As reported by the Wall Street Journal, “President Trump and President Xi Jinping of China managed to get trade talks back on track this past weekend, but an even tougher job lies ahead—appeasing hard-line factions within their own governments demanding they give no quarter.

Mr. Xi faces party leaders and executives of state-owned enterprises who believe Washington is out to demolish the government-led economic model that is responsible for China’s emergence as a global power and U.S. rival. Mr. Trump, for his part, faces skepticism from some Republican and Democratic lawmakers who worry he will give up too much in any deal, as well as wariness among some of his own appointees. Heading into an election year, Mr. Trump must also contend with restiveness among his supporters in the business community and farm-belt states who have been hit by the tariffs imposed by both countries.”

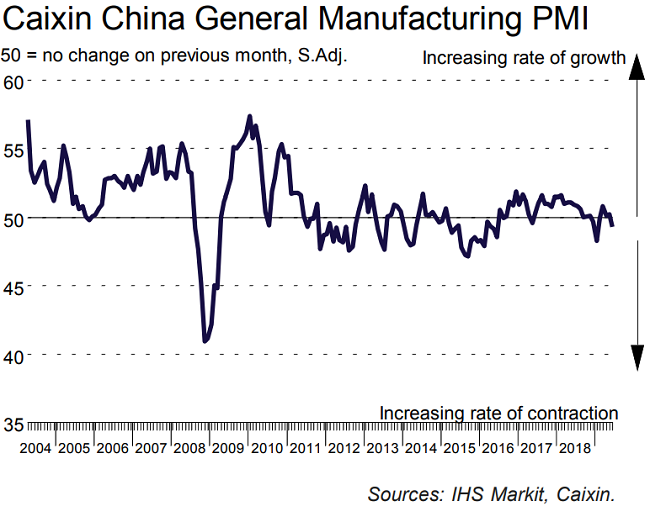

The truce in the tariff battle comes amid reports of slower manufacturing output in China. IHS Markit reports today that the Caixin manufacturing PMI fell from 50.2 in May to 49.4 in June, falling below the 50 threshold separating expansion from contraction for the first time in 4 months. According to the IHS Markit press release, “June data highlighted a challenging month for Chinese manufacturers, with trade tensions reportedly causing renewed declines in total sales, export orders and production. Companies responded by reducing headcounts further and making fewer purchases of raw materials and semi-finished items. At the same time, selling prices were raised following another increase in input costs, though rates of inflation were negligible. Business sentiment was broadly neutral at the end of the second quarter, with firms mainly concerned about the US-China trade dispute.”

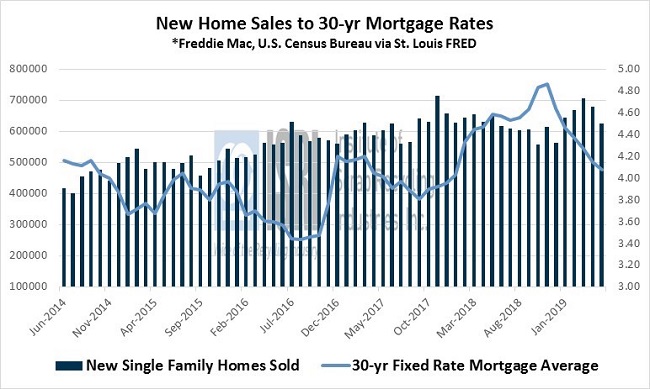

Here in the U.S., new home sales fell below consensus expectations and have bucked the traditional expectation that lower mortgage rates spur new home sales. Mortgage rates have been falling over the last year which prompted buying activity into spring of 2019. As rates continue to fall, however, it appears that home buying is still softening as sales declined to a seasonally adjusted annual rate of 626,000 in May, down from 673,000 in April.

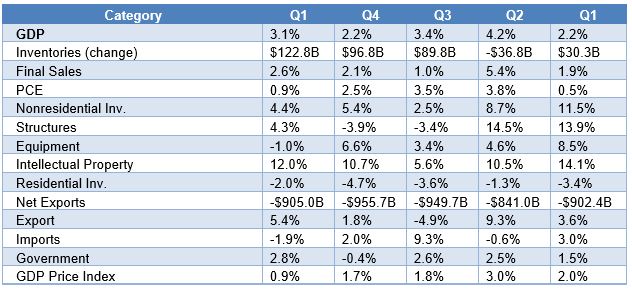

The third estimate of Q1 GDP did not change from the second estimate and firmly puts Q1 growth at 3.1 percent as a slowdown in personal consumption spending (+0.9% vs. 2.5% in Q4 2018) was offset by rising exports (+5.4%), reduced imports (-1.9%), and higher government spending (+2.8%).

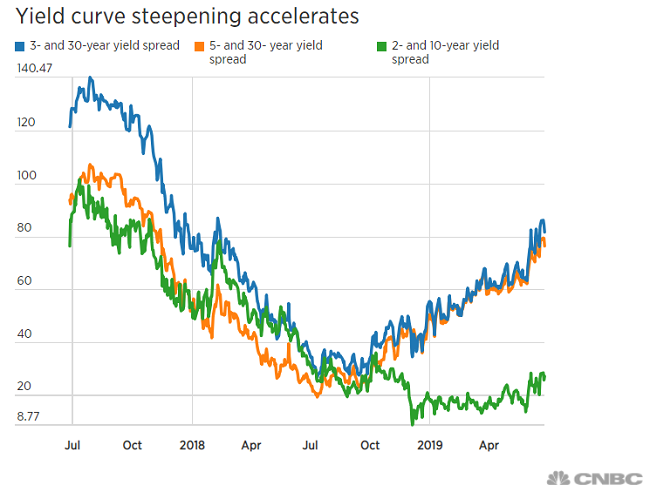

But looking forward, investors remain concerned about uncertainty on the trade and monetary policy fronts and the potential impacts on business investment & economic growth, as evidenced by the steepening yield curves: