May/June 2020

By Joe Pickard and Bret Biggers

Recyclers experienced a difficult year in 2019, as U.S. manufacturing output slowed,

scrap exports to China fell to the lowest level since 2000, and scrap commodity prices declined sharply. Now they wonder how much worse 2020 might be.

Scrap recyclers faced significant market challenges in 2019. Compared with the unprecedented economic and social upheaval the COVID-19 pandemic is creating in 2020, however, 2019’s challenges might seem relatively modest. For example, extremely tight labor market conditions were one major concern in 2019, as the apparent shortage of qualified workers constrained output and productivity. This spring’s massive job losses are creating a much different labor market picture. For scrap recyclers, 2019’s slower U.S. manufacturing output, softer business sentiment and investment, diminished export sales, and faltering commodity prices were already putting profit margins under pressure, leaving 2020’s difficulties to take conditions from bad to worse.

Scrap recyclers faced significant market challenges in 2019. Compared with the unprecedented economic and social upheaval the COVID-19 pandemic is creating in 2020, however, 2019’s challenges might seem relatively modest. For example, extremely tight labor market conditions were one major concern in 2019, as the apparent shortage of qualified workers constrained output and productivity. This spring’s massive job losses are creating a much different labor market picture. For scrap recyclers, 2019’s slower U.S. manufacturing output, softer business sentiment and investment, diminished export sales, and faltering commodity prices were already putting profit margins under pressure, leaving 2020’s difficulties to take conditions from bad to worse.

Given the close connections among domestic manufacturing, scrap generation, and scrap demand, the slowdown in U.S. industrial production was a key factor weighing on scrap markets in 2019. According to Federal Reserve figures, U.S. industrial production contracted at an annual rate of 0.5% in the fourth quarter of 2019. The manufacturing purchasing managers’ index reports also reflected the slowdown in industrial and manufacturing output late last year. According to the Institute for Supply Management, its manufacturing PMI reading fell to 47.2 in December 2019, well below 50—the threshold separating expansion from contraction—and marking the fifth consecutive month of contracting U.S. manufacturing output.

The rapidly changing trade policy landscape compounded the slowdown in domestic manufacturing. In addition to China’s retaliatory tariffs, reduced quotas, and tighter contamination limits on a wide range of U.S. scrap imports, other nations also enacted a series of trade restrictions on scrap imports, particularly for nonmetallic commodities. Indonesia, for example, implemented stricter requirements for recovered paper imports, including requiring pre-shipment inspections, prohibiting transshipments through other destinations, and requiring exporters to be listed on the shipping documents to allow for occasional exporter verification.

Due in large part to higher trade barriers and slower global economic growth—the International Monetary Fund estimates world economic output slowed from 3.6% in 2018 to 2.9% in 2019—global demand for U.S. scrap deteriorated last year. Total U.S. scrap exports—including all ferrous and nonferrous metals, recovered paper, plastics, rubber, glass, and textiles—declined 5.5% in 2019, to 38.2 million mt. In dollar terms, total U.S. scrap exports were down 5% last year, to $19.2 billion. Remarkably, for the first time since 2000, China was no longer the top export destination for U.S. scrap in dollar terms. U.S. scrap exports to China plunged from $3.5 billion in 2018 to $1.8 billion in 2019, and Canada became the most valuable export destination for U.S. scrap.

The trade war with China and downturn in economic growth contributed to weaker business sentiment and investment. According to the Business Roundtable, 68% of CEOs surveyed in the fourth quarter of 2019 expected either no change or a decrease in their capital spending over the next six months. At the same time, the Bureau of Economic Analysis reported U.S. gross private domestic investment declined 6% at a seasonally adjusted annual rate in the last quarter of 2019.

These conditions contributed to the continued restructuring of the U.S. recycling industry in 2019. For residential recycling programs, the disconnect between which materials programs could collect and which materials recyclers could profitably process and market became even more pronounced. Although the major commodity price indexes got a boost late in the year from reported progress in U.S.-China trade talks and looser monetary policy, scrap price performance varied widely. Here’s a recap of how the major recycled commodity markets fared last year.

Aluminum

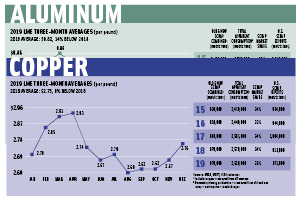

Aluminum scrap prices continued to underperform compared with both primary aluminum prices and commodity prices generally last year. Primary aluminum prices at the London Metal Exchange ended 2019 down less than 1%, while average old aluminum cast and sheet scrap prices in the United States finished the year down more than 22%. Prices for several aluminum scrap grades fell to 30-year lows in 2019, including those for used beverage containers. As they did with other commodities, trade developments and deteriorating domestic demand had negative repercussions for aluminum scrap recyclers. According to Census Bureau trade data, U.S. exports of aluminum scrap to China declined 36% by volume last year, to just over 315,000 mt, as China’s share of the aluminum scrap export market fell to just 17%, down from its 68% market share in years past. Although aluminum scrap demand from Canada and Mexico also declined last year, improved demand from Malaysia, India, Hong Kong, South Korea, Thailand, and other markets more than offset those losses. In the United States, the U.S. Geological Survey estimates aluminum recovered from scrap declined nearly 9% in 2019, to 3.38 million mt, as falling aluminum demand from key industries, including the transportation sector, weighed on scrap prices and supply. Overall, U.S. aluminum consumption is estimated to have dropped 24% last year.

