March/April 19

By Katie Pyzyk

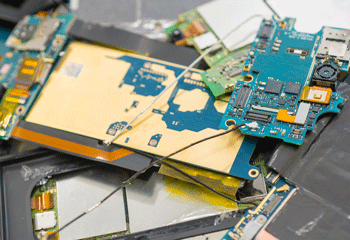

Scan nearly any room in the United States, and you’ll see one or more electronic device: Televisions, phones, computers, tablets, and video game systems are among the most popular, but electronic circuitry and printed circuit boards are in countless other products as well. The Consumer Electronics Association estimates the average U.S. household has approximately 28 electronic devices. What they all have in common is that at their end of life, their primary value comes from the precious metals they contain.

Scan nearly any room in the United States, and you’ll see one or more electronic device: Televisions, phones, computers, tablets, and video game systems are among the most popular, but electronic circuitry and printed circuit boards are in countless other products as well. The Consumer Electronics Association estimates the average U.S. household has approximately 28 electronic devices. What they all have in common is that at their end of life, their primary value comes from the precious metals they contain.

“Most people don’t realize how many precious materials there are in our technology,” says Andrea Falkin, senior manager of environmental affairs at Dell. The European Commission estimates that about 10 percent of the total gold supply worldwide is used in manufacturing modern electronics. “We use precious metals like gold, silver, platinum, and palladium not because we want to make the products fancy … but because of the technical properties of those metals,” says Federico Magalini, managing director at sustainability consulting firm Sofies UK (Weybridge, England). Precious metals have excellent electrical conductivity properties, as does copper. Silver and palladium typically serve as connectors and solder. Gold is a preferred connector because it doesn’t oxidize or corrode; corrosion can create electrical charge distortion, which is especially undesirable in audio electronics.

Each electronic product contains only a small amount of precious metals, however. In 2008, Umicore estimated that a single cellphone contains an average of 250 mg of silver, 24 mg of gold, 9 mg of palladium, and 9 g of copper, which is not a precious metal but a valuable nonferrous metal. Recycling 1 million cellphones—weighing an average of 4 ounces each without their batteries, for a total of 250,000 pounds—will produce 33 pounds of palladium, 75 pounds of gold, 772 pounds of silver, and 35,274 pounds of copper, according to U.S. Environmental Protection Agency estimates. Although metal prices vary, in mid-February those quantities of precious metals would have been worth more than $2.3 million combined.

Pump Up the Volume

Not all circuit boards are created equal. They come in a variety of sizes and, more importantly, a variety of grades. Recyclers consider certain items more desirable because they contain higher proportions of precious metals. For example, printed circuit boards from mobile phones contain more precious metals by weight than those from the average laptop computer.

Military-grade computers and other military electronics contain more precious metals than traditional consumer devices, thus they are especially valuable for those who can secure a relationship with military equipment recyclers. “For military items, we can get probably around 700 grams of gold per ton, whereas circuit boards in laptops have around 150 grams of gold per ton,” says Florian Sauer, head of research and development for Mairec (Alzenau, Germany). He estimates that consumer smartphone circuit boards contain 500–600 grams of gold per ton. The discrepancy is due to precious metals’ greater operating dependability. “If stuff has to be reliable, and it’s not a cost issue, you can use a lot of precious metals,” Sauer says. Pacemakers are another niche product that must be reliable. They house circuit boards with “a huge amount of precious metals,” he says.

As electronic devices have evolved over the years, their precious metals content has evolved as well. Smartphones have changed the electronics landscape significantly because they serve as all-in-one devices that render others, such as calculators and point-and-shoot cameras, all but obsolete. Because users expect smartphone circuit boards to do so much, and do so reliably, “[their] metal content … is significantly higher in most cases,” compared with “the circuit board that you pull out of a PC or stereo or monitor,” says Hunter Scott, vice president of scrap purchasing at Dynamic Lifecycle Innovations (Onalaska, Wis.). That’s despite manufacturers’ efforts to use less precious metals to lower manufacturing costs. Thus, the trend for most electronics other than smartphones is that they contain less precious metals than they did in previous years.

Environmental Benefits

Extracting precious metals from electronics is not just good business, it also has less of an environmental impact and greater recovery efficiency than extracting them from the ground, industry participants say. “There is 800 times more gold in a ton of motherboards than a ton of ore from the earth,” Dell’s Falkin says. Dell won ISRI’s 2018 Design for Recycling® award for incorporating gold it recovered from its end-of-life products in the plating of its Latitude 5285 laptop computer. The company was able to achieve the required purity level for its plating application with recycled gold just as it did with primary or virgin gold, Falkin says.

Some call this process of recovering metals from consumer products urban mining. It can be done on a much smaller scale than traditional mining, explains Tim Johnson, technical director at Tetronics International (Swindon, England). “Instead of 300,000 tons a year being the normal, you might only … process 3,000–4,000 tons a year,” he says. “Large facilities are not necessarily the best way of doing it. Smaller, more localized facilities are often a better way to go.”

