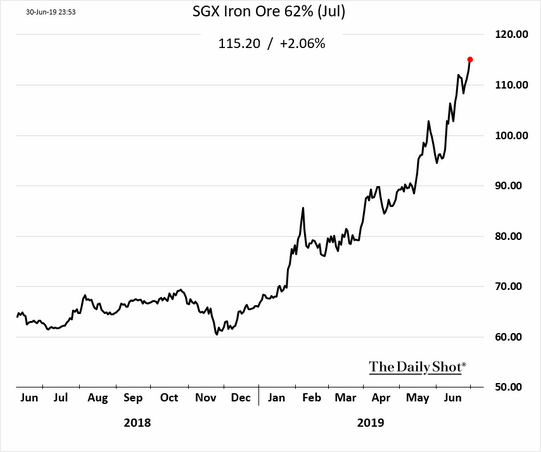

Ferrous – Iron ore prices continue to ramp up to nearly $118 per dmt, a five-year high. The surge in iron ore prices comes as China’s steel production continues to set new records. According to figures released last week by the World Steel Association, China produced 404.9 million tons of crude steel during Jan-May 2019, up 10.2% from the corresponding period last year.

In comparison, U.S. steel production during the first 5 months of 2019 was up 6.2% year-on-year to 37.2 million tons, while TYD Turkish steel production declined 10%, according to worldsteel data. While Turkish ferrous scrap prices have shown signs of improvement recently, U.S. exports of ferrous scrap to Turkey are still down 18% so far this year.

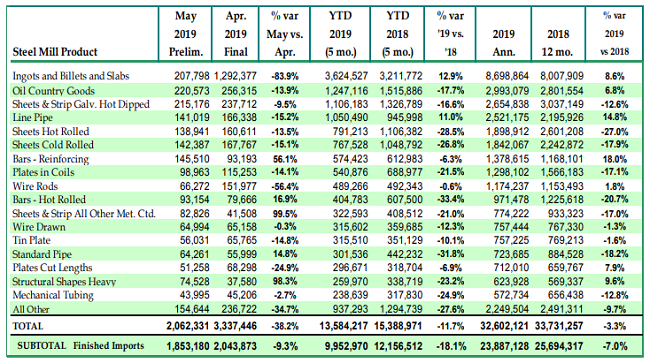

As the summer lull sets in, AMM and other news outlets have been reporting U.S. steel mills are trying to push through a series of price hikes on hot and cold-rolled coil, along with a $40 per ton price hike on tubing. Meanwhile, the import tariffs and competitive U.S. prices have reportedly been disincentivizing steel imports. The American Iron and Steel Institute estimates U.S. total and finished steel imports are down 12% and 18%, respectively, so far this year. Here’s the import breakdown by product from AISI:

Nonferrous – For nonferrous scrap metal exporters, China’s July 1 deadline for import restrictions on higher quality (Category 6) scrap metal is now upon us, but the turmoil in China started well before July 1. As reported in ISRI’s member alert two weeks ago, “A list attributed to the China Solid Waste and Chemical Management center under the MEP was circulated {recently}, indicating severely restricted import quotas for Chinese copper, aluminum, and ferrous scrap imports in the 3rd quarter… Given the uncertainty surrounding what materials will be acceptable for import into China following July 1, the release of the restricted quota list only added to the confusion. Key unanswered questions include whether additional batches of quotas will be announced in the near future, what port regions could be included in future announcements, and the shipment periods for these and additional quotas. For now, the third quarter quotas volumes for the Ningbo and Shanghai port areas appear to be set as follows:

HS 7404000090 (copper scrap): 240,796 metric tons;

HS 7602000090 (aluminum scrap): 54,256 metric tons; and

HS 7204100000/7204290000/7204300000/7204410000/7204490090/7204500000 (ferrous scrap):

14, 968 metric tons.”

