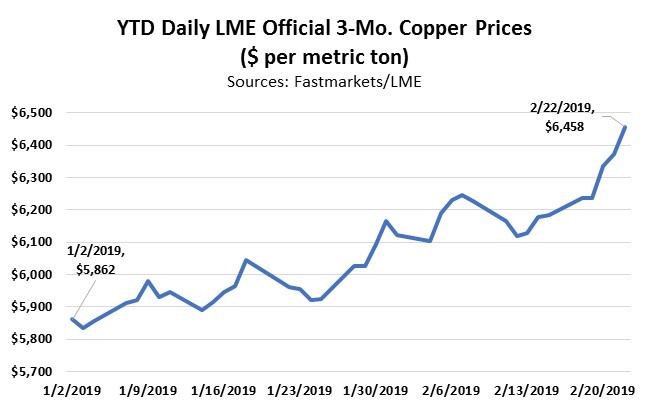

Nonferrous – Refined copper prices rebounded sharply last week as LME 3-mo. copper traded as high as $6,485/mt (=$2.942/lb.) while COMEX Mar copper traded as high as $2.9545 on Friday.

Progress on the US-China trade talks was widely cited as a supportive factor. But as Macquarie notes, “A raft of cancellations in the two stocked US LME warehouse locations led to on-warrant copper inventory falling to the lowest level (39.8kt) since November 2005… The market perceives that the CME/LME arb has opened up again on US investor bullishness (which tends to be expressed more on the American exchange) and believes that the cancelled tonnes on LME are heading for Comex warehouses, just crossing the street in New Orleans and likely heading for CME Detroit from LME Chicago.” Here’s the trend in LME official 3-mo. copper prices so far in 2019:

Refined copper market fundamentals have been somewhat more supportive that what many analysts were expecting, with the International Copper Study Group reporting last week that global copper demand exceeded supply by 396,000 metric tons during Jan-Nov 2018. According to ICSG, “World apparent refined usage is estimated to have increased by about 2.2% in the first eleven months of 2018: Chinese apparent usage grew by around 5.5% driven by a 20% increase in net refined copper imports. It is possible this development was influenced by a tightness in the availability of scrap in China.”

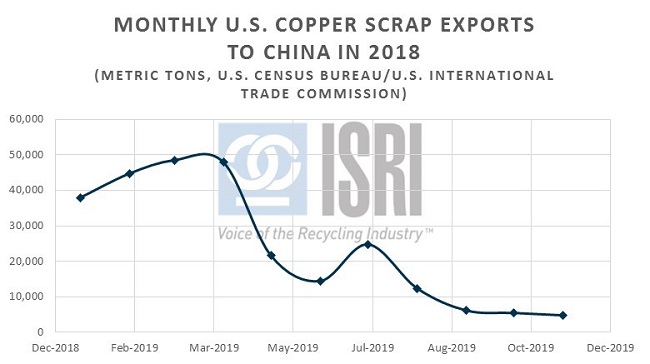

For nonferrous scrap market participants, what materials China will continue to accept remains a critical question this year, along with what markets will help to fill in the gap in Chinese demand. Here’s the trend in U.S. copper and copper alloy scrap exports to mainland China in 2018:

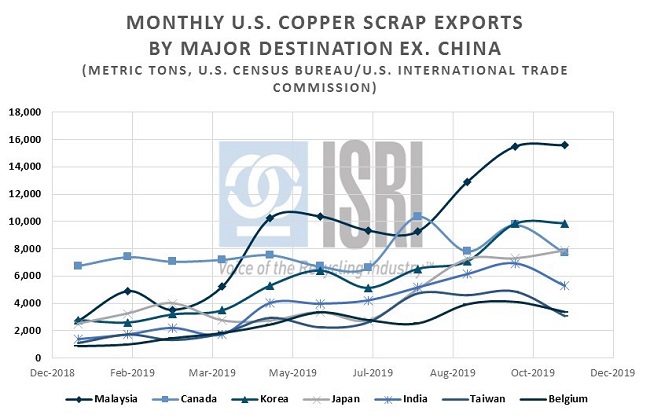

By taking China out of the export data, it becomes easier to see how other economies are filling the demand void. Malaysia, South Korea, India, and Japan have the most significant growth in their nonferrous scrap demand and the development in their industrial infrastructure to indicate these increases aren’t necessarily temporary.

