Ferrous – The American Iron and Steel Institute reported last week that for the month of February, “U.S. steel mills shipped 7,744,304 net tons, a 4.2 percent decrease from the 8,079,757 net tons shipped in the previous month, January 2019, and a 2.9 percent increase from the 7,525,590 net tons shipped in February 2018.

Shipments year-to-date in 2019 are 15,824,061 net tons, a 4.4 percent increase vs. 2018 shipments of 15,161,931 net tons for two months. A comparison of February shipments to the previous month of January shows the following changes: hot rolled sheets, up 2 percent, cold rolled sheets, down 3 percent, and hot dipped galvanized sheets and strip, down 4 percent.”

Fastmarkets AMM reports that HRC prices rebounded late last week after having started the week in negative territory: “Hot-rolled coil prices continued to mount a modest recovery in the United States after dropping close to $34 per hundredweight ($680 per ton) at the outset of the week. Fastmarkets AMM’s daily hot-rolled coil index stood at $34.51 per cwt on Thursday April 11, up by 0.7% from $34.27 per cwt a day earlier and up by 1.1% from $34.15 per cwt on April 8.”

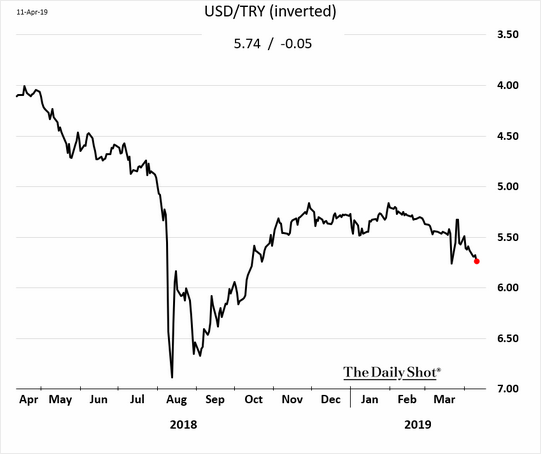

On the scrap export front, Turkish buying interest was reportedly negligible last week amid reports that demand for Turkish steel products has waned even as the value of the Turkish lira has depreciated:

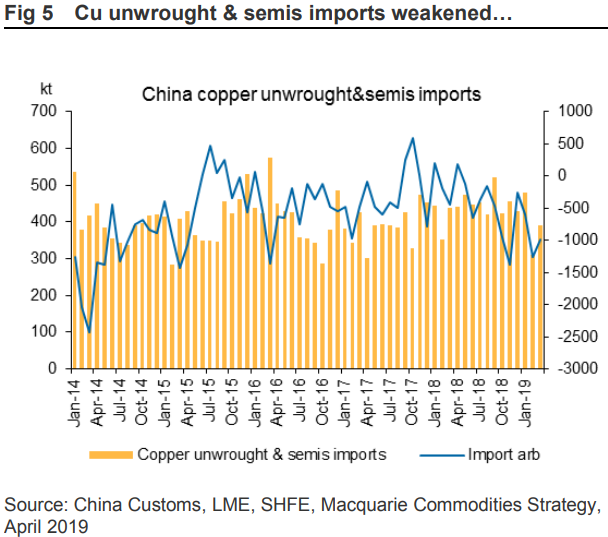

Nonferrous – China’s copper import figures were underwhelming last month. Macquarie reports “China imported 391kt of unwrought/semis in the last month, down 11%YoY. Year-to-date imports were 1.2Mt, 4% less YoY. Besides, according to NBS, accumulative domestic copper semis production has sustained double-digit growth since Jun-18. In Jan-Feb 19, the total copper semis output was reported at 2.1Mt (+14.6%YoY).

COMEX copper prices were bumpy last week, with May copper futures slipping as low as $2.8835/lb. on Thursday before rebounding to close at $2.946/lb. on Friday. At our copper spotlight in Los Angeles last week, Jason Schenker from Prestige Economics projected choppy sideways trading for the red metal between $2.75 - $3.25 per pound in the near future.

On the corporate front, it was announced last week that the Wieland Group would acquire the outstanding shares of Global Brass & Copper (which includes Olin Brass, Chase Brass and A.J. Oster). AMM reports, “The transaction is expected to be finalized in the second half of 2019 and combines two of the largest copper fabrication producers… Competition for brass ingot makers could also increase due to the merger. Brass ingot participants have indicated that supply for red brass remains tight, which - combined with a higher Comex copper price - has helped to elevate scrap prices over the past week.”

Paper and Plastic – The Residential Recycling Summit was a featured track at the 2019 ReMA Convention. As residential recycling has a large impact on the visibility of recycling and the paper and plastics markets, the summit provided an important look into an array of factors that are complicating paper and plastics recycling. Bill Moore and Susan Cornish of Moore & Associates presented their full study on the Impact of E-commerce on Residential Recycling, with additional input from Dennis Colley, President & CEO of the Fibre Box Association. The primary takeaway from this session for paper and plastics recyclers is that the composition of this stream reacts rapidly to consumer sentiment and the volumes are only going to grow larger. The Fibre Box Association commissioned a study on how to improve the collection of corrugated from the residential stream and provided the comparison that commercial/industrial sources capture 95% of recoverable OCC, while residential systems have a much lower rate of around 35%. This is a paradigm shift as consumers eschew the brick and mortar store for many products ordered through online retail outlets, particularly Amazon.

Private sector businesses, particularly growing mid-cap enterprises, react more quickly to market shifts than more entrenched municipal or larger governmental operations. But some of those large governmental operations have a more holistic or systems-based way of thinking that can provide remarkable insights. Tom Day, the Chief Sustainability Officer of the US Postal Service, provided an interesting review of their sustainability operations and gave some remarks about how he sees coming changes in the stream. One takeaway is that instead of exact solutions to each problem, larger governmental organizations can provide a basic framework to encourage recycling. What is evident is that changes are coming, but a cooperative environment is more likely to make the road less bumpy.

For more information, please contact ReMA Research Analyst Bernie Lee.

Back to Main