard capacity of 410,000 tons per year. What this more significantly indicates is the continued trend of supply-chain integration in the paper industry in order to absorb volatile cost centers and improve efficiency.

Companies that produce bottled beverages are facing a shortage in recycled plastic to produce their bottles and meet environmental targets that the general public demands. Secondary sorting has become a viable niche in plastics recycling in Canada. While many would attribute this to EPR regulations, the key motivating point may be the minimum recycled content standards. What this may also point out is the scale in which China was producing recycled resin out of mixed plastic bales.

For more information, please contact ReMA Research Analyst Bernie Lee.