Ferrous – The American Iron and Steel Institute reports that for the week ending January 12, “…domestic raw steel production was 1,891,000 net tons while the capability utilization rate was 79.8 percent.

Production was 1,715,000 net tons in the week ending January 12, 2018 while the capability utilization then was 73.6 percent. The current week production represents a 10.3 percent increase from the same period in the previous year. Production for the week ending January 12, 2019 is up 0.8 percent from the previous week ending January 5, 2019 when production was 1,876,000 net tons and the rate of capability utilization was 80.0 percent.

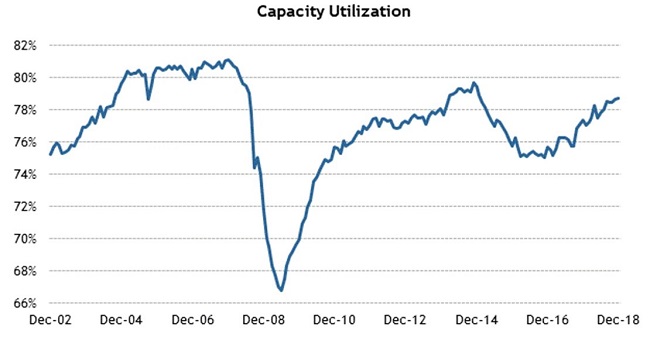

The rise in steel production comes amid reports that industrial production in the U.S. overall is also improving. The Federal Reserve reported last week that U.S. industrial production rose 0.3% in December while the total capacity utilization rate edged up to 78.7%.

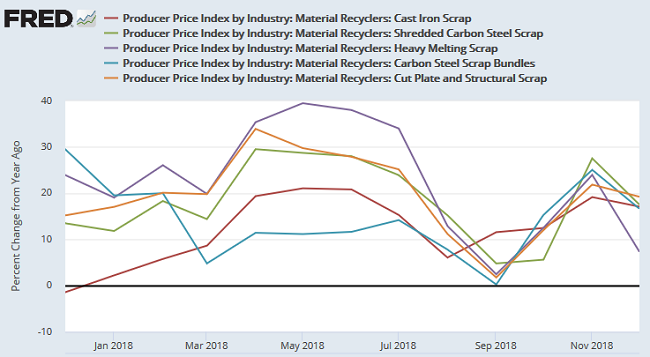

As for domestic steel prices, Fastmarkets AMM reports their “daily US Midwest hot-rolled coil index stood at $34.58 per cwt ($691.60 per ton) on Thursday January 17, down 0.2% from $34.64 per cwt on January 16 and nearly level with the $34.59 per cwt recorded on January 15. But the latest price is down by 4.5% from $36.21 per cwt at the beginning of this year.” Ferrous scrap prices have also gotten off to a mixed start in 2019 following significant disparity among the different scrap grades last year. Here’s are the Bureau of Labor Statistics’ producer price trends for U.S. cast iron scrap, shredded, heavy melt, bundles, and cut plate & structural last year:

Nonferrous –Nonferrous metal prices at the London Metal Exchange ended the week on a positive note amid reports of renewed optimism on the U.S.-China trade talks. LME 3-mo. copper ended the week higher at $6,056 per metric ton while 3-mo. aluminum advanced to $1,870/mt, after having closed the prior week at $1,833.50/mt. Aluminum scrap continues to garner attention, with the Wall Street Journal reporting last week: “…domestic smelters that make new aluminum from bauxite aren’t able to supply more than a fraction of the aluminum consumed, even with higher production last year. Instead, much of the increase in domestic {aluminum} production to offset lower imports has come from the processors that make aluminum from scrap. China implemented more-stringent quality standards on U.S. scrap exports early last year that started to drive down exports, and then it followed with tariffs totaling 50% on U.S. scrap aluminum, creating a glut for U.S. recyclers to remelt into new aluminum. ‘It is a complete buyers’ market,’ said Matt Kripke, president of Ohio scrap broker Kripke Enterprises Inc. The U.S. generates more aluminum scrap than any other country. Much comes from old automobiles, demolished buildings and factory waste. Inventories were rising before China’s tariff took effect. Vehicles sold during the automotive boom following the 2008 recession are reaching the end of their lives, providing the U.S. scrap industry with a burgeoning supply of junked cars. That nationwide scrap heap grew more rapidly after Beijing’s trade barriers squeezed exports lower.” Here are the Journal’s charts on aluminum scrap exports and prices:

Paper and Plastic –

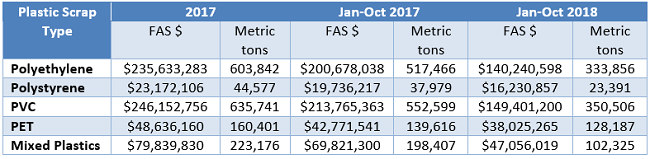

It appears that plastic scrap prices have found a new normal during the 2018 year. U.S. exports declined in volume but trade value prices per ton indicate that the remaining demand held stronger margins. Based on trade data from the U.S. Census Bureau and International Trade Commission, the price per ton for the major polymers increased by 31% for mixed plastics despite a volume decline of -48%. The increased price for polystyrene tracked similarly. These two plastics generally account for the highest public concern in regard to ocean plastics while they may not actually account for the largest volumes of ocean plastic pollution.

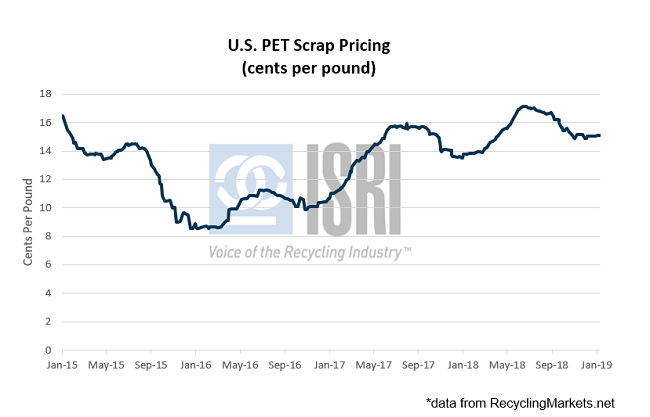

PET plastics remained rather stable. RecyclingMarkets.net shows that PET prices has recovered from 2015 lows. While the market may have been affected by the lack of Chinese processing, it appears that other demand areas have been able to bolster the void.

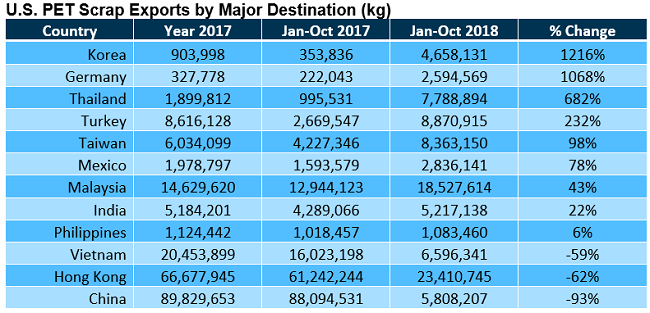

Destinations for U.S. PET scrap have shifted to South Korea, Germany, Thailand, and Turkey. Despite the volume disparity from China’s lack of demand for U.S. PET scrap, these are still significant shifts in market demand.

For more information, please contact ReMA Research Analyst Bernie Lee.

Back to Main