The news last week was somewhat more encouraging given the reports of progress on U.S.-China trade talks and the release of minutes from the last Fed meeting that indicate “the extent and timing of further policy firming has become less clear.”

The initial market reaction to those developments was positive, helping to underpin stock and commodity market indexes despite the partial U.S. government shutdown.

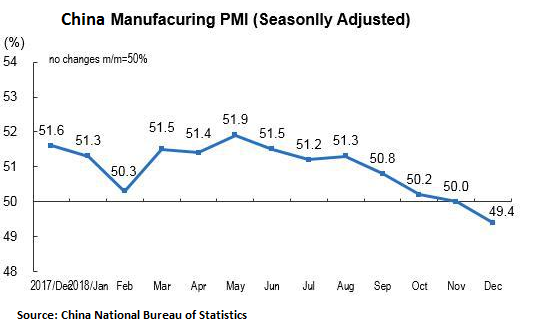

In China, the latest economic reports have been somewhat less encouraging as of late. CNBC reports “China's producer inflation rose less than expected for the month of December to hit the lowest growth rate in two years, official data showed on Thursday. The Producer Price Index in December rose 0.9 percent from a year ago, lower than the 1.6 percent economists were expecting in a Reuters poll.” In addition, China’s National Bureau of Statistics reported that the “new {manufacturing} orders index was 49.7 percent, a decrease of 0.7 percentage point month-on-month, and was lower than the threshold, showing that the manufacturing market demand was decreased.”

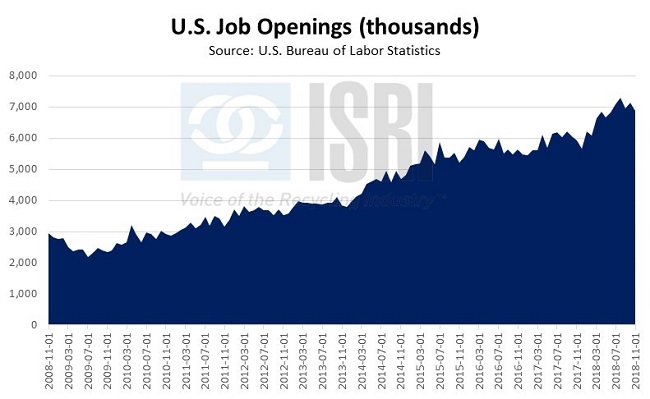

In the United States, the Bureau of Labor Statistics reports that job openings dipped to less than 6.9 million opening in November, but the news on the labor front overall remains quite positive. Initial unemployment claims for the week ending January 5, 2019 declined to 216,000 and as Briefing.com reports, “The key takeaway from the report is that it fits neatly with the market's latest awareness that the labor market has held up fine despite the burgeoning concerns about the economy slowing.”

Back to Main