Ferrous – The World Steel Association reported last week that China’s steel output increased 4.3 percent year-on-year in January to just over 75 million tons. 75 million tons in one month.

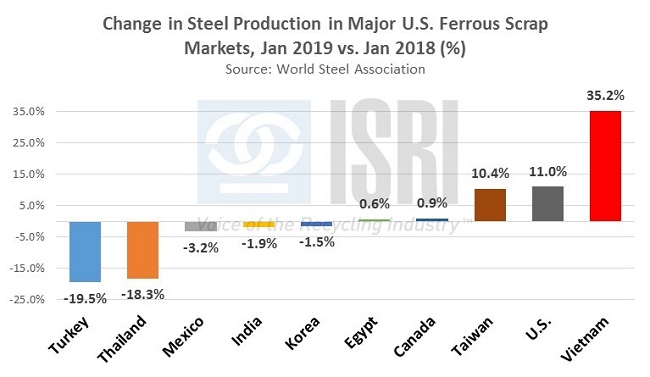

For comparison’s sake, the U.S. produced about 86 million tons of steel for the entire year last year. Of note, the worldsteel numbers show a wide disparity in steel production trends among the major consumers of U.S. ferrous scrap. While steel production in the U.S. reportedly increased 11% year-on-year in January 2019 to more than 7.6 million metric tons, worldsteel reports that Turkish steel output plunged 19.5% lower during the corresponding period while output in Vietnam surged 35% higher. Here’s the year-on-year trend in steel production for the month of January for the major U.S. ferrous scrap markets:

After a slow start to the year, published sources indicate that Turkish demand and pricing have shown signs of improvement lately. Meanwhile, here in the U.S. Fastmarkets AMM reports that “Ferrous scrap market participants… received no order cancellations from mills on outstanding February orders, cementing expectations that all scrap grades will log at least a $20-per-gross-ton price increase in the March domestic trade.”

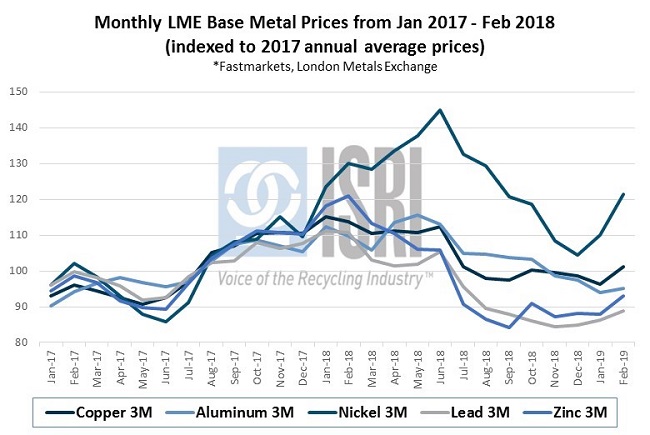

Nonferrous – Falling stockpiles of industrial metals are drawing investors and fueling a rally prices. As statements from the U.S. administration put a Sino-U.S. trade agreement on the horizon, investors have increased their activity on the many base metals. 2018 had been a decoupling year for nonferrous metals. Nickel prices soared and fell quite dramatically during the year while the other major base metals dealt with a tumultuous decline.

The boom in electric vehicle and battery development has contributed to nickel price volatility. However, nickel stockpiles have declined nearly 50% since 2018 according to data analysis from Capital Economics. Slowdowns in mining investments have investors seeing diminishing supply potential as well. The International Stainless Steel Forum’s forecast expects that consumption will rise during the first two quarters of 2019, particularly for hot rolled flat and long product. However, if meltshop production numbers continue their upward trajectory, the supply and demand relationship for finished stainless steel should remain relatively healthy with the real drama being in alloying metal prices and scrap availability.

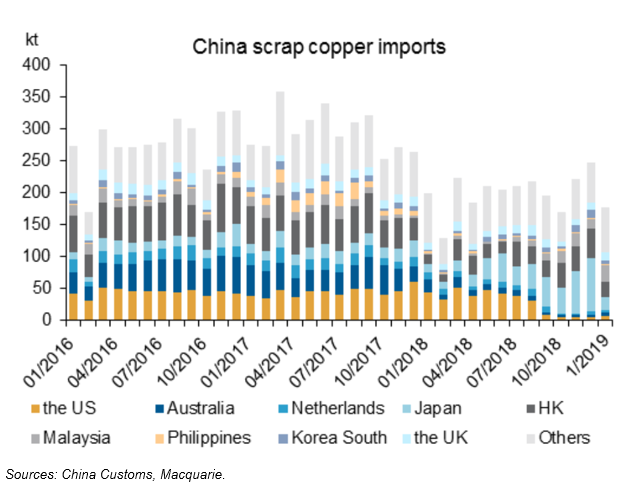

Copper prices have made a turnaround in 2019 as talks of ending the trade war have calmed fears in the market. No. 2 copper scrap prices tumbled in the second half of 2018 with a severe drop in demand from Chinese copper scrap buyers. Macquarie Research reports that total Chinese imports of copper scrap plunged 28 percent month-on-month in January to 177,000 metric tons, while Chinese ferrous scrap imports dwindled to just 28,000 tons in January, down 76 percent from the prior month as China increasingly relies on imports of ores and concentrates to meet its raw material needs.

Paper and Plastic – Transportation logistics and artificial pricing mechanisms are filling up the pipeline for paper and plastics processors. Several U.S. states have introduce new or revised legislation on bottle bills with many of the revisions increasing the redemption amount for bottles. Maine has a bill that implements a post-consumer content level that progressively increases over time.

California has a state bill that’s been introduced to promote a shift to dual stream recycling. The bill may be heard in committee in late March. California’s Department of Resources Recycling and Recovery estimates that two-thirds of their curbside recyclables were exported to foreign markets. Considering the spike in Chinese demand for Japanese recovered news grades, a fundamental shift in residential curbside collections may reopen the gates of a declining market niche. However, transportation costs may throw a wrench in such a cost calculation as the labor shortage in truck drivers doesn’t seem to be easing anytime soon.

Many European economies may be adopting more EPR programs as evidenced by a recent European Parliament event on the PET industry and the circular economy. However, there is also a review on how recycling is measured and that may be an opportunity to make processing output, rather than input, the focal point of diversion rates.

For more information, please contact ReMA Research Analyst Bernie Lee.

Back to Main