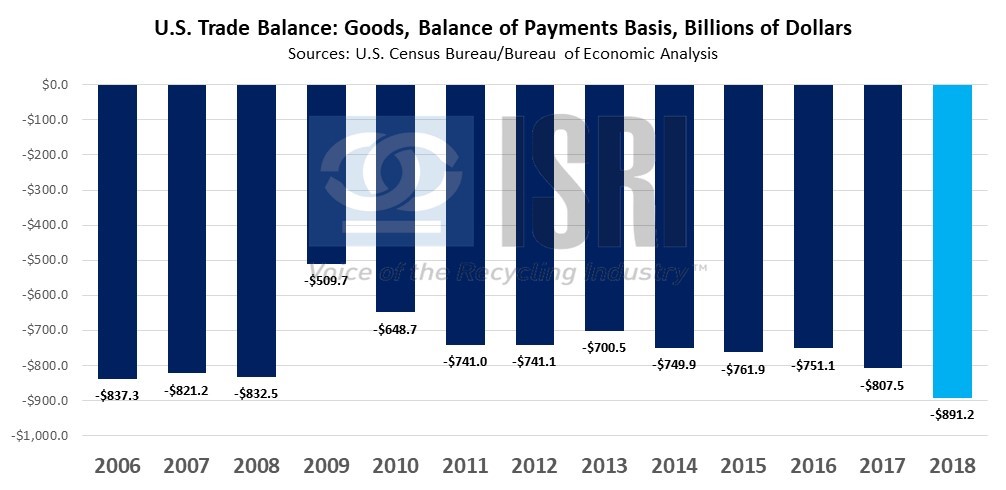

The U.S. trade deficit in goods soared to a record high in 2018. While tariffs were championed as drivers to rebalance trade, the solution to the trade issue remains elusive.

The Bureau of Economic Analysis and Census Bureau report the trade gap in goods hit an all-time high of $891.3 billion in 2018, which is $54 billion more than the previous record hit in 2006.

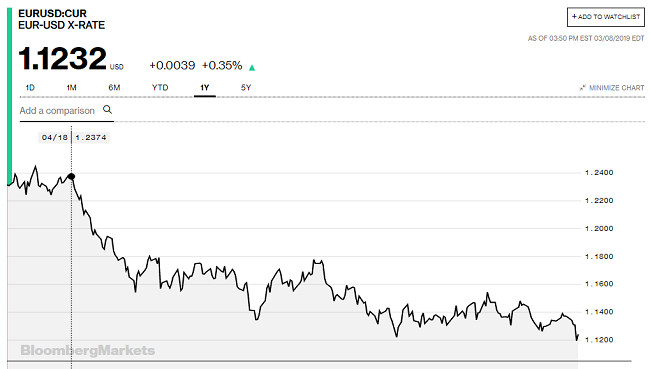

In addition to new and existing trade barriers (see plastics section below), U.S. exporters are having to contend with a stronger dollar. Following the European Central Bank’s announcement last week that it is launching a new "targeted" lending program to allow European banks to obtain cheap funding for business and consumer loans, the euro traded as low as $1.118, the Wall Street Journal reports. For comparison’s sake, the euro was buying $1.25 back in January 2018 but weakened significantly following Fed rates hikes, slower European growth, and Brexit worries.

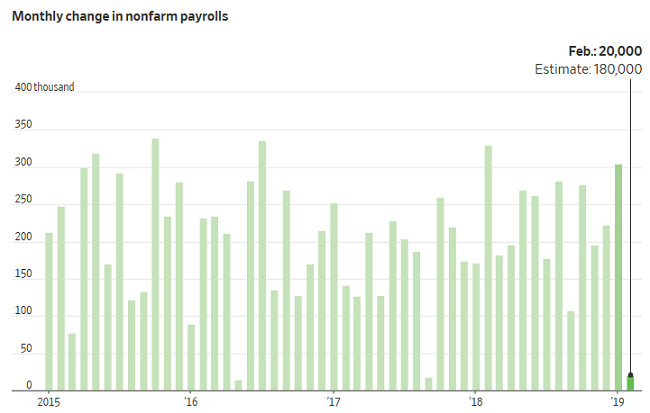

The Fed isn’t expected to raise rates any time soon given, especially in light of the disappointing jobs report that came out last week. According to the Bureau of Labor Statistics, the U.S. added just 20,000 jobs in February as compared to an expected gain of 180,000 jobs. The construction sector actually cut 31,000 jobs in February and earlier in the week the Census bureau reported U.S. construction spending fell 0.6% in December, which is another cause for concern.

Sources: Wall Street Journal/Bureau of Labor Statistics

The Organization for Economic Cooperation and Development (OECD) cut its forecast for global economic growth in 2019 to 3.3%. OECD analysts cite a deep slowdown in European growth and concerns about China’s slowdown to a more moderate growth rate as the primary reasons for the downgrade in their 2019 forecast.

Back to Main