The unfolding U.S.-China trade dispute remains the key question for the global economy right now. Forbes reports that both sides are preparing for a prolonged conflict as “Nomura Securities gave 65% odds that 25% tariffs on an additional $300 billion worth of Chinese goods will go into place by the third quarter.

As it stands, the U.S. Trade Representative is reviewing the legalities of those tariffs and will hold public hearings on them in early June.”

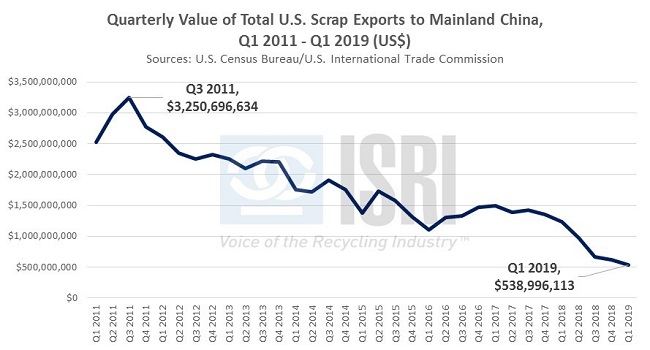

U.S. scrap processors, exporters, and recycling equipment manufacturers remain caught in the middle of the current trade hostilities. On the scrap commodities front, the official U.S. trade statistics show that, as compared to the peak period in 2011 when quarterly U.S. scrap exports to China exceeded $3 billion, by the first quarter of 2019 that figure had dropped to less than $540 million. Put another way, U.S. scrap exports to mainland China exceeded $11.5 billion in 2011 and are currently on course to come in at less than $2 billion in 2019, according to ReMA estimates.

Of course, trade worries are also a major concern for monetary policymakers and financial markets. Federal Reserve officials say they are committed to a “patient” policy stance and are holding rates steady for now. Despite an escalation in trade war rhetoric from both the U.S. and Chinese leadership, the FOMC members saw global risks and uncertainties having moderated. Of note, amid the raising of tariffs, China also holds $1.2 trillion in U.S. Treasuries (nearly 20% of the total foreign owned debt). Business Insider recently reported that the Chinese government ran a small scale test by selling $20 billion of U.S. Treasuries in March. Meanwhile, the Wall Street Journal reports that “the yield on the benchmark 10-year U.S. Treasury note settled Tuesday at 2.268%, its lowest close since Sept. 2017.”

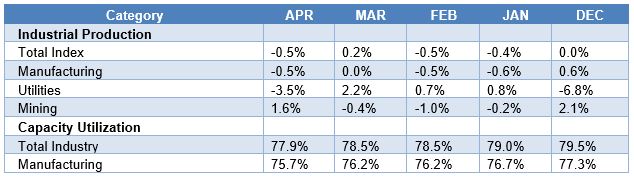

On the manufacturing front, Chinese industrial production decelerated to 5.4 percent growth in April, which was off nearly one percent from consensus expectations. The decline in growth was primarily attributed to manufacturing output falling from 9.0% to 5.3%. Automobile production was the main factor in China’s manufacturing output decline. In comparison, U.S. industrial production in April fell 0.5%, a drop that was unexpectedly matched in U.S. manufacturing output. However, quarterly e-commerce sales rose 3.6% for a year-on-year increase of 12.4% as e-commerce sales continue to capture a bigger slice of the overall retail market.

Notwithstanding the trade worries, U.S. consumer sentiment reportedly remains healthy. Briefing.com reports “The Conference Board's Consumer Confidence Index increased to 134.1 in May… The key takeaway from the report is that it shows consumer confidence has not been impacted yet by the increased trade tension between the U.S. and China, which includes an escalation in tariff rates on Chinese imports that could ultimately be passed along to the consumer.”

Back to Main