While recent statements from Federal Reserve officials have investors wondering if 2019 interest rates hikes will stick to schedule, the European Central Bank announced it is ending its quantitative easing program.

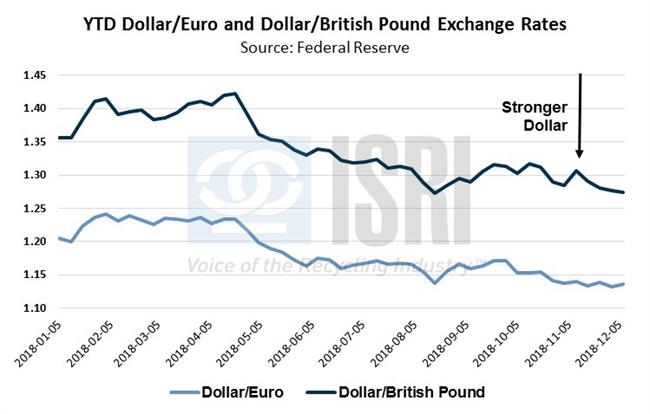

This may impact the valuation gap between the euro and dollar should U.S. interest rate hikes get delayed as European monetary conditions tighten. Here’s the year-to-date appreciation of the dollar against the euro and pound in 2018:

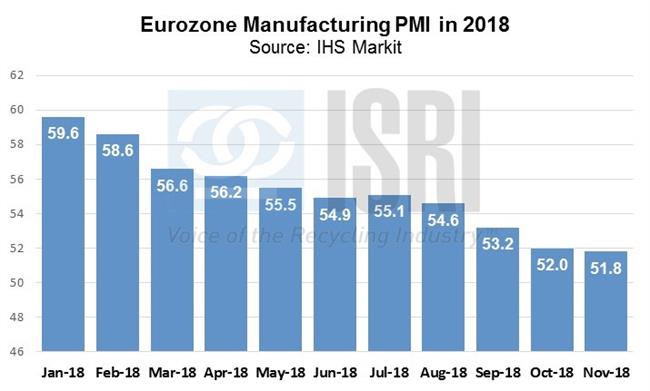

The strong dollar, U.S.-China trade war, Brexit worries, and expectations for rising U.S. interest rates have all been widely cited as sources of global market jitters. Indicators of slower European manufacturing growth have also raised concerns. According to IHS Markit, “Eurozone Manufacturing

PMI signaled the continued growth slowdown of the single currency area’s manufacturing economy… Although remaining above the crucial 50.0 nochange mark for a sixty-fifth month running, the final PMI came in at 51.8 in November, down from 52.0 in October and the lowest reading since August 2016.” They also report the Eurozone business confidence is at the weakest level in around six years.

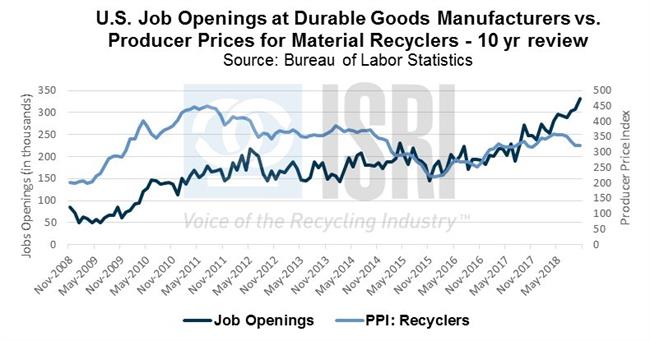

Here in the U.S., real-estate speculation appears to be slowing down, pointing to a weakening longer-term outlook on the U.S. housing market. The Wall Street Journal reports “The national housing slowdown is spreading to markets like Las Vegas and Phoenix, where prices still haven’t reclaimed their pre-crisis peaks.” We’ll get new data on housing starts and building permits, along with existing home sales data, this week. On a positive note, recently released U.S. inflation and jobs numbers continue to point to healthy economic growth in the near term. The Bureau of Labor Statistics reported last week that the Producer Price Index was up just 0.1% in November while the Consumer Price Index was flat (0.0%) last month. As for the labor market, U.S. job openings rose to nearly 7.08 million in October while there were 332,000 job openings in the durable goods manufacturing sector. This exceeds any level seen since 2001. While producer prices for recyclers have eased as of late due in part to Chinese trade restrictions, U.S. durable goods manufacturing job openings have continued to improve according to the BLS data: