July/August

2018

ISRI’s

2018 convention and exposition drew nearly 5,500 attendees to Las Vegas in

April to find winning moves in an era of game-changing events.

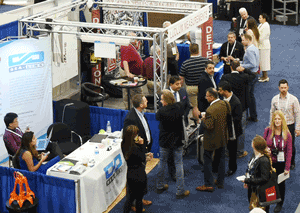

The stakes always seem higher in Las Vegas, but 5,500 scrap

recyclers bet wisely by attending ISRI2018 in April. The sold-out exhibit hall

offered an abundance of business-boosting technologies, services, and ideas,

and the event’s many education sessions and networking opportunities allowed

attendees to focus their attention in the most productive ways. The heart of

the industry also shone through this year in the generosity of those donating

and bidding on silent auction items for the Recycling Research Foundation,

which raised nearly $40,000. Convention organizers fine-tuned the convention’s

general, spotlight, and education sessions up to the last minute to ensure

attendees would get the latest news and analysis on swiftly changing global

market conditions.

The stakes always seem higher in Las Vegas, but 5,500 scrap

recyclers bet wisely by attending ISRI2018 in April. The sold-out exhibit hall

offered an abundance of business-boosting technologies, services, and ideas,

and the event’s many education sessions and networking opportunities allowed

attendees to focus their attention in the most productive ways. The heart of

the industry also shone through this year in the generosity of those donating

and bidding on silent auction items for the Recycling Research Foundation,

which raised nearly $40,000. Convention organizers fine-tuned the convention’s

general, spotlight, and education sessions up to the last minute to ensure

attendees would get the latest news and analysis on swiftly changing global

market conditions.

General Sessions Focus on Trade, Technology, and

Transportation

International trade issues—not just from China, but also from

other regions—were a major focus of ISRI2018. So, too, were the new and

emerging technologies promising to alter the playing field for recyclers, as well

as the many urgent transportation and logistics issues scrap businesses are

facing.

China changes the game—again. Recyclers who once relied on

Chinese buyers to import their scrap are scrambling to find new domestic and

international markets while shouldering the associated shipping costs.

Panelists at a session to help recyclers navigate China’s new market conditions

described how their companies have changed the way they do business since China

enacted new import restrictions and low contamination thresholds for most scrap

commodities.

“On the West Coast, we were reliant on China. We relied on cheap

freight, and [China’s] consumption, and that has now put us in a tight spot,”

said Vinod

Singh, outreach manager at Far West Recycling (Portland, Ore.). “Now

we are sending 10 loads here, 10 loads there to domestic mills. It’s our goal

to seed domestic growth.”

Queen City Metal Recycling & Salvage (Charlotte, N.C.) also

is working to find new domestic markets for items such as low-grade copper

wire, said General Manager Steve Gilbert. It plans to send previously China-bound

motors to markets in Europe and Pakistan.

Shen

Dong, