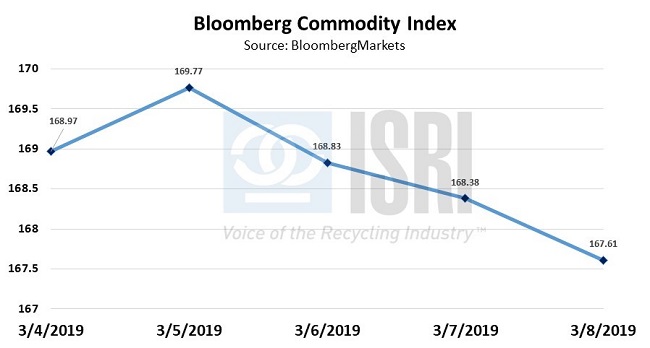

Last week, the major commodity indexes drifted lower in the second half of the week in response to a stronger dollar, weaker than expected Chinese trade and U.S. jobs numbers, and rising U.S. oil production.

Reuters reports that U.S. crude oil production has increased by more than 2 million barrels per day since early 2018 to 12.1 million barrels per day, making America the world’s biggest producer.

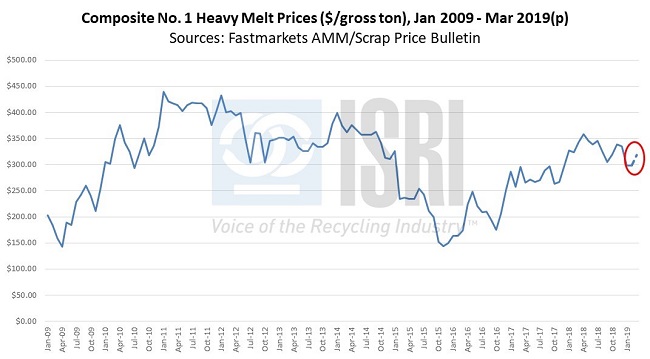

Ferrous – Fastmarkets AMM reports that scrap prices for most of the major ferrous scrap grades are trending $20 per ton higher this month amid steady to firmer steel sheet prices, challenging transportation conditions, healthy domestic steel production levels, and diminished steel import competition.

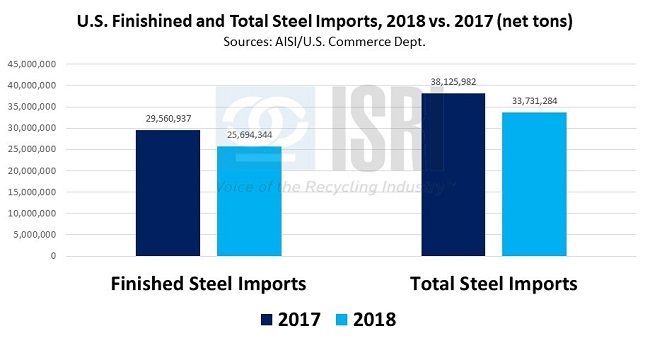

The American Iron and Steel Institute reported last week that total U.S. steel imports declined 11.5 percent in 2018 and finished steel imports decreased 13.1 percent as import tariffs resulted in less competitively priced imports. Among the major overseas steel suppliers to the U.S., imports from Turkey declined 47 percent last year, imports from South Korea fell 26 percent, and imports from China were down 14 percent.

