Last week started with some unsettling Chinese trade data showing China’s exports and imports both fell in December as compared to a year ago.

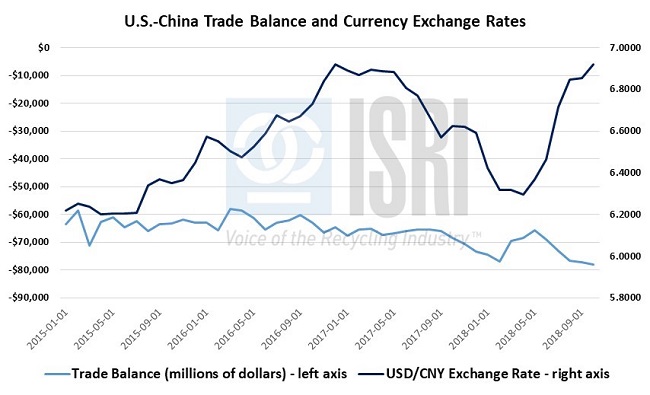

But at the same time, The Wall Street Journal reports that “China’s trade surplus with the U.S. hit an all-time record last year, as robust American demand for Chinese goods undercut the Trump administration’s tariff offensive aimed at narrowing the countries’ lopsided trade gap.” Here’s a look at the mirror image of the U.S. trade deficit with China and depreciation of the Chinese RMB.

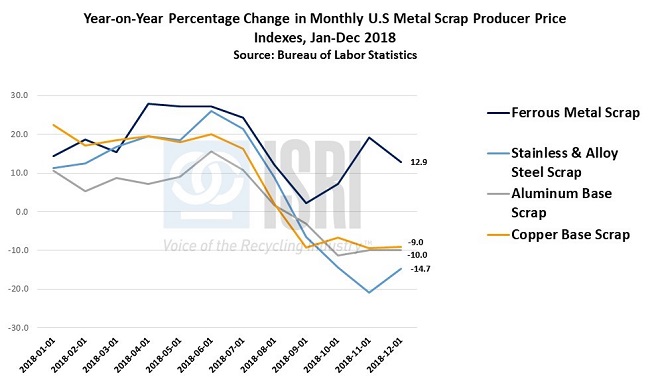

As the trade deficit with China has widened, producer price inflation in the United States has moderated lately, including a 0.2 percent month on month decline in the producer price index in December. But why should recyclers care about producer price inflation? First off, the producer price index represents the change in the selling prices received by producers for their output, including scrap. The following chart shows the year-on-year percentage changes over the course of 2018 for the major metal scrap commodities including ferrous scrap, stainless, copper and aluminum scrap as reported by the BLS. As we can see, nonferrous scrap prices significantly underperformed as compared to ferrous scrap, particularly in the second half of last year.

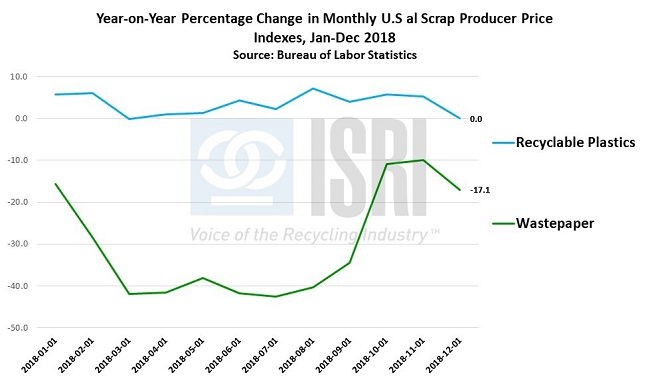

Recycled plastics and paper have also diverged significantly as the BLS data show producer prices for wastepaper -- their term, not ours -- were down just over 17 percent year-on-year in December. However, note that within the paper sector, prices varied widely by grade.

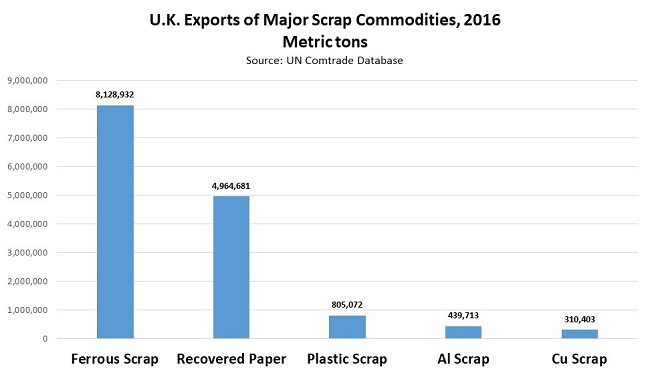

Of course Brexit was in the news again last week after Theresa May’s plan was overwhelmingly defeated in Parliament last week. For scrap recyclers in the U.S., the uncertainty surrounding Brexit has a couple of important implications: one is the potential for an unorderly Brexit to wreak havoc on global financial markets. But more directly, the UK is one of the world’s major scrap exporters. In 2016, the UK was the 4th largest exporter of ferrous scrap in the world, the third largest copper scrap exporter, and second largest recovered paper exporter. Should the Brexit troubles cause a serious meltdown in the UK economy or the value of the British pound, British scrap exports could become much more competitive on the global stage, including for import into the United States.

Back to Main