In the January/February edition of SPAN, we wrote about the current state of play for sales and use tax compliance legislation in the states (frequently referred to as “nexus” legislation) and how it might relate to, and impact, the scrap recycling industry.

We focused on the manufacturing sales tax exemption because we are

hearing more reports of ReMA members being audited and assessed thousands, and

sometimes even millions of dollars in unpaid sales taxes for manufacturing

equipment. While this remains a concern for ReMA members, however, the remote

sales and use tax issue is a much broader tax matter that warrants similar

vigilance.

The collection of

sales and use taxes by remote sellers from one state into another state is one

of the most prominent tax issues in the state legislatures this year. More than

35 bills have been introduced in 17 states to promote broader collection of

sales taxes which are already legally due and payable. The purpose of all of

these bills is the same: to promote collection of sales taxes by as many

sellers as possible (including remote sellers). State legislators are beginning

to pursue a variety of strategies to enhance compliance which could have

unanticipated consequences.

Recyclers who sell

and/or broker sales in multiple states need to pay attention. While much of the

media focus has been on remote online sales, the proposals being considered

apply to ANY sales into another state. In the past, if the seller did not have

a physical operation and location in the state in which goods were sold, they likely

did not have to pay that state’s sales taxes. This is all quickly changing now

that the U.S. Supreme Court has essentially given states its blessing to pursue

alternative approaches when it denied a petition last December to rule directly

on the issue.

Given that this is

one of the most prevalent tax issues addressed by state legislatures this year,

we thought it would be useful to partner with the state tax experts at

MultiState Associates (the ReMA consultant providing state legislative and

regulatory tracking services direct to the chapters and ReMA membership) to

provide a survey of current state law of sales tax compliance directed at

remote/internet to provide context for these bills. In other words, under

what circumstances does a state by law or regulation currently require sales

tax collection and remittance?

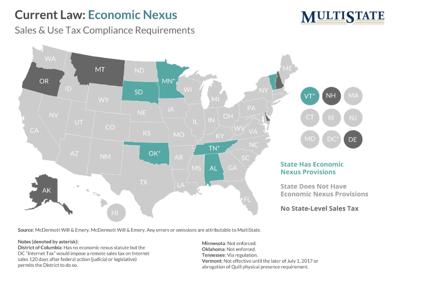

We've placed the states based in three broad buckets:

(1) Economic Nexus Bills. These bills set

“physical presence” as the standard for state authority to require sellers to

collect sales taxes. Instead of focusing on physical presence, these bills set

a bright line sales threshold (in dollars or number of transactions or both),

with sellers exceeding these thresholds required to collect legally due and

payable sales taxes. These measures were inspired initially by U.S. Supreme

Court Justice Anthony Kennedy, who, in his concurring opinion in DMA v. Brohl, invited the

legal system to present the Court with a case that would allow it to revisit

its holding in the precedent-setting case Quill Corp. v. North Dakota, 504 U.S. 298

(1992), in which the Court held states could not collect sales taxes from

out-of-state sellers who do not have a physical presence in the state.

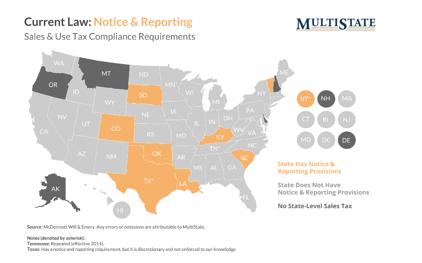

More and more state policymakers are of the

opinion that a physical presence isn’t the correct standard and are now pushing

the limits and creating unique and creative means in which to get their hands

on sales taxes. In the state of Colorado, for instance, a new compliance burden

on Colorado businesses includes a requirement of notifying out-of-state

customers of their duty to remit use tax, as well as providing the state revenue

department all of its customer information. The State of Vermont has a comparable

law in place that will go into effect on July 1, 2017, and as with the Colorado

law, noncompliance comes with a steep financial penalty that could add up

quickly. Louisiana and Oklahoma have similar reporting laws but without the

monetary fines.

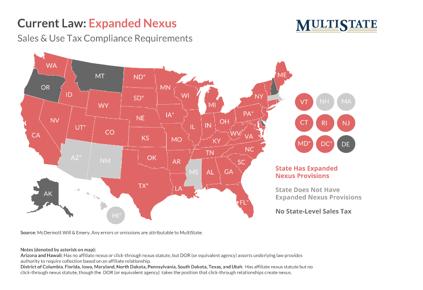

(2) Expanded Nexus Bills. These bills aim to

extend the physical presence standard to the existing constitutional limit.

Many non-practitioners mistakenly believe that “physical presence” means that a

company must have a store or a distribution center or own some other real

estate in a state to be subject to sales tax collection. However, “physical

presence” isn’t clear; yes, it includes ownership of real estate, but it also

has been interpreted to extend to activities of affiliates, agents, and others

who are acting on behalf of, or in conjunction with, the remote/internet

seller. This could clearly include the brokers that many recyclers utilize for

scrap transactions. Examples of these “expanded nexus” bills include affiliate

nexus, click-through nexus, and drop-ship nexus. This category also includes

extending the imposition of a sales tax collection obligation to new economic

actors, such as online marketplaces (assuming they have physical presence in

the state; if they do not, then the bill falls under economic nexus).

(3) Non-Nexus Collection Bills. Other sales tax

compliance bills that don’t address the nexus question often require out of

state sellers to inform their buyers about the responsibility to pay sales tax

on their purchases, typically with an annual mailer.

The

three maps below show whether or not a state falls in each of these three

categories. Note that some states fall in more than one bucket.

Economic Nexus

Six states have economic nexus laws or rules for sales tax (Alabama, Minnesota,

Oklahoma, South Dakota, Tennessee, and Vermont), but two are not enforced

(Minnesota and Oklahoma). Vermont's law is not effective until the latter of

July 1, 2017.

Expanded Nexus

By far, some form of “expanded nexus” is the most prevalent nexus standard for sales tax, with all but five states having affiliate or click-through nexus laws on the books. Even among these five, however, the Department of Revenue (or equivalent agency) in a few of them has taken the position that click-through relationships create nexus or that underlying law provides authority to require collection based on an affiliate relationship (Arizona and Hawaii).

Non-Nexus Collection Bills (Reporting and Notification Requirements)

Eight states currently have use tax notice and reporting requirements (Colorado, Kentucky, Louisiana, Oklahoma, South Carolina, South Dakota, Texas, and Utah), although Texas' requirement is not enforced. Tennessee formerly had this requirement, but it was repealed (effective 2014).

To be certain, the matter of sales taxes will continue to be on the forefront of states’ agendas so long as budget shortfalls remain a problem. ReMA members should be vigilant and consult frequently with their tax counsel to ensure compliance with the ever-changing laws. For more information on the progress of tax legislation on various matters in the states, our friends at MultiState Associates have written a short analysis, which ReMA members may access online through the State Policy webpage at ISRI.org/state.

SPAN Main