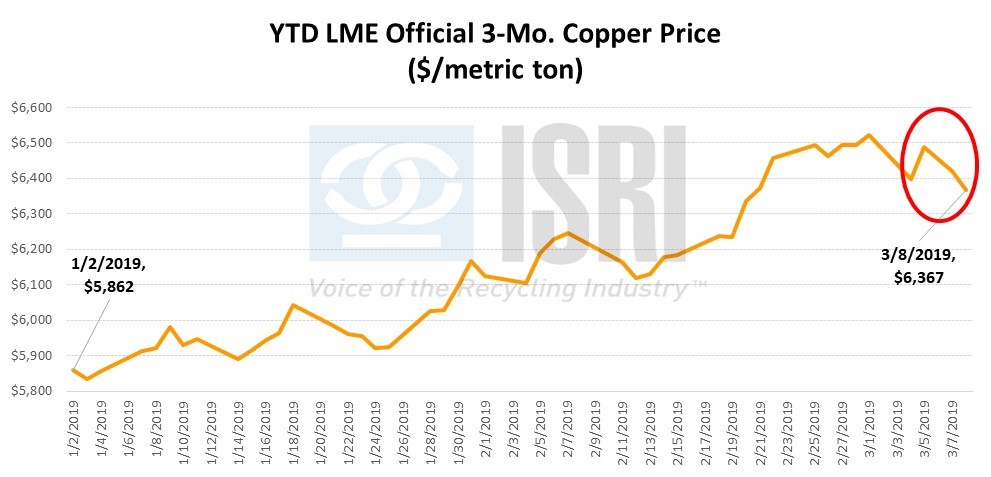

Nonferrous – In London, copper prices at the LME were on a similar trajectory with other commodities, approaching $6,500 per ton early in the week but subsequently trading as low as $6,351 per ton on Friday. Even still, LME copper prices are up around 9 percent from the start of the year, which has incentivized an increase in the supply of copper scrap. AMM reports was recently discounts for Bare Bright copper at 7 to 8 cents a pound, No. 1 copper at 15 to 17 cents, and No. 2 copper at 35 to 36 cents, all delivered to brass ingot makers. Want to know where the copper and copper scrap markets are headed going forward? Then you won’t want to miss our ISRI Copper Spotlight to be held on April 10, 2019 in Los Angeles as part of our best ever 2019 ReMA Convention & Expo where moderator extraordinaire Randy Goodman from Greenland America will be joined by an outstanding panel of experts including Tim Strelitz from California Metal X, Jurgen van Gorp from Metallo, and Jason Schenker from Prestige Economics. We hope to see you there!

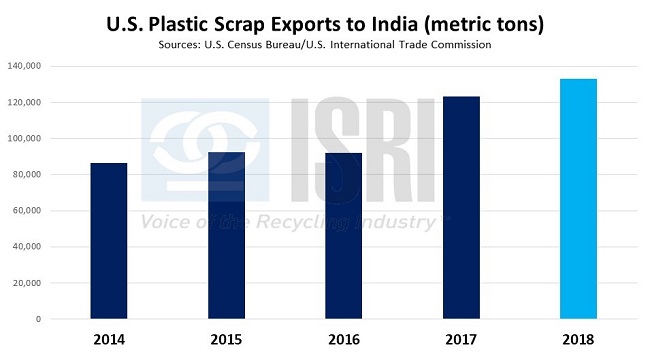

Paper and Plastic – India has become the latest country to ban the imports of plastic scrap. As per last week’s ReMA member alert: “The Indian Government's official announcement, posted in The Gazette of India, states that the new rule will ‘come into force on the date of their publication in the Official Gazette’ – or March 1.” The new policy focuses on plastic waste and scrap imported under HTS code 3915 but does not appear to include other scrap that may have plastic constituents. Of note, the US exported more than 133,000 metric tons of plastic scrap to India last year, an 8 percent increase from 2017, and India was the third largest destination market for U.S. scrap plastics last year. Stay tuned for additional ReMA updates on India’s plastic scrap ban.

PPI Asia reports that China’s buying activity for recovered paper imports has been sluggish. Chinese producers are preparing for another 40% decline in import quota volumes. If this projection were to hold true, then the release of import licenses earlier this year may have been the lion’s share of imports to be seen in 2019. However, this may be more of a constraining measure that will be revisited in the second half of 2019 as the government will have to assess the economic impact that packaging prices will be making on their exports.

This chokepoint may be narrowing price ranges for a product supply that is optimized to the extremes on supply. The data from the Japanese Paper Recycling Promotion Center had indicated that news grades from Japan were in high demand from Chinese paper mills. News grades narrowing the gap on OCC means that the limited quantity of imports is driving cost cutting measures to be about finding news and groundwood grades that help keep OCC affordable.

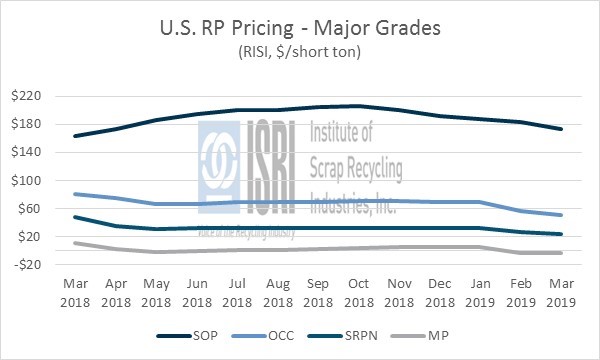

Domestically, OCC has been dealt a sizable decline in 2019. SRPN-56 exports may have kept domestic prices from falling as significantly. PPI Asia also reported that much of the OCC rejected at China’s border have taken even deeper discounts in their alternative markets like South Korea and Taiwan.

So while the above chart seems to show a relatively stable 2018 pricing market, there is a lot of activity in in shift in volumes of the highly traded grades.

For more information, please contact ReMA Research Analyst Bernie Lee.

Back to Main