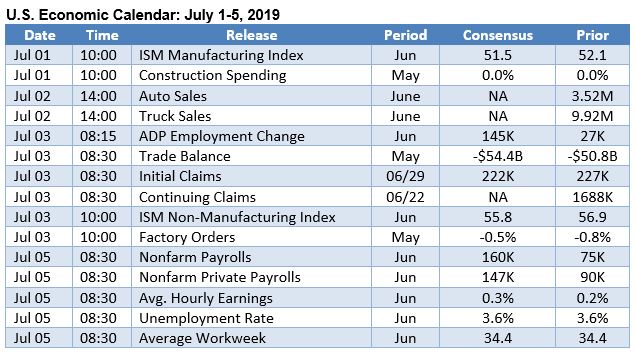

It’s a holiday-shortened week in the U.S. this week due to the Independence Day holiday, but there’s still plenty of economic news for investors to digest. Key U.S. economic reports out this week will cover manufacturing PMI, construction spending, light vehicle sales, trade, along with the big jobs report due out late in the week.

The consensus forecast is that nonfarm payrolls rose by around 160,000 in June while the unemployment rate is expected to remain steady at 3.6 percent. Markets are expected to get an early bounce this week following the U.S-China truce on tariffs announced over the weekend. Markets will also be paying attention to this week’s OPEC meeting, with the Financial Times reporting “Oil ministers meet in Vienna at the start of the week to discuss whether to continue with OPEC’s supply curbs policy. OPEC and allies outside the cartel, including Russia, pledged to cut production by 1.2m barrels a day from January, a level they have since exceeded because of U.S. sanctions against Iran and other supply disruptions.” Overseas, new German figures are due out on unemployment, manufacturing PMI, retail sales, and manufacturers’ orders. In the UK, the race between Boris Johnson and Jeremy Hunt to become the next leader of the Conservative Party and U.K. Prime Minister is expected to heat up. Have a great week and hope you all have a terrific 4th of July holiday!