Factory orders declined 0.6% in November as compared to a 2.1% drop in October. December saw a large market sell-off that bled into a record-long government shutdown during January.

Prior to November, factory orders saw relatively big shifts every other month with intervening months having small corrections. It appears that business confidence has been highly reactionary to policy announcements so we may be in for a ride in the coming months.

Motor vehicle sales for December bumped up a bit to an annualized rate of 17.5 million units. Ford released promising January sales numbers up 7%. Operating profits for Ford were down 27% in 2018 and that could prompt a push to drive down material costs so that C-suite executives can meet shareholders’ dividend expectations.

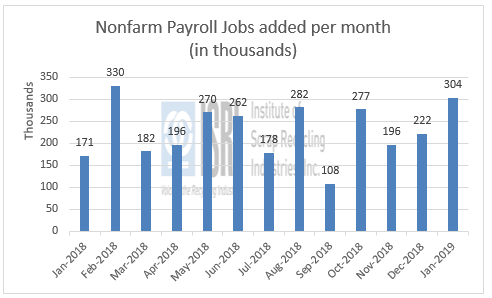

The January employment figures beat analysts’ expectations as nonfarm payrolls increased by 304,000 according to figures from the Bureau of Labor Statistics. Corrections made to previous months temper the size of the jump. Furloughed workers contributed to the unemployment rate increase from 3.9% to 4.0% but there has also been an increase in the participation rate, indicating that new entrants are coming back to the labor market. Wages nudged higher by 0.1% in January but couldn’t move the year-on-year rate from 3.2%.

The ISM’s manufacturing PMI moved up 2.3 percentage points to 56.6% for the month of January. This exceeded consensus expectations and points to solid growth last month. New Orders was the subset that seemed to bounce back the most, going up 7 points to 58.2 after a soft December dropping 11 points. A paper products industry representative said that “Unlike in the last few years, we are experiencing a first quarter slowdown.” A fabricated metal products representative said “Going to be a very strong spring. Business levels will be just as good [compared to] the same time frame in 2018.”

The EIA Petroleum Status report came out with some mixed signals as crude inventories rose in the first week of February. However, the inventory split on gasoline and crude distillates with the former going up half a million barrels to 5.1% above last year’s level while the latter declined 2.3 million barrels, a drop of 2.0%. Refinery capacity increased to 90.7 but gasoline and distillate production moved in opposite to the demand on inventories.

Consumer sentiment continued to remain high despite the government shutdown but some of the survey’s subsets did see a slide such as current conditions and future expectations declined 7.3 and 7.1 points, respectively. Further reading into this, mortgage applications continued their third week of declines despite lower financing costs and a reprieve from the Fed on interest rate hikes. Many analysts believe this decline will prompt a soft spring selling season more so than the early 2019 jumps in applications had previously indicated.

Back to Main