Following the President’s Day holiday in the U.S. on Monday, stock futures in the U.S. were pointing to a lower open following the decline in European shares and softer euro. In early foreign exchange trading, the euro dipped to $1.128 while the British pound was little changed at $1.292.

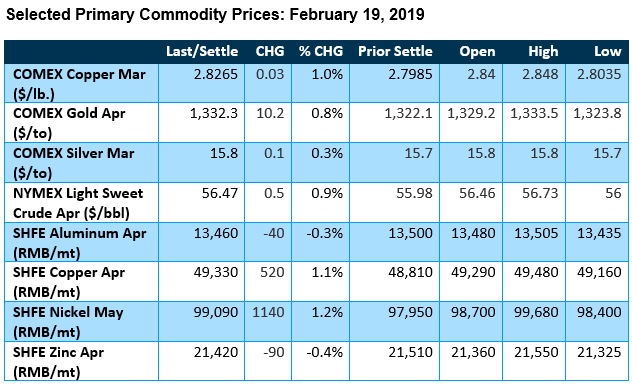

In commodity markets, the Bloomberg Commodity Index advanced 0.27% this morning amid firmer crude oil, precious metal and base metal futures. In New York, COMEX copper opened higher this morning at $2.84 per pound while NYMEX crude oil futures rose above $56 per barrel. Reuters cited the OPEC supply cuts as a supportive feature, reporting “The supply curbs led by the Organization of the Petroleum Exporting Countries have helped crude prices to rise more than 20 percent this year. U.S. sanctions against OPEC members Iran and Venezuela have also tightened the market.” In London, base metal prices were mixed this morning with LME 3-mo. copper and aluminum recently trading around $6,245 and $1,865 per ton, respectively, while 3-mo. nickel was flat around $12,465/mt. On the ferrous front, Bloomberg reports today that “BHP Group, the world’s biggest miner, doesn’t have capacity to raise shipments into the iron ore market as competitor Vale SA faces outages following the fatal mining disaster in Brazil last month.”

Back to Main