Copper

The U.S. Geological Survey estimates domestic copper scrap consumption was practically unchanged last year at around 870,000 mt, even as total U.S. copper consumption (primary plus secondary copper) declined 2%. The USGS reports that “of the total copper recovered from scrap (including aluminum- and nickel-base scrap), brass and wire-rod mills recovered approximately 80%; copper smelters, refiners, and ingot makers, 15%; and miscellaneous chemical plants, foundries, and manufacturers, 5%.” Accompanying the dip in total domestic copper consumption last year were weaker refined copper prices. At the LME, three-month copper futures averaged $2.73 per pound in 2019, down 8% from the 2018 average. Slower economic growth in China was a driver for both copper cathode and copper scrap pricing last year. U.S. exports of copper and copper alloy scrap to China declined nearly 68% in 2019, to less than 88,000 mt. For comparison’s sake, the U.S. exported nearly 688,000 mt of copper scrap to China in 2017. For the first time in decades, China was no longer the top destination for U.S. copper scrap exports last year, having been surpassed by Malaysia and Canada, although Chinese end-use demand for copper continued to feature prominently.

Iron And Steel

U.S. ferrous scrap exports, excluding stainless steel and alloy steel, grew by a modest 1.2% in 2019, to nearly 15.9 million mt, as improved shipments to Turkey, Malaysia, Saudi Arabia, Vietnam, Bangladesh, and others more than offset weaker business with Egypt, China, and Mexico. Turkey not only retained its place as the largest export destination for U.S. ferrous scrap, but it also posted the largest net volume gain (up by 524,000 mt, to more than 3.9 million mt) last year. More total exports of cast iron scrap and No. 1 bundles helped offset weaker shipments of shredded scrap and No. 1 heavy melt. In the United States, total ferrous scrap consumption is estimated to have increased from 60.1 million mt in 2018 to 60.7 million mt, but steel and ferrous scrap market conditions deteriorated as the year progressed. Published composite prices for No. 1 heavy melt started the year above $300 per gross ton, but by September, they had dropped to around $183 per gt. The average No. 1 heavy melt price in 2019 was down 24% compared with the 2018 average, as steel mill production and capacity utilization rates deteriorated in the second half of the year.

Lead And Zinc

Refined zinc and lead prices were among the worst performers at the London Metal Exchange in 2019, falling 6.5% and 4.0%, respectively, by the end of 2019 compared with their prices at the end of 2018. The decline in prices for the sister metals came despite a drawdown in LME warehouse stocks, which typically coincides with rising prices. Reuters explains that the disconnect stems from the difficulty in getting mined material transformed into refined metal: “Smelters’ collective capacity to convert raw material into metal was last year hampered by a string of outages, including the fire at the Mooresboro refinery in the United States, the temporary suspension of the Skorpion refinery in Namibia and lower output due to an electrical failure at the Trail plant in Canada. Chinese smelters’ ability to lift run-rates, meanwhile, was constrained by the rolling environmental inspections that have become a feature of the country’s metallic supply chains.”

The slowdown in domestic manufacturing demand and weaker export sales both had a negative effect on lead and zinc scrap recyclers in 2019. According to Census Bureau figures, U.S. lead scrap exports declined 20% in 2019, to 39,000 mt, while zinc scrap exports were off about 23%, to 31,000 mt for the year.

Nickel And Stainless Steel

Last year, LME three-month nickel futures ranged from as low as $10,530 per mt in January to as high as $18,850 per mt in September. At the same time, closing nickel stocks in LME warehouses dwindled from more than 207,000 mt at the end of 2018 to less than 65,000 mt late in 2019. Despite the ongoing volatility in nickel prices and warehouse stock levels, nickel prices outperformed the other major base metals in 2019, ending the year nearly 32% higher in London compared with the price at the end of 2018. However, prices for stainless steel scrap came under pressure late last year amid reports of excess scrap supplies in the United States and Europe. According to the latest figures from the International Stainless Steel Forum (Brussels), stainless steel melt shop production in the United States fell 7.6% last year, to 2.593 million mt. In contrast, stainless steel production in China climbed 10.1% higher in 2019, to 29.4 million mt, according to ISSF estimates. As a result, the price of U.S. 304 stainless steel scrap declined nearly 2% over the course of 2019, despite rising primary nickel prices.

Paper And Plastic

U.S. plastic scrap exports fell 38% by volume, to less than 663,000 mt, in 2019, as shipments to virtually every major market declined, with the exceptions being Canada and Turkey. U.S. shipments of plastic scrap to China and Hong Kong combined fell to less than 90,000 mt last year. In comparison, the United States shipped more than 1.4 million mt to those two destinations in 2016. Plastic scrap shipments to Malaysia, Thailand, and Vietnam were all down more than 70% last year as those countries implemented additional import restrictions and scrap had to compete with attractively priced primary resin.

As for recovered paper, 95% of all U.S. recovered paper and fiber exports in 2019 went to just 15 countries. China topped the list, at 5.5 million mt—half the quantity the United States exported to China in 2017. More than half of the countries in the top 15 destinations reached 20-year paper importing highs in 2019, helping to compensate for the reduction in recovered paper shipments to mainland China. As import restrictions constrained the availability of paper and paperboard scrap in China last year, Chinese mills increasingly turned to virgin fiber and recycled pulp and pulp substitutes. RISI reported that Chinese paper companies planned to invest in “significant amounts of recycled pulp capacity to expand recycled pulp production in different regions.” In the United States, the American Forest & Paper Association (Washington, D.C.) reports the paper and paperboard recovery rate declined from 68% in 2018 to 66.2% in 2019. At the same time, composite U.S. recovered paper prices declined 24% in 2019.

Joe Pickard is ISRI’s chief economist and director of commodities, and Bret Biggers is ISRI’s economist.