Two months into the New Year and every state but Florida, Alabama, and Louisiana is in session, with policymakers racing against committee and chamber deadlines that have already passed in some states.

By the end of February, Virginia and Wyoming will have already adjourned, with legislators in five more states following close behind in March.

Bills and regulations targeting metals theft, packaging, product stewardship, and other commodities and issues can directly change how your business operates. You can keep track of these and other state legislation and regulations targeting the industry on ISRI's State Resources and Tracking Pages.

Materials Theft

While ReMA is already tracking 41 materials theft bills for 2019, the majority follow recent trends towards comparatively small tweaks to existing law instead of the massive rewrites of past years. A few examples include:

- South Dakota HB 1082, currently in the Senate, would require payments for nonferrous metal property that exceed $100 be made by check or electronic funds transfer, and require a photocopy of the seller's ID for the transaction record;

- Indiana SB 471, amending the penalties for the theft of valuable metal to include increased penalties for critical infrastructure facilities;

- Bills in Arizona and Florida changing the thresholds for different theft penalties related to metals;

- Maryland HB 442, allowing scrap metal processors to request a list of all junk dealers and scrap processors submitting the required transaction reports; and

- Massachusetts HD 3229 bucks this trend by creating a new chapter for secondary metal dealing, including registration, recordkeeping, inspection, hold by request, and penalties for violations.

Synthetic Turf

New York and Connecticut rang in the New Year by returning to proposals to ban the installation of synthetic turf and other crumb rubber ground covers. The following bills have been introduced:

- New York SB 1109 would require a six month moratorium while the state conducts an environmental and public health study:

- Connecticut HB 7003 would ban new contracts for crumb rubber ground covers until the U.S. EPA completes a federal study; and

- Connecticut HB 5249 would simply ban future state or municipal contracts for the purchase, use, or installation of artificial turf.

And in a new wrinkle, Maryland HB 1142 would require that synthetic turf and turf infill (any turf infill, not just crumb rubber) be disposed of in a controlled hazardous substance facility or at a closed loop recycling facility, bans incineration, and states that turf and infill may only be reused if processed at a closed loop facility and used for new turf and infill. It would also require tracking manifests from the manufacturer through to disposal or reuse that would be published on the Maryland Department of Environment webpage.

In contrast, Indiana SB 615, aimed at combatting lead poisoning of children, lists artificial turf as an acceptable method of control for covering lead contaminated soil, and other states continue to introduce appropriations for rubberized track and artificial turf athletic fields for school districts.

For reference, ISRI supports the ongoing EPA and other scientific studies regarding recycled rubber.

Plastics, Paper, Packaging, and Producer Responsibility

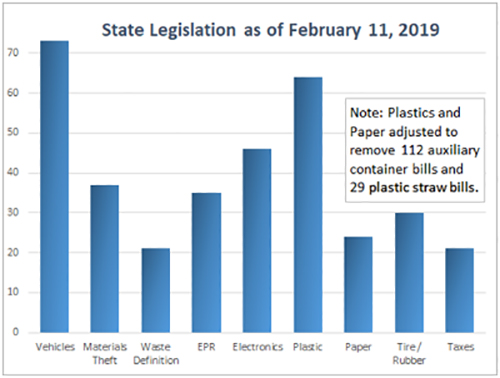

Driven by news reports about ocean plastics and Americans using 500 million straws a day - a questionable statistic with its own story - ReMA has seen a surge in legislation targeting "auxiliary containers" (112 bills targeting plastic and paper bags and other "single use" items) or just seeking to ban plastic straws (29 bills and counting).

Most of these auxiliary container bills are unlikely to pass, with most states instead opting to prevent local governments from passing their own restrictions. But all this attention has led to a resurgence in extended producer responsibility (EPR) legislation targeting packaging.

2019 has already seen bills targeting packaging in Indiana, Massachusetts, Washington State, New York, and Vermont, along with broader bills like New York’s AB 1642 that would require manufacturers of all "consumer goods" purchased or leased for household use to provide and pay for collection of these items. Whether these bills will receive traction remains to be seen.

ISRI's Position on Producer Responsibility opposes government fees and mandates on paper, packaging, and other products that are being manufactured into commodity grade materials and sold into viable, commercial markets, as these can restrict or interfere with the free flow of recyclables by giving producers control over the recycling market.

For certain products such as electronics, ReMA recognizes that such programs can stimulate recycling, but ReMA supports ending producer responsibility and government imposed fees as soon as practicable.

Recyclables vs. Waste

China's import restrictions and uncertain commodity markets don't just hurt recyclers; local governments with contracts for curbside collection and recycling are also feeling the pinch. However, how states choose to confront this issue varies widely:

- Texas HB 286/SB 649 would promote the use of recyclable materials as feedstock for manufacturing; the Gulf Coast Chapter is seeking an amendment to clarify that for-profit private recycling companies are not subject to any reporting requirements intended to target municipal facilities;

- Maine LD 401 is a concept draft that declares the intent to discourage landfilling of recyclable materials and ensure materials used as daily cover at a landfill are not counted towards the State's recycling goals;

- Florida SB 816 would prohibit local governments from requiring the collection or transport of contaminated recyclable materials by residential recycling collectors, and require that "contaminated recyclable material" be defined in every contract between a local government and a collector or MRF; and

- Washington HB 1795/SB 5854 would restrict what is considered recyclable material for curbside collection and allow transporters to apply for waivers to dispose of materials.

ISRI members need to be involved with their policymakers on the federal, state, and local levels to ensure the industry can continue to operate without excessive statutory and regulatory burdens.

If you'd like to find out what changes could impact your company, visit ISRI's State Policy page or contact Danielle Waterfield (202) 662-856 if you have any questions about the system or legislation impacting your state. ReMA has also added live legislative and regulatory reports to the State Resources and Tracking pages to make keeping up-to-date in your state easier, and will be adding more resources in the coming year.

SPAN