The failure of China and the U.S. to reach a trade agreement last week continues to roil markets as the Dow Jones Industrial Average plunged 617 points lower on Monday.

As reported by Bloomberg and other news outlets, “The U.S. prepared to hit China with new tariffs even as President Donald Trump said he’ll meet his Chinese counterpart, Xi Jinping, at next month’s G-20 summit, an encounter that could prove pivotal in a deepening clash over trade. The U.S. Trade Representative’s office Monday released a list of about $300 billion worth of Chinese goods including children’s clothing, toys, mobile phones and laptops that Trump has threatened to hit with a 25% tariff. If Trump proceeds with the tariffs, it would see almost all imports from China covered by punitive import duties. It also would turn the president’s trade wars into a tangible reality for many Americans as he seeks re-election. At the same time, Trump is sounding optimistic about the chances of a deal. ‘When the time is right we will make a deal with China. My respect and friendship with President Xi is unlimited but, as I have told him many times before, this must be a great deal for the United States or it just doesn’t make any sense,’ he tweeted on Tuesday. Under a process outlined by U.S. officials, the new tariffs would not take effect until late June at the earliest.”

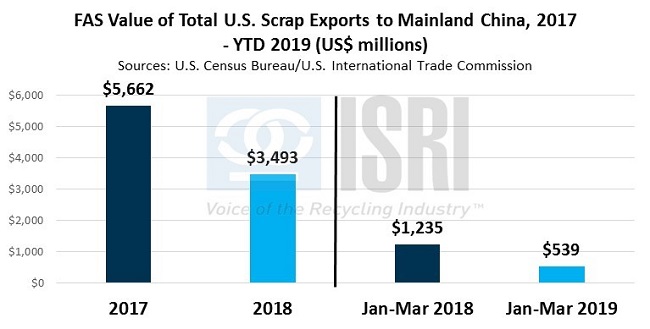

On a related note, the Census Bureau reported last week that the U.S. trade deficit widened in March to $50 billion (from $49.3 billion in February) as imports increased by $2.8 billion to $262 billion, more than offsetting the $2.1 billion gain in exports. For U.S. scrap exporters, the drop-off in shipments to China continues to take a toll. In 2018, U.S. scrap exports to China fell declined by more than $2.1 billion to just under $3.5 billion and that trend is continuing in 2019. According to Census Bureau trade figures, U.S. scrap exports to China decreased to less than $540 million in 1Q 2019, down from $1.2 billion in the first quarter of last year:

Unlike last year, other countries have not made up for the Chinese shortfall so far this year, with total U.S. scrap exports to all countries down 10% year-on-year in the first quarter of 2019 to $4.6 billion, according to the Census Bureau figures.

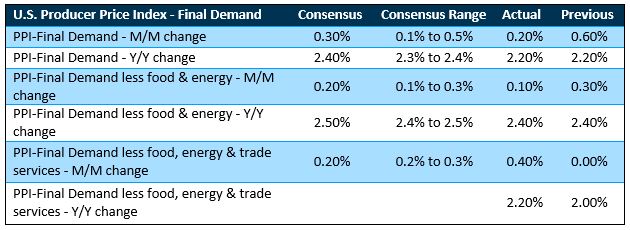

In other economic news last week, U.S. producer prices saw moderate growth in April. While food and energy were the primary drivers for price growth, trade services seemed to be the stagnating factor.

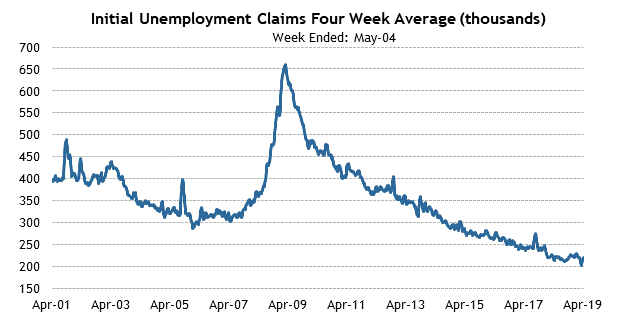

The number of job openings rose to 7.5 million at the end of March according to the Bureau of Labor Statistics’ JOLTS report. BLS reports that “Over the month, hires and separations were little changed at 5.7 million and 5.4 million, respectively. Within separations, the quits rate was unchanged at 2.3 percent and the layoffs and discharges rate was little changed at 1.1 percent.” In other labor market news, the 4-week moving average of initial unemployment claims remains extremely low at 220,000, another indicator of tight labor market conditions:

Back to Main