The major commodity indexes started the morning in negative territory as concerns about Chinese growth weighed on market sentiment. The Wall Street Journal Reports, “Data early on Monday showed that China’s exports and imports both fell in December from a year ago as the impact of U.S. tariffs started to kick in and demand weakened.

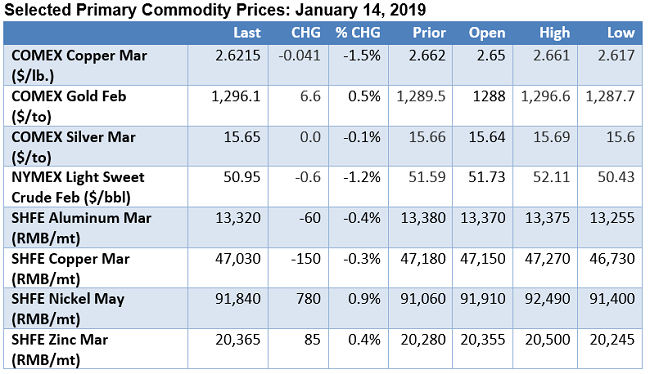

China’s exports dropped 4.4%, contrary to economists’ expectations of a 2.5% growth rate.” In Shanghai, base metal prices were mixed this morning with SHFE copper and aluminum settling lower while SHFE nickel was up nearly 1%. In New York, WTI crude oil futures were down more than 1% this morning to less than $51 per barrel while COMEX copper futures were down 4 cents to around $2.62 per pound. The weaker than expected Chinese trade data reportedly kept a lid on base metal prices in London, with LME 3-mo. copper recently trading around $5,888/mt as 3-mo. aluminum eased to $1,820/mt (=82.6 cents/lb.). On the ferrous front, Fastmarkets AMM reports that ferrous scrap export prices continue to be supported by recent bulk sales to Turkey and South Korea. In foreign exchange trading, the euro eased to $1.146 and while the greenback was buying 108.08 Japanese yen in early trading this morning.

Back to Main