More recently, Reuters reported that “The port of Sanshan in southern China’s Guangdong province stopped accepting scrap metal shipments on Thursday after an excessive build-up of stockpiles caused by importers racing to bring in cargoes ahead of new rules starting next week… Because scrap stockpiles at the port have grown too large, customs decided to bring forward the deadline for scrap cargoes to arrive at Sanshan from June 29 to June 26, according to a notice from the Sanshan port authority sent to customers and reviewed by Reuters.” We should have more for you on the situation in China in next week’s report. For now, here’s Reuters’ map of the designated ports of entry approved for scrap imports:

Paper and Plastic – Curbside recycling programs are continuing to be rewritten as communities adjust to the demand void from China’s import ban. At the Sustainable Oregon conference in Bend, OR, the most relevant topics were about hard to recycle plastics and contamination in the recycling stream. Dylan deThomas, of the Recycling Partnership, remarked that their surveys of recycling programs have found only a few small-market municipalities moving to a dual-stream system to address contamination issues. Narrowing lists and cart tagging appear to be the more prevalent solutions being implemented. Rogue Disposal & Recycling, who service parts of southern and central Oregon, have done both and found that resistance to the changes may draw out as long as a few months but have successfully established new norms for their stream. Fastmarkets RISI reported that municipal contracts have flipped with the communities paying out for their recyclables to be processed rather than receiving revenue from the secondary sale of the materials.

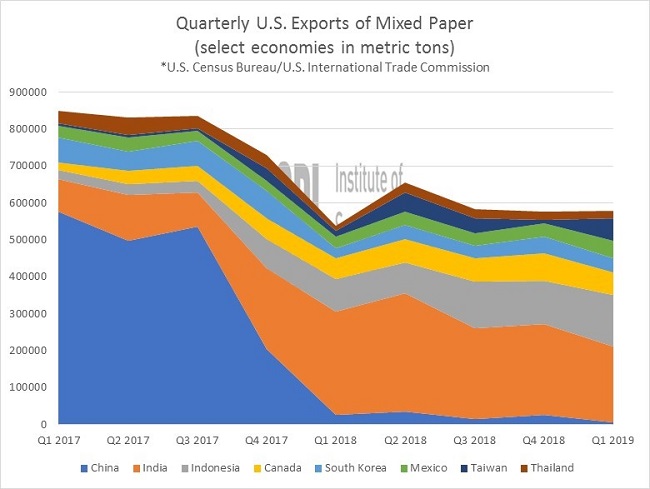

A look at the recent exports of mixed paper show that India has become the largest regular consumer for U.S. mixed paper exports. But Indonesia is the still on a growth pace after India’s demand slowed down in the middle of 2018. However, there’s still a quarterly shortfall of over 20,000 metric tons due to the loss in demand from China.

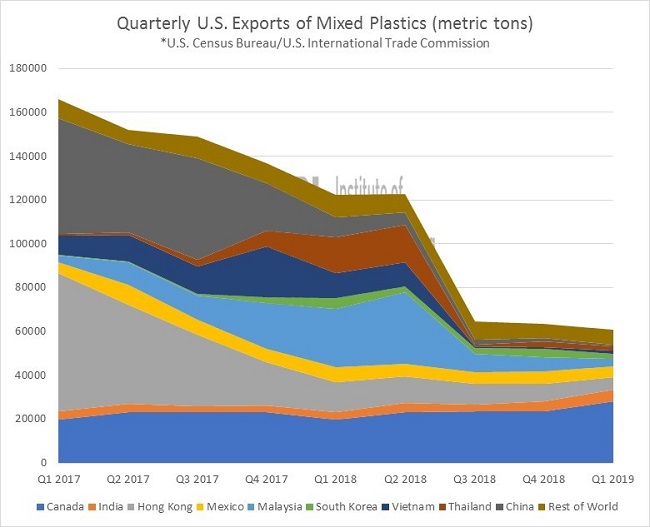

The search for alternative markets for plastics, the picture is bleaker. Malaysia, Vietnam, and Thailand were hopeful growth markets for a variety of low grade plastic bales but these sharply dropped off in mid-2018. The onset of China’s import ban had already seen a 25% decline in U.S. mixed plastic exports. This decline was softened by the increased acceptance from Malaysia and Vietnam followed by Thailand. After the copycat regulations and restrictions were implemented around southeast Asia, the demand gap fell to less than half of what it was from peak levels in 2017.

Canada and Mexico have remained steady partners in mixed plastics trade. Canada’s demand for mixed plastics has been at a steady quarterly growth rate of 4%. It appears that a lot of the secondary sorting investments are creating a stronger demand market that’s capable of extracting value from mixed bales.