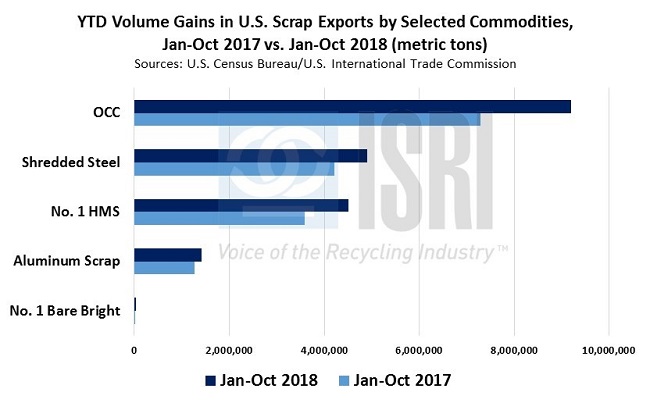

International Trade – Despite some onerous trade policy shifts, U.S. scrap exports are on track for their best performance since 2013. Which scrap commodities (and countries) are driving this change? Mostly paper and steel.

U.S. OCC exports increased 26% during Jan-Oct of 2018 as compared to the same period in 2017. That’s an increase of 1.9 million metric tons of exported material. As for ferrous scrap, No. 1 HMS exports increased 25% (+912,000 metric tons) year-on-year. Bare Bright #1 copper and stainless steel scrap also made large relative leaps of 93% (+18.8k metric tons) and 72% (+286.4k metric tons), respectively, according to Commerce Dept. trade data. Other scrap categories that saw a major increase in export volumes were shredded steel (+686,000 metric tons), pulp substitutes (+310,000 metric tons), cast iron scrap (+216,000 metric tons), and aluminum scrap (+147,000 metric tons, including UBCs and RSI).

Exports of Bare Bright to South Korea more than quadrupled during the first 10 months of 2018. Mexico, Vietnam, Egypt, Taiwan, and South Korea all increased their imports of No. 1 HMS, so much so that they already exceeded their 2017 totals by the end of Q3 2018. Shipments of recovered paper to China were down across the board, with U.S. exports of OCC to China down 5% for the year-to-date through October. India led the way with an increase of 701,000 metric tons of U.S. OCC shipments. The rest of the 1.9 million metric ton increase in OCC export volumes went to Vietnam, Taiwan, Indonesia, South Korea, Thailand, and about 30 other countries.

Going forward, the International Monetary Fund expects the pace of growth in the global trade of goods and services will continue to decline this year to 4.0 percent, down from 4.2 percent growth in 2018 and 5.2 percent growth in 2017.

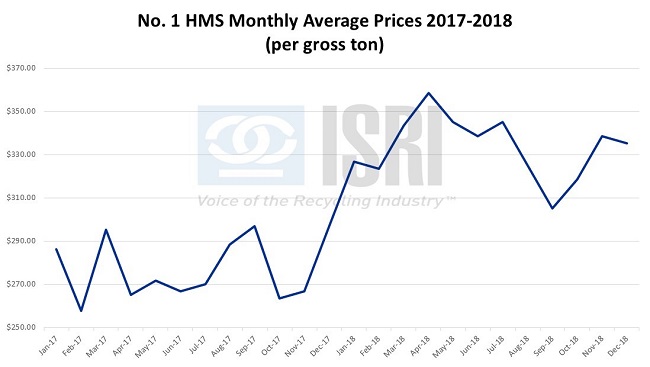

Ferrous – Fastmarkets AMM reports that their “No. 1 busheling US domestic Midwest Index moved to $372.11 per gross ton for January, down by 7.3% from $401.46 per ton in December. The shredded scrap index settled at $320.42 per ton, down by 8.4% from $349.75 per ton last month; and the No. 1 heavy melt index decreased by 9.1% to $293.74 per ton from $323.19 per ton in the same comparison.” At the same time, AMM reports that Turkish buyers “…booked a 40,000-tonne US cargo comprising HMS 1&2 (80:20) at $280 per tonne, shredded at $285 per tonne and bonus at $290 per tonne cfr.”

