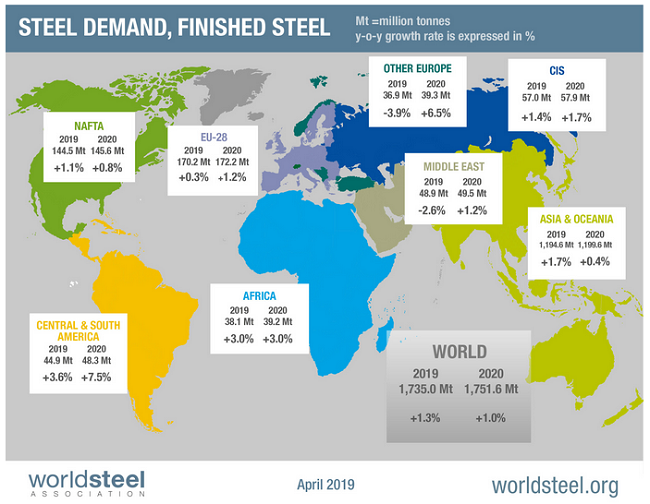

Ferrous – According to the World Steel Association, global demand for steel increased by 2.1 percent in 2018. This is a slight improvement over 2017 and their analysts believe that growth is still expected in 2019 and 2020.

It will be under less favorable circumstances but developing economies will still have a need for steel that will outpace declining demand from established markets and projects, according to worldsteel. Steel demand in 2018 from developing economies grew 1.8 percent, well below the 3.1 percent growth posted in 2017. If developing economies choose to leapfrog in development with less than expected demand in automobiles and mobile infrastructure, then steel demand growth may falter. Here’s a look at worldsteel’s regional steel demand growth expectations for 2019 and 2020:

According to AISI, “In the week ending on April 13, 2019, domestic raw steel production was 1,915,000 net tons while the capability utilization rate was 82.3 percent. Production was 1,780,000 net tons in the week ending April 13, 2018 while the capability utilization then was 76.0 percent. The current week production represents a 7.6 percent increase from the same period in the previous year. Production for the week ending April 13, 2019 is down 0.7 percent from the previous week ending April 6, 2019 when production was 1,928,000 net tons and the rate of capability utilization was 82.8 percent.” Fastmarkets AMM reports that “US spot prices for hot-rolled coil have fallen below $34 per hundredweight ($680 per ton) for this first time in two months on increased domestic output and fears of softening demand.”

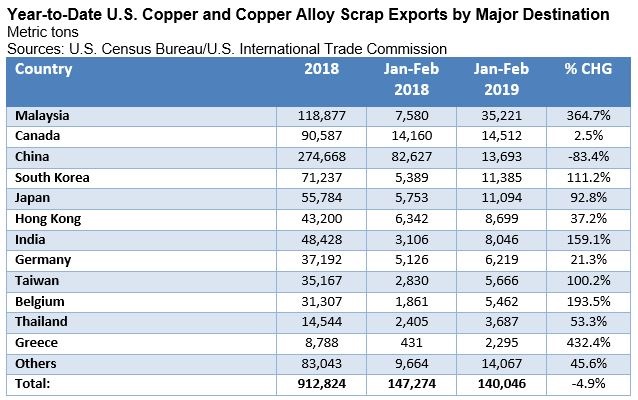

Nonferrous – After having traded as high as $2.9955/lb. in the middle of the week, COMEX May copper futures were back down to $2.92/lb. at the end of the week. Meanwhile Fastmarkets AMM was reporting wider spreads on No. 2 copper: “Fastmarkets' assessment of the discount for refiners' No. 2 copper scrap and brass ingot makers’ No. 2 copper scrap both increased by 1 cent on Wednesday April 17 to 40-41 cents per lb. and 40-42 cents per lb., respectively.” U.S. exports of copper and copper alloy scrap reportedly edged up to 73.9 thousand tons in February (up from 66.2 thousand tons in January) according to trade figures released by the Census Bureau last week. Improved sales to Malaysia, Hong Kong, and mainland China accounted for most of the gains. However, U.S. copper scrap exports to China

Overall, total U.S. goods exports rose 1.5 percent to $139.5 billion as civilian aircraft shipments rose $2.2 billion for the month. Outside of aircraft, however, gains are less striking with auto exports up $0.6 billion and with monetary gold and consumer goods showing marginal gains. Total U.S. imports rose only 0.2 percent for the month, totaling $259.1 billion but with consumer goods showing yet another large increase of $1.6 billion. Imports of industrial supplies fell $1.2 billion despite a 0.8 billion rise in the oil subcomponent.

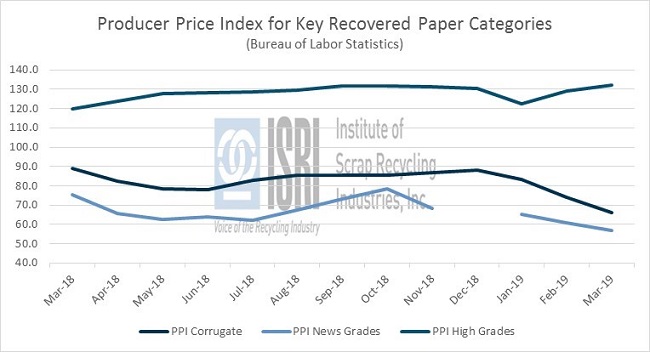

Paper and Plastic – OCC prices appear to have gotten a haircut last month with domestic prices dropping about 20% in virtually every region as reported by RecyclingMarkets.net and Fastmarkets RISI. Producer prices for news and corrugated grades have not recovered from the declines going into the winter. By the end of 2018, Chinese consumers used up their available import licenses and many alternative markets in Asia had begun implementing stricter restrictions. What may also be driving down prices, according to KeyBanc Capital Markets, is the large consolidation of OCC consumers in the U.S. and reactionary demands from an environmentally concerned consumer base.

For more information, please contact ReMA Research Analyst

Bernie Lee.

Back to Main