Brexit and monetary policy were back in focus last week. The Federal Reserve announced that “Information received since the Federal Open Market Committee met in January indicates that the labor market remains strong but that growth of economic activity has slowed from its solid rate in the fourth quarter…

Recent indicators point to slower growth of household spending and business fixed investment in the first quarter… In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate.” In other words, the Fed is expecting slower growth ahead and is in no hurry to adjust interest rates.

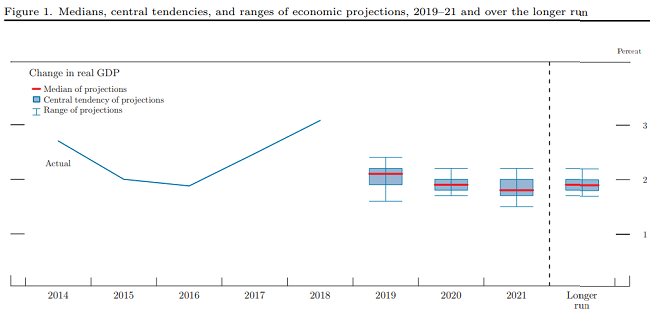

Source: Federal Reserve.

Source: Federal Reserve.

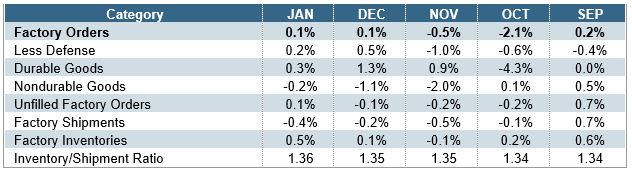

Looking ahead, the central tendency among Fed members and bank presidents is for 1.9 – 2.2 percent growth this year. U.S. factory orders slowed down in late 2018 and the numbers for January don’t show much promise that orders will accelerate in 2019. According to the Census Bureau, U.S. factory orders were up just 0.1% in January while factory shipments declined 0.4% and inventories rose 0.5%. The Census Bureau notes that inventories have increased in twenty‐six of the last twenty‐seven months.

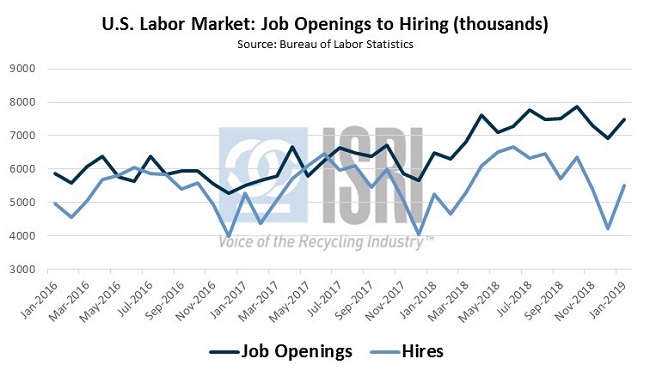

Other economic reports out last week indicated that existing home sales increased 11.8% month-on-month in February to a seasonally-adjusted annual rate of 5.51 million, although total sales were still down 1.8% as compared to the same period last year. On a more positive note, the Conference Board’s index of leading economic indicators advanced in February for the first time in five months. The Conference Board’s Director of Economic Research was quoted as saying that “February’s improvement was driven by accommodative financial conditions and a rebound in stock prices, which more than offset weaknesses in the labor market components.” But as reported earlier, the recent Job Openings and Labor Turnover Survey (JOLTS) shows the upward trend in job openings is still trucking along as the spread of openings to hires rose to a record 1.78 million in January.

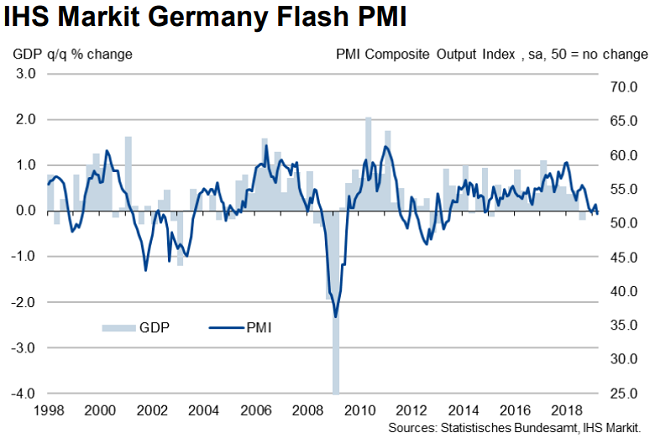

As for economic reports from overseas last week, Markit Economics reports that Germany’s flash composite PMI fell to a 69-month low of 51.5 in March as the manufacturing component dropped to a six and a half year low of 44.7, the 14th decline in the last 15 months for German manufacturing.

Back to Main