Meanwhile, the American Iron and Steel Institute reports that for “the week ending on January 5, 2019, domestic raw steel production was 1,876,000 net tons while the capability utilization rate was 80.0 percent. Production was 1,704,000 net tons in the week ending January 5, 2018 while the capability utilization then was 73.1 percent. The current week production represents a 10.1 percent increase from the same period in the previous year.”

And for those of you who may not be regular NPR listeners, AISI President Thomas Gibson was interviewed on All Things Considered last week regarding the potential steel wall on our southern border, indicating “We estimate a barrier of about a thousand miles would require about 3 million tons of steel. And the industry is ready to meet that demand, to produce the steel that's required for the project.”

Nonferrous – On the aluminum front, U.S. sanctions against UC Rusal have re-entered the political fray. The Financial Times reports, “A Trump administration plan to lift sanctions on the aluminum empire controlled by the Kremlin-linked billionaire Oleg Deripaska has come under threat from Democratic lawmakers, who have demanded it be delayed for further scrutiny. Seven Democratic chairs of House of Representatives committees on Tuesday sent a letter to Steven Mnuchin, the Treasury secretary, expressing reservations about the plan in which Rusal, En+ and EuroSibEnergo — which together form one of the world’s largest aluminum producers — would be released from sanctions in return for various governance changes intended to distance them from Mr. Deripaska.”

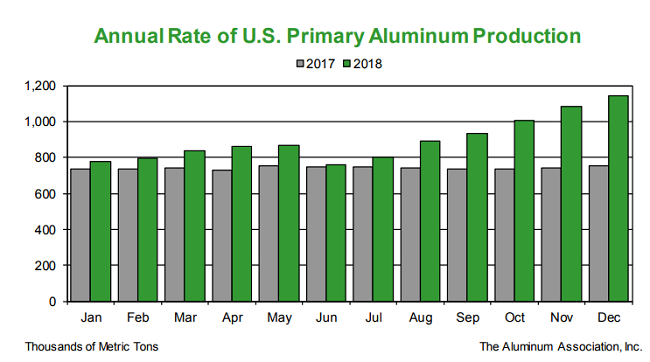

On a somewhat related note, the Aluminum Association reports U.S. primary aluminum production increased 21 percent in 2018 to nearly 897,000 metric tons:

And yet aluminum scrap prices in the U.S. continue to languish. Fastmarkets AMM was recently listing secondary smelter aluminum prices at 43-44 cents for old cast, 44-45 cents for old sheet, painted siding at 45-47 cents, and MLC at 50-51 cents, with domestic aluminum producer prices for UBCs at 54-56 cents per pound. For comparison’s sake, UBCs were listed at around 74-76 cents per pound this time last year. In London, LME 3-mo. aluminum was trading around $1,860 per metric ton late last week, or around 84 cents per pound.

Paper – Prices for the major bulk grades stayed relatively steady in 2018 despite the major shifts in demand on the different paper grades. The impact of investments made by Nine Dragons into U.S. mills should begin to take shape this year but it may be difficult to characterize the shifts through the customary supply and export statistics used in years past to understand the state of the industry. Over 5 million tons of Chinese import licenses have been issued, but the Lunar New Year starts in early February.

Electronics – Dubai appears to have a massive, underestimated source of discarded electronics that has prompted Sims Recycling Solutions to move their operations to a larger site to handle the demand. Australia’s MobileMuster, a joint product stewardship effort of their domestic handset manufacturing industry, estimates that 23 million mobile phones are collecting dust across the nation. That’s a remarkably large number when compared to the 90 metric tons of discarded phones and chargers that they collected over the previous year.

For more information, please contact ReMA Research Analyst Bernie Lee.

Back to Main