Earlier today, Caixin and Markit Economics reported their reading on Chinese manufacturing PMI was unchanged at 50.2 in May, as compared to last week’s “official” reading on Chinese manufacturing PMI which came in lower than expected at 49.4.

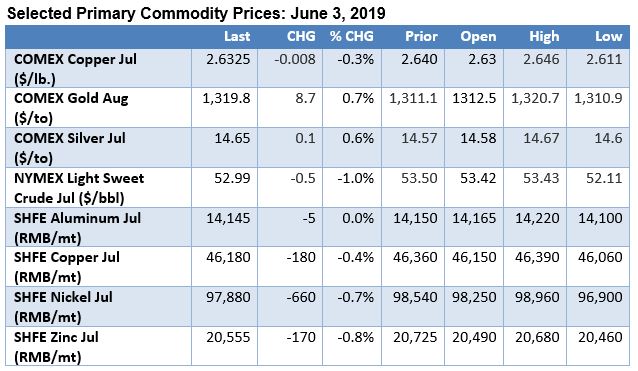

The market reaction was underwhelming as most of the major exchanges in Asia and Europe started the week in negative territory in light of the escalating trade disputes. In Shanghai, SHFE nickel and zinc prices settled 0.7% and 0.8% lower today, respectively, and most of the base metals got off to a lackluster start in London as well. LME 3-mo. aluminum and nickel dipped as low at $1,781/mt and $11,910/mt in early trading, while LME 3-mo. copper was recently trading around $5,825/mt. Crude oil prices were trending lower in New York this morning as NYMEX light sweet crude futures approached $52 per barrel. Reuters reports that “Oil prices plunged by more than 1.5%... on Monday, extending last week’s heavy losses as deepening U.S. trade wars fanned fears of a global economic slowdown.” But the flight to safety provided a boost to precious metal prices as COMEX gold futures touched $1,320 per troy ounce. In foreign exchange trading, the euro was little changed around $1.118 in early trading while the British pound edged up to $1.264 ahead of President Trump’s meetings in Europe this week.

Back to Main