The Dow Jones Industrial Average advanced 1.03% on Friday to finish the week at 26,412.30 as markets took the news of extended Brexit deadlines, mixed inflation numbers, and steady monetary policy largely in stride.

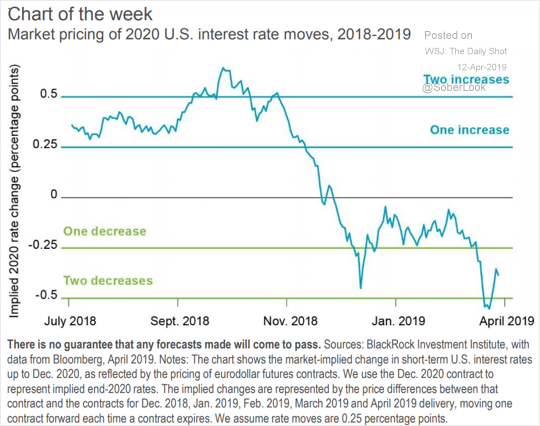

The minutes from the last Fed meeting released last week indicated: “With regard to the outlook for monetary policy beyond this meeting, a majority of participants expected that the evolution of the economic outlook and risks to the outlook would likely warrant leaving the target range unchanged for the remainder of the year.” But looking into next year, analysts are increasingly expecting rate cuts ahead:

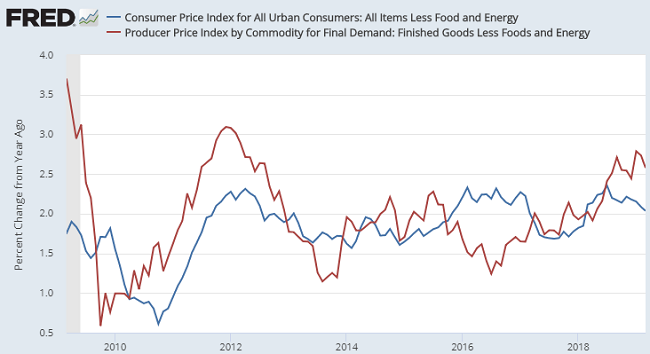

The rate cut expectations come in spite of inflation readings that are close to the Fed’s target levels and extremely low levels of unemployment. Here’s the recent trend in year-on-year changes in the core (ex- food and energy) U.S. consumer and producer price indexes, which are still holding above 2% for now:

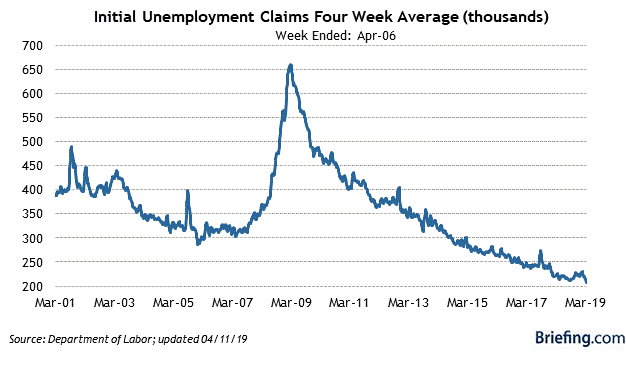

Meanwhile, the Labor Department reported last week that initial unemployment claims for the week ending April 6 declined to 196,000. As Briefing.com explains, “The key takeaway from this leading-indicator report is that it clearly shows employers are reluctant to let go of employees, either because they can't find other qualified workers or because they see demand being strong enough to justify the size of their existing work force.”

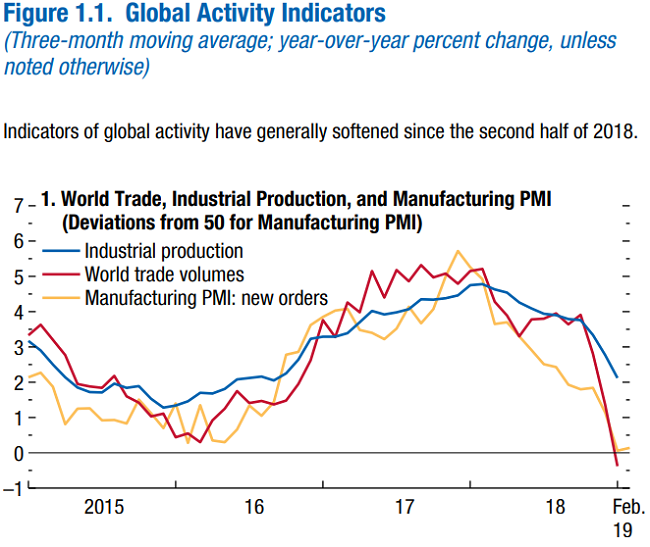

Of note, since our last Market Report the International Monetary Fund has updated its economic projections, with key indicators signaling slower growth ahead. The IMF now expects global economic growth will slow from 3.6% in 2018 to 3.3% in 2019, a downward revision of 0.2 percentage points.

Back to Main