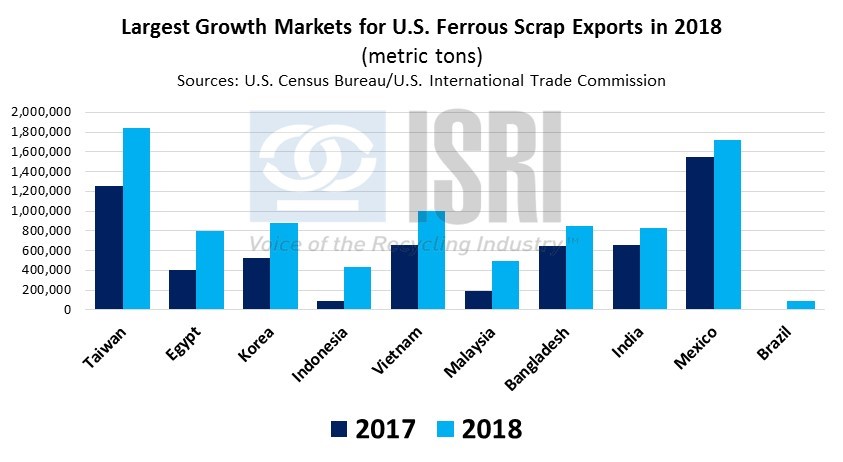

Among the major scrap commodity groups, U.S. ferrous scrap exports saw the largest gain last year, increasing nearly 14 percent to 15.6 million metric tons. Turkey remained the largest export market for U.S. ferrous scrap in 2018, importing more than 3.4 million metric tons, followed by Taiwan, Mexico, Vietnam, and South Korea according to official trade statistics from the U.S. Census Bureau:

But last year’s gain in ferrous scrap exports was not driven by Turkey. In fact, the largest net market gains (by volume) were in Taiwan (+583 kt), Egypt (+401 kt), S. Korea (+359 kt), Indonesia (+345 kt), Vietnam (+342 kt), Malaysia (+296 kt), and Bangladesh (+200 kt), along with gains to India, Mexico, and Brazil.

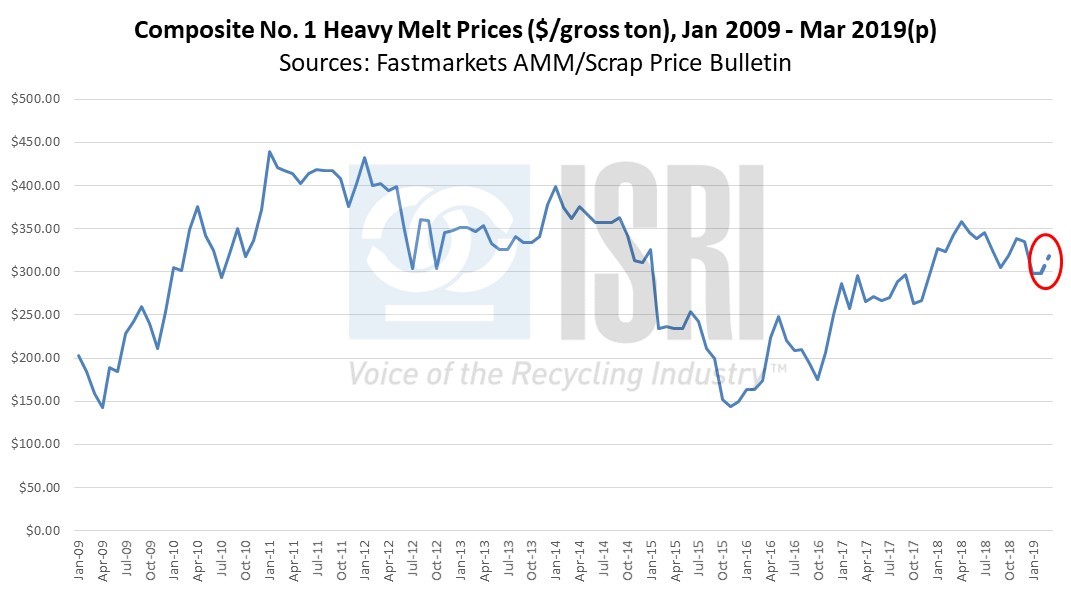

Fastmarkets AMM reports that scrap prices for most of the major ferrous scrap grades are trending $20 per ton higher this month amid steady to firmer steel sheet prices, challenging transportation conditions, healthy domestic steel production levels, and diminished steel import competition.

The American Iron and Steel Institute reports that total U.S. steel imports declined 11.5 percent in 2018 and finished steel imports decreased 13.1 percent as import tariffs resulted in less competitively priced imports. Among the major overseas steel suppliers to the U.S., imports from Turkey declined 47 percent last year, imports from South Korea fell 26 percent, and imports from China were down 14 percent.

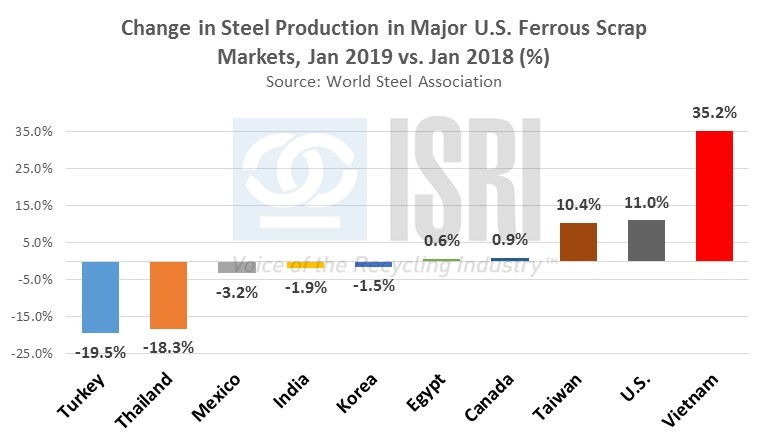

The World Steel Association reports that China’s steel output increased 4.3 percent year-on-year in January to just over 75 million tons. 75 million tons in one month. For comparison’s sake, the U.S. produced about 86 million tons of steel for the entire year last year. Of note, the worldsteel numbers show a wide disparity in steel production trends among the major consumers of U.S. ferrous scrap. While steel production in the U.S. reportedly increased 11% year-on-year in January 2019 to more than 7.6 million metric tons, worldsteel reports that Turkish steel output plunged 19.5% lower during the corresponding period while output in Vietnam surged 35% higher. Here’s the year-on-year trend in steel production for the month of January for the major U.S. ferrous scrap markets: