The American Iron and Steel Institute reports that “adjusted year-to-date {domestic raw steel} production through May 25, 2019 was 39,417,000 net tons, at a capability utilization rate of 81.8 percent.

That is up 6.4 percent from the 37,033,000 net tons during the same period last year, when the capability utilization rate was 76.6 percent.” But steel production in China has reportedly been rising even faster than in the US. According to the World Steel Association, China produced just over 85 million tons of steel in April 2019 alone, an increase of 12.7 percent as compared to April 2018. (For comparison’s sake, worldsteel reports that the United States produced 86.7 million tons of steel in all of 2018.)

China’s import ban and reduced contamination thresholds are creating significant demand voids in global trade that have raised the importance of exploring alternative markets. One of those growth markets has been Malaysia.

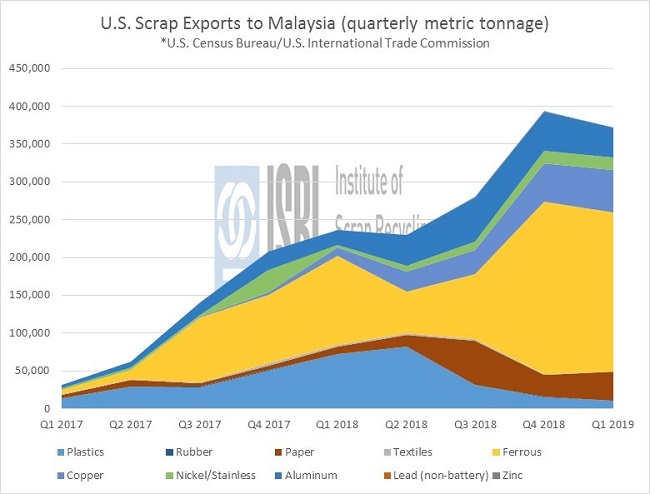

In purchasing power parity, Malaysia ranks 26th in the world according to 2017 USD valuation and approximately 55% of their GDP is through household consumption. Over half of their economic output is service related and their import/export ratio with the U.S. is fairly balanced. The chart above shows that, during the spring of 2017, U.S. ferrous and plastic scrap exports to Malaysia began a dramatic rise. Anticipation of China’s Blue Sky initiative prompted many paper mills to begin investing heavily in or exporting their production infrastructure to alternative markets. The increase in recovered paper exports to Malaysia starting in Q2 2018 is indicative of that mill infrastructure coming online.

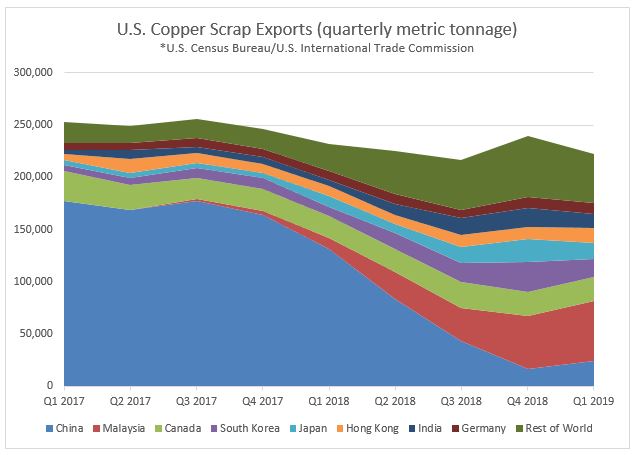

Meanwhile, by the end of 2018, the dramatic fall in copper scrap exports to China resulted in Malaysia taking the top spot for U.S. copper scrap exports:

Malaysia’s position along the Strait of Malacca provides a prime pass-through position between India and Pacific Rim countries. With ambitions to transition into higher level electronics manufacturing, Malaysia’s growth in U.S. copper scrap demand may not be a short-term reaction to changing market conditions.

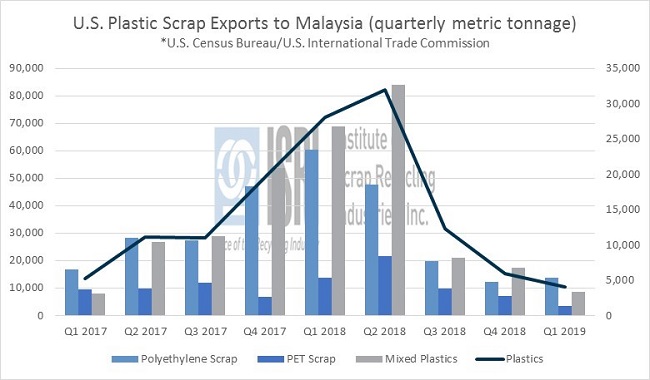

The massive influx of scrap commodities to Malaysia has prompted policy responses as their infrastructure wasn’t prepared to handle such a shift in global market dynamics. Plastic scrap has been under increased scrutiny due to environmental concerns. This prompted the Malaysian government to take steps in limiting plastic scrap imports. Here’s the trend in U.S. plastic scrap exports to Malaysia going back to the first quarter of 2017:

Back to Main