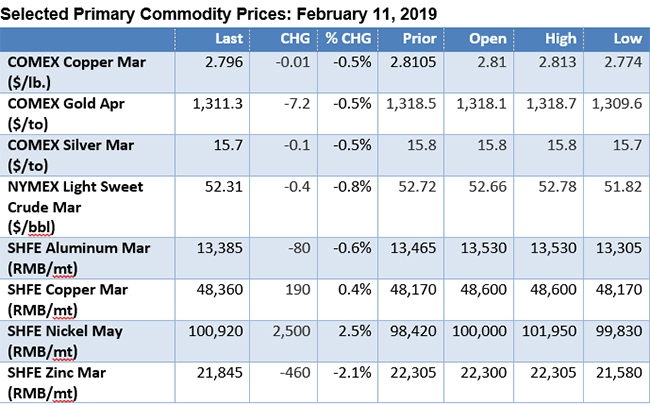

Following last week’s Lunar New Year holiday, iron ore prices in China surged this morning, rising 8% and hitting the intra-day limit-up maximum. Business Insider reports, “The latest price spike reflects renewed concerns about supply disruptions from Brazil following a mine disaster in Brazil in late January. Combined with seasonal restocking ahead of the Spring construction season in China… that explains the scale of the increase seen today.” But softer crude oil, industrial and precious metal prices weighed on commodity indexes as the Bloomberg Commodity Index slipped 0.1% in early trading. In New York, most actively-traded COMEX copper dipped below $2.80/lb. this morning while NYMEX crude oil futures were trading around $52 per barrel. In London, most of the base metals started the week in negative territory although LME 3-mo. nickel firmed to around $12,600 per ton. Fastmarkets reports that stronger iron ore prices and nickel’s “…strong consumption as a downstream component in the stainless steel sector has led to upticks in nickel’s three-month price.” In foreign exchange trading, the euro was little changed around $1.131 this morning while the British pound traded as low as $1.2895. Reuters reports “Sterling extended its fall on Monday after data showed that Britain's economy last year grew at its slowest since 2012, with Brexit uncertainty hitting investment.”

Back to Main