Geopolitical forces play a role in determining where and how electronics are collected and processed for precious metals recovery. China’s scrap import restrictions—and those implemented or proposed by neighboring Southeast Asian countries, including Thailand and Vietnam—have increased interest in e-scrap processing and downstream recovery opportunities in other parts of the world. “The situation in China has … implied that there is more electronics scrap available for smelters like us,” says Thierry Van Kerckhoven, head of supply recyclables at Umicore Precious Metals Refining (Hoboken, Belgium). “These materials have to find a home in the market where they are generated.”

That works out well in countries where leaders are becoming aware of the value urban mining can bring to their economy. “Increasingly, a lot of countries see waste as a resource, and [leaders] don’t want to see these metal resources go out of their country,” Johnson says. But harnessing that value is dependent on a country having the infrastructure to process, recover, and refine them.

The E-Scrap Supply Chain

Electronics processors, secondary metal smelters, and refiners each play a role in the chain of capturing precious metals from end-of-life electronics and returning them into commerce. One company could do everything, from taking in whole end-of-life electronic devices to producing pure precious metals, but it’s more common for these to be separate, specialty businesses or combinations of two or three steps in the chain. Mairec, for example, can process whole electronics for resale or recycling, but it primarily buys and processes electronic scrap such as circuit boards, control units, plugs, and similar precious-metals-bearing materials. Each batch of material will be sampled by undergoing several rounds of successively finer shredding, milling, and blending until it forms a fine, homogenous powder sample Mairec can assay. Then, based on that information, it sends the material “to specialized refining companies that then do the melting and precious metals recovery,” Sauer says. In PM-bearing scrap, the assay is essential to find out how much of each precious metal a batch contains, he explains. Knowing the composition “is very important for further processing and to decide to which refiner the material is going. There are different refiners all over the world, and they have different capabilities and prices,” he says.

Various types of business agreements exist among these industry participants. In a tolling agreement, the supplier of the PM-bearing scrap receives the extracted metals in refined bullion form after final processing. More common, perhaps, are direct sales agreements. At Umicore, for example, most customers “sell the metals to us, and we sell [them] on the metal markets. We deduct our cost and fees, then pay you” the remaining value of the extracted, refined metals, Van Kerckhoven says. Processors, secondary smelters, and refiners all report a preference for forging long-term relationships with their partners, although they’re open to short-term or one-off opportunities with new clients. Some recyclers prefer to use brokers as an intermediary between them and the secondary smelters. “Brokers offer fixed prices, and you know the price as soon as you sell the material,” Magalini says. That’s a plus for those who prefer stability when dealing with the wildly fluctuating precious metals commodity markets. Using a broker also offers much faster pricing than waiting for the results of an assay.

E-scrap recyclers are an important first step in the supply chain because material separation increases efficiency at each step downstream. By the time the separated materials reach the secondary smelters, they’re “not dealing with the shell [or] hard drive, just circuit boards,” says Sean Magann, vice president of global sales and marketing for Sims Recycling Solutions (West Chicago, Ill.). Plus, separation eliminates shipping costs on non-PM materials. “At the end of the day, we’re only paid for the metals we send to smelters. Any other material … we pay to ship it there [but] we don’t get paid on the recovery,” says Jason Schott, vice president of sales at Dynamic Lifecycle Innovations. Umicore’s website notes that it pays suppliers for the silver, gold, palladium, and copper content of their scrap, but not for any other elements, such as aluminum or iron. Thus, the site says, “we recommend removing these fractions beforehand as much as possible.” As with any commodity, electronics recyclers can expect that “the purer the fraction, the higher prices you get,” Sofies UK’s Magalini says.

Processors generally have two options for recovering circuit boards and other PM-containing scrap from electronic products: manual dismantling or automatic processing, namely shredding and downstream separation. Magalini recommends manual separation for maximum PM recovery. Although shredding is quick and efficient, it can lead to greater material loss; therefore, “most big smelters tell [processors] it is better to receive the full board, not shredded,” he says. “The more you shred, the more precious metals end up in the dust, unless you have a system to collect the dust.” Manual dismantling is more labor-intensive, however. It all comes down to each business’s practices and what it’s trying to achieve. “We do both. … It really depends on how much precious metal content is recoverable in the different kinds of products,” Schott says. Sims Recycling Solutions also employs both methods. “If it’s a [cable] box, we may manually take parts off because then you get a cleaner stream,” Magann says.

Cleaner ways of recovering PMs

Secondary smelting and refining can be performed at separate facilities or at integrated ones. Integrated facilities, like Umicore’s, tend to be larger operations that benefit from economies of scale, but currently none operate in the United States. Secondary smelters and similar facilities perform an important intermediary step because “you can’t go straight from a printed circuit board to the final refining … of bars of gold, silver, palladium, and copper. There has to be some separation,” says Tetronics’ Johnson.

