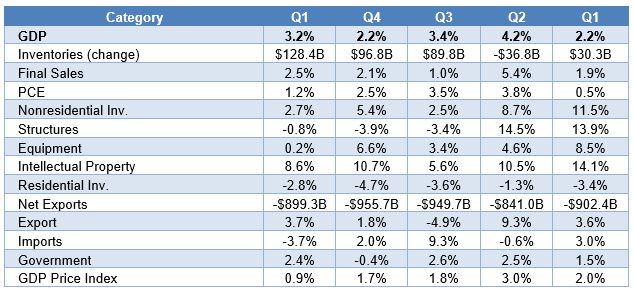

The big U.S. economic report out last week was the advance estimate of first quarter real GDP growth from the Bureau of Economic Analysis, which came in much better than expected at 3.2%, as compared to the consensus forecast for 1.9% growth.

The BEA reports “The acceleration in real GDP growth in the first quarter reflected an upturn in state and local government spending, accelerations in private inventory investment and in exports, and a smaller decrease in residential investment. These movements were partly offset by decelerations in {personal consumption expenditures} and nonresidential fixed investment, and a downturn in federal government spending. Imports, which are a subtraction in the calculation of GDP, turned down” 3.7%.

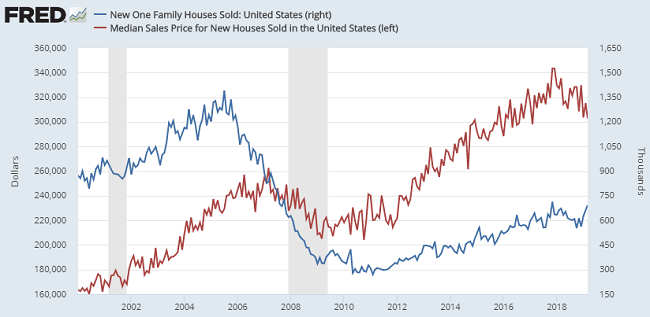

In other news, new home sales soared over expectations to a 692,000 annualized rate which exceeded consensus expectations. This is the highest monthly reading since November 2017 and some analysts believe was prompted by the reduction in mortgage rates that began in the fall of last year. Existing home sales were on the lower end of the consensus range and continue a downward trend that began in the fall of 2017. The Federal Housing Finance Agency’s (FHFA) House Price Index (HPI) has been showing house price declines since March 2018 with a sharper year-over-year decline for February. It’s likely that lagging new home prices reflect the need to provide sharper discounts in order to move inventory. Here’s the trend in new one-family houses sold and the median sales price for new houses:

Of note, there signs that industrial space is starting to open up for warehousing. Availability rates have declined for nearly a decade but the past quarter (Q1 2019) saw a flattening that may be due to increased warehouse capacity. In other economic news, U.S. durable goods orders rose by a better-than expected 2.7% in March while the University of Michigan’s final reading on consumer sentiment in April remained elevated at 97.2:

Back to Main