With the Federal Open Market Committee meetings coming up this week, we thought it might be useful to review the main indicators that Fed officials have been monitoring. To be sure, the potential impacts of the on-going trade battles continue to be a source of concern.

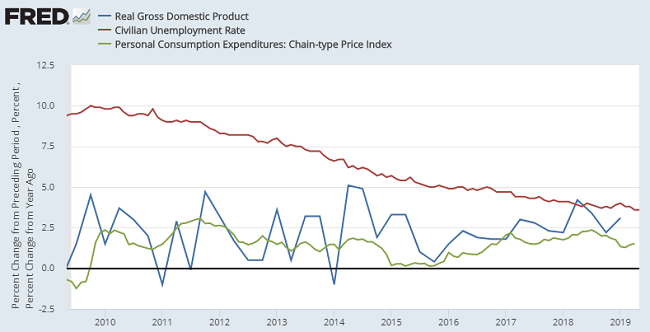

But the main macroeconomic indicators remain positive. The headline U.S. unemployment rate remained extremely low by historical standards at 3.6 percent in May, down from the 10 percent level following the Great Recession. U.S. real (adjusted for inflation) GDP growth was still robust at 3.1 percent in the first quarter of 2019. And the Fed’s preferred measure of inflation, the Personal Consumption Expenditures Index, remained muted at 1.5% in April.

Of course, the Fed also pays close attention to financial market fluctuations. Although stock prices have been adversely impacted by recent developments on the trade front, the latest correction hasn’t nearly been as severe as the one we saw late in 2018:

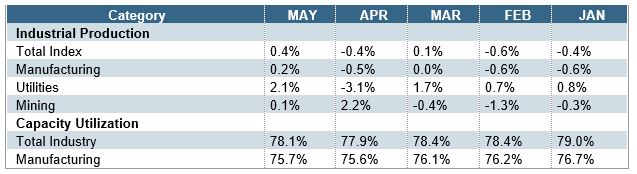

Some of the economic data out last week actually came in better than expected, including U.S. industrial production, which advanced 0.4% in May, against a consensus forecast for 0.2 percent growth as utilities output jumped 2.1 percent higher and manufacturing production rebounded 0.2 percent.

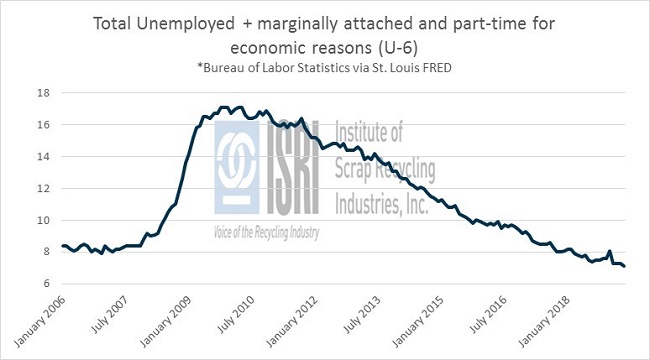

In addition, the Bureau of Labor Statistics’ JOLTS report for April totaled a higher-than-expected 7.449 million job openings. Hiring in April was slower which expanded the gap between openings and hirings to 1.752 million. Overall, this report marks the largest margin on record between the number of job openings and the number of unemployed. A bright light from the report is that underemployment has reached levels that haven’t been seen since the turn of the century.

As a result of these largely favorable economic indicators, most forecasters expect the Fed to keep rates on hold this week, despite bond market and trade jitters, and we don’t expect a rate cut this week either. But recent scrap market developments are painting a decidedly less rosy picture for the U.S. economy.