Shifting global market dynamics are also having significant impacts on stainless steel scrap processors. As BIR Stainless & Special Alloys Committee Chair Joost Van Kleef of Oryx Stainless reports in the latest BIR World Mirror on Stainless, “The global stainless steel industry in general and Europe’s in particular are facing one of the most challenging times in years. Apart from the current trend towards applying tariffs and duties on all kinds of product throughout the world, it is mainly the significant investments in stainless production capacity in Indonesia that are threatening the industry. These investments are based on the use of very cheap raw material units which appear to give significant cost advantages. These cost advantages are used to reduce the price of the final product in order to gain market share… As a result, all stainless producers outside of Indonesia are coming under extreme price pressure. Consequently, the relative price level for stainless scrap throughout the world is also under heavy pressure. Needless to say, this is impacting on the flow of material throughout the complete value chain.”

What can stainless scrap processors in the U.S. expect for the rest of the year, and where are the opportunities for growth? For the answers to those questions and much more, you won’t want to miss our upcoming ISRI Nickel/Stainless Spotlight to be held on April 9, 2019 in Los Angeles, where former ReMA Chair Doug Kramer of Spectrum Alloys and Kramer Metals will be joined by an outstanding panel of speaking including Markus Moll of SMR GmbH, Mitch Greenberg of Allied Alloys, and Barry Jackson from Anglo American. For more info about our commodity spotlights and our fast-approaching, best-ever 2019 ReMA Convention and Expo, please visit ISRI2019.org!

Ferrous – According to the latest BIR estimates of world steel recycling, “In the first nine months of 2018, there was a 38.9% increase in steel scrap usage for crude steel production in China to 140.6 million tonnes; this compares to 101.2 million tonnes in the same period of 2017 and underlines China’s position as the world’s largest steel scrap user. As indicated in our previous report, this increase in steel scrap usage is mainly due to the fact that the Chinese government has established stricter environmental quality thresholds and thereby higher pollutant emission standards for the steel industry. To meet these new thresholds and in order to avoid production restrictions, most BOF mills have actively increased their scrap input. It is reported their steel scrap/crude steel ratio is currently around 25-30%. In addition, many new EAFs are being installed or are in the pipeline for the near future, as a result of which further investments in steel scrap processing are planned, especially in shredder capacity. In the first nine months of 2018, steel scrap usage for crude steel production also increased in the EU-28 (+0.7% to 70.2 million tonnes), the USA (+4.4% to 37.8 million tonnes), Japan (+2.6% to 27.249 million tonnes), Turkey (+1.3% to 23.518 million tonnes) and Russia (+6.5% to 23.406 million tonnes). Conversely, there was a decline in steel scrap consumption in the Republic of Korea (-3.3% to 22.391 million tonnes).” Please visit https://mirrors.bir.org/ferrous/ for the entire report.

Here in the U.S., the American Iron and Steel Institute reports that YTD domestic steel production (through February 16th) increased 8.4 percent from the corresponding period last year to 12.737 million net tons as the capacity utilization rate improved to 80.7%, up from last year’s corresponding utilization rate of 75.7%.

Paper and Plastic – Import licenses being released by China seem to be shrinking at an alarming rate. With 60,420 metric tons issued at the end of January and 9,720 issued last week, these issuances appear to be little more than supply corrections for producers. The South China Morning Post reported that Chinese Vice-Premier Liu He was being given greater clout to negotiate an end to the trade war. This could be another arrow in Mr. Liu’s quiver or it may be that large batches of licenses will be issued in a quarterly or biannual basis with minor corrections in between.

MRF fires sparked by Li-ion batteries have been and remain an important concern but 2019 has kicked off with notable fires at paper mills. Both Marcal Paper and the Kendrick Paper Stock Company dealt with devastating fires at their facilities. Jamaica Packaging Industries in Kingston, Jamaica also suffered from a fire that destroyed about 25 to 30 percent of their production stock.

A new McKinsey study looked into Denmark’s plastics consumption behaviors and estimates that approximately $152 million could be captured through recycling plastics rather than diverting them for incineration. Another benefit would be a cut in pollution generated. One of the effects of incinerating plastics for energy is that their markets do not have similar incentives to use recyclable polymers or packaging designs. Neither McKinsey’s executive summary nor technical report seem to address what would be the energy source substitute in exchange for diverting their plastics to recycling. However, this report does lay out an interesting blueprint that better equates the environmental impact of recycling in a monetary sense over the direct marginal cost comparison in energy production.

For more information, please contact ReMA Research Analyst Bernie Lee.

Back to Main