U.S. China trade negotiations continued last week with the Wall Street Journal reporting “President Trump, citing progress in U.S.-China trade talks, said he is looking at extending a deadline to raise tariffs and hoping to meet next month with Chinese leader Xi Jinping to complete a broad trade agreement.

His comments in the Oval Office followed four days of talks between U.S and Chinese negotiators, which Mr. Trump extended through the weekend. ‘We’re having good talks, and there’s a chance that something very exciting can happen,’ he said. Among the accomplishments that Mr. Trump cited was a pact with Beijing to curb currency manipulation, which Treasury Secretary Steven Mnuchin called ‘one of the strongest agreements ever on currency.’” Over the weekend, Reuters reported that the “Talks were extended through the weekend in a bid to iron out differences on changes to China’s treatment of state-owned enterprises, subsidies, forced technology transfers and cyber theft” as the President tweeted that Saturday’s talks were “very productive.”

Progress on the trade talks was credited with helping push equity and commodity prices higher as the Dow Industrials rose by 181.18 points on Friday to finish the week at 26,031.81 while the Bloomberg Commodity index ended the day 0.42% higher. For those keeping score at home, total U.S. scrap exports (including ferrous and nonferrous metals, paper, plastic, glass, textiles, etc.) during the first 11 months of 2018 (the most recent data available) to China declined to $3.3 billion,

a loss of $1.9 billion as compared to the first 11 months of 2017.

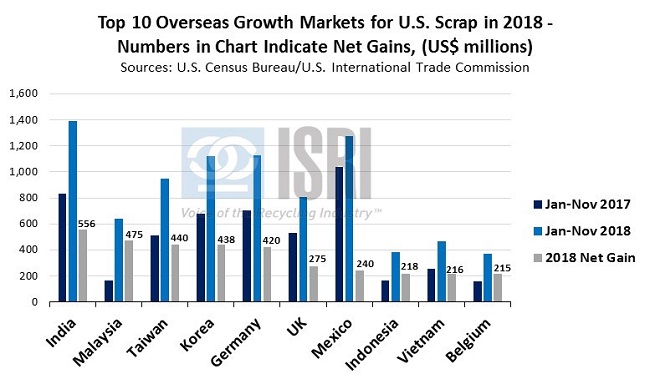

Perhaps of greater interest, though, is how growth in other markets more than offset the drop in Chinese demand last year. According to Census Bureau trade data, U.S. scrap exports to all countries rose from $16.2 billion during Jan-Nov 2017 to $18.7 billion during Jan-Nov 2018. In terms of net gains, India led the world, taking in nearly $1.4 billion in U.S. scrap exports, an increase of $556 million as compared to the first 11 months of 2017. Here were the top 10 overseas growth markets for U.S. scrap in dollar terms last year (through November):

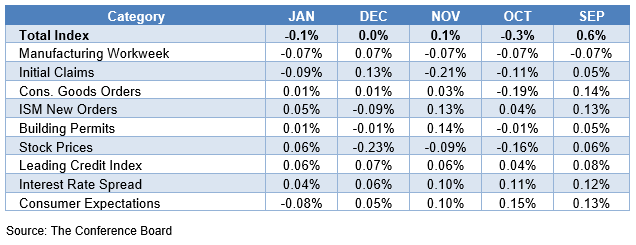

On the domestic front last week, the National Association of Realtors reported U.S. existing home sales in January decreased 1.2% month-on-month (-8.5% as compared to one year ago) to a seasonally adjusted annual rate of 4.94 million units, below the consensus forecast of around 5.1 million units. The conference board’s index of leading economic indicators also came in below expectations, declining 0.1% in January:

The minutes of the last FOMC meeting that were released last week confirmed that the Fed will be more patient regarding future interest rate hikes and balance sheet reductions in light of the softer economic data, low inflation expectations, and uncertainty in the financial markets. According to Bloomberg, “Federal Reserve officials widely favored ending the runoff of the central bank’s balance sheet this year while expressing uncertainty over whether they would raise interest rates again in 2019, minutes of their January meeting showed… The shift occurred after the worst December for U.S. stocks since the Great Depression, trade tensions escalated between the U.S. and China, and President Donald Trump berated officials for tightening monetary policy too much. ‘Many participants observed that if uncertainty abated, the Committee would need to reassess the characterization of monetary policy as ‘patient’ and might then use different statement language,’ the minutes noted.”

Back to Main