Leaching and other chemical processes smelters use to recover precious metals have raised concerns due to their use of hazardous chemicals, such as cyanide or sulfuric acid, which require proper management to ensure they don’t enter the environment. Cyanide leaching is the most common and economical approach and recovers the greatest proportion of precious metals, according to research presented at the Seventh International Conference on Waste Management and Technology in 2012. Other, less hazardous chemicals show potential, but at a higher cost or lower recovery rate, the researchers noted.

Chemical recovery of metals directly from scrap printed circuit boards “tends to be expensive and inefficient, especially at any significant scale, and there are plenty of unpleasant chemicals to dispose of afterward,” Johnson says. In his experience, “most scrap printed circuit boards are recycled in advanced economies today by some kind of melting technology first,” instead of purely by a chemical process, “before using traditional electrolytic and chemical processes to recover the individual metals from the resulting metal alloy.” His company and others are trying new approaches that are more energy or resource efficient or have less environmental impact:

n Tetronics uses plasma technology, in which heat and ultraviolet light in a sealed furnace separate the precious metals from other materials while destroying hazardous elements. “We take the printed circuit boards in their shredded form—5-mm size to 35-mm size—and put those directly into a plasma furnace,” Johnson says. The technology creates a precious metals stream; volatile gases, which it burns, cools, and treats with lime to control emissions; and a nonhazardous, vitrified residue it calls Plasmarok, which can be used as aggregate in construction projects.

n EnviroLeach Technologies (Burnaby, British Columbia) has developed a chemical precious metals recovery process that uses room-temperature water and five ingredients—each approved by the FDA for human consumption, it says—to extract gold from electronics with the help of a diamond electrode. “We have a zero environmental footprint except for [a] 25 percent fraction we’re sending to smelters,” says Todd Beavis, vice president of corporate development, because that fraction contains 15 percent copper and 4 percent nickel. The precious metals fraction is ready for further refining. “We’re an enhancement to the current smelting and recycling operations. We can work with [them] to improve their overall recoveries and returns,” says EnviroLeach CEO Duane Nelson.

n All Green Precious Metal Recovery (Charlotte, N.C.) subjects whole (not shredded) circuit boards to a patented “alkaline hydrometallurgical process” that does not use cyanide to create a precious-metals-bearing concentrate it further processes in its refinery, according to an August 2018 company profile in E-Scrap News. The bare circuit boards are then sent for copper recovery.

n Gannon & Scott (Cranston, R.I.) touts the Tru3Tec Thermal Reduction and Environmental Control System it uses to tightly control emissions from its process, which turns precious-metals-bearing scrap into ash that it mills, blends, and assays. The system is designed to take in high volumes of scrap, both hazardous and nonhazardous, with lower precious metals concentrations to maximize their value.

n Itrimex (Bromborough, England) has developed an alternative to mechanical separating and smelting that removes solders from circuit boards, facilitating the recovery of both base metals and precious metals. It touts the lower energy requirements and lower carbon emissions of its process compared with smelting.

n Sepro Urban Metal Systems (Langley, British Columbia) is using pyrolysis—heating material in a vacuum—to process circuit boards, destroying toxins and recovering heavy metals, precious metals, and copper that’s ready for refining, it says.

n Itronics (Reno. Nev.), which recovers silver from photographic processing liquids and turns the remaining trace elements into fertilizer, is now combining its recovered silver with shredded circuit boards in a furnace, where the silver attracts precious metals, copper, and tin. The resulting bullion can go to a refiner, although Itronics is testing further separation of the copper and tin from the precious metals. The company says it’s the first U.S. firm to recover the tin and antimony from circuit boards, noting that the U.S. Interior Department deemed tin critical to U.S. national security and the economy last year.

Other techniques that are at the research stage include the use of ultrasonic waves for recovering precious metals from electronics at the U.S. Center for Integrated Nanotechnologies (Albuquerque, N.M.), new metal scavenger technologies and a “liquid-liquid” extraction process at the University of Jyväskylä (Finland), and gold extraction using a new, nontoxic chemical compound at the University of Edinburgh (Scotland).

Despite the promise these new secondary smelting technologies hold, their reliability and staying power have yet to be determined. Some efforts in the past few years have failed because they could not develop the economies of scale necessary to turn a profit. Those who attempt pyrolysis, for example, might “come to the conclusion quickly that it is not easy to run something like that, and secondly, the recovery rates are not good,” says Umicore’s Van Kerckhoven.

Employees at the new ventures recognize the steep uphill battle they face to find suppliers where tight profit margins abound. “We’re environmentally friendly, but nobody cares if we don’t have a cost-effective solution,” EnviroLeach’s Nelson says. Yet, they maintain a positive outlook. “This will change the industry as we know it,” Beavis says.

Katie Pyzyk is a contributing writer for Scrap. Editorial Director Rachel H. Pollack contributed to this story.