After getting off to a positive start in the first half of the week, commodity prices retreated late last week thanks in part to weaker than expected PMI numbers out of Europe and Japan and renewed dollar strength.

As a result, the Bloomberg Commodity Index was off 0.7% on Friday. In New York, crude oil futures dipped below $59 per barrel while copper futures fell to $2.84 per pound after having approached $2.97 the day before.

Ferrous – Iron ore prices have outperformed this year amid reports of supply disruptions and Chinese destocking. The spot price for benchmark 62% iron ore fines rose 1.7% on Friday to $85.96 per ton, Metal Bulletin reports. Meanwhile, Macquarie reported last week that “China’s steel mills and traders reported another week of destocking, both 6% lower than the {prior} week. Considering the seasonality and the CNY distortion… we compare the current stocks to that of the same week post-CNY in 2018. The total finished steel products inventory are 22mt, which is 4% less than that time in 2018.”

In the U.S., the American Iron and Steel Institute reports that domestic steel production for the week ending March 16th was up 5.7% year-on-year to 1.93 million net tons as the capacity utilization rate came in at 82.9%, up from 78.3% one year prior. For the year-to-date, AISI reports that U.S. steel production is up 6.7% to more than 20.3 million net tons. On the ferrous scrap front, AMM reports that Turkey purchased 100,000 tons of ferrous scrap from East Coast exporters on Friday, reportedly the first East Coast sales to Turkey since March 7th.

The domestic and global ferrous markets continue to be reshaped by shifting trade, investment, and regulatory policies. Please join Schnitzer Steel President and CEO Tamara Lundgren for an open discussion of the key factors impacting the steel and ferrous scrap markets at our ISRI Ferrous Spotlight to be held on April 9, 2019 in Los Angeles!

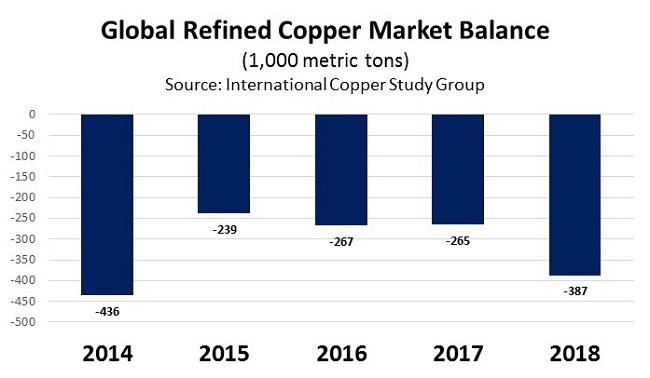

Nonferrous – Copper prices took a tumble late last week even as the global deficit in copper production reportedly widened last year. According to figures from the International Copper Study Group, global refined copper demand exceeded supply by 387,000 metric tons in 2018, the largest supply deficit since 2014. Including estimated changes in Chinese bonded warehouse stocks, the Study Group estimates an even larger deficit of 447,000 metric tons. But after having traded as high as $6,555 per ton on Thursday, LME 3-mo. copper plunged to around $6,300 per ton on Friday amid weak flash PMI numbers from Europe and Japan. As primary prices have eased and China’s import restrictions continue to reshape the global copper scrap market, AMM reports that the spread on No. 2 copper at brass ingot makers has widened to 38-39 cents per pound, from 35-37 cents previously.

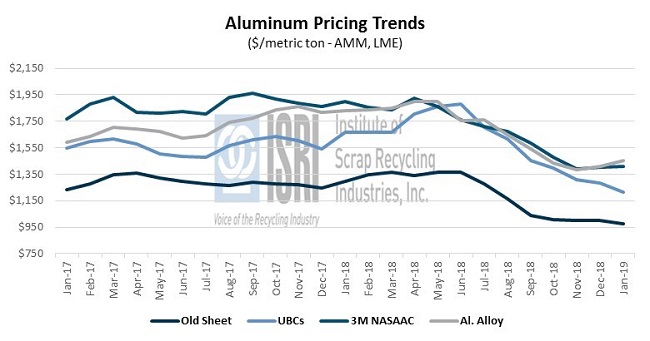

The International Aluminium Institute estimates primary aluminum production came in at 4.92 million metric tons in February, down 9 percent from January but up 0.26% from one year ago. IAI estimates that China produced 2.78 million tons of primary aluminum last month as Fastmarkets analysts note the impacts of Chinese aluminum production restrictions during the winter and weaker than expected demand from the automotive industry. Aluminum alloy and scrap prices have tracked primary prices lower in recent months, but have market conditions finally bottomed out? For insights on all your aluminum market questions, you will not want to miss this year’s ReMA aluminum spotlight to be held on April 10th when Jason Schenker of Prestige Economics will be joined by an outstanding group of industry members including Richard Mayknecht from Nemak, Andy McKee from Schupan & Sons, and Stephen Deacon from EMR. We hope to see you there!

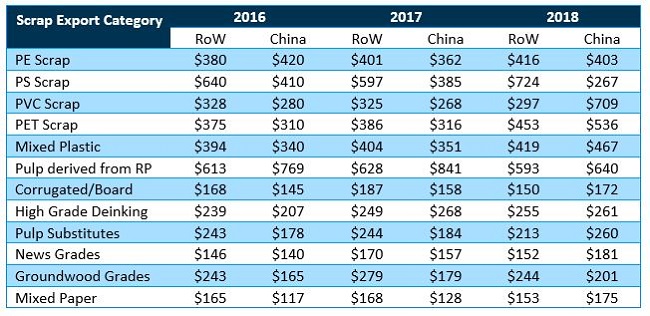

Paper and Plastic – One of the consequences of China’s import restrictions on recyclables is increased competition for premium grades. Trade data from the U.S. Census Bureau show that demand for most export categories of paper and plastics to China declined dramatically last year, the notable exceptions being pulp made from recovered paper and corrugated grades. The import restrictions have pushed China’s scrap consuming industries to compete with higher quality scrap grades and the flight to quality has led to price shifts. The trend is more evident with plastics where the virtual cutoff of demand from China created a large void for other economies to contest. The following table is the average price per ton of material for the major export categories of paper and plastic scrap for China and the rest of the world according to the US Census Bureau trade statistics:

Essentially, China’s departure from the mixed paper and plastics markets had pushed global prices for the other categories higher for a short period before those prices leveled off. This was primarily due to the just-in-time manufacturing systems that have primed supply-chain participants to keep material moving despite price fluctuations and retail consumer demand. Warehousing scrap paper invites control costs that are further complicated by transportation and logistical issues, which are further compounded by the relatively large volumes of recovered paper as compared to other scrap commodities.

For more information, please contact ReMA Research Analyst Bernie Lee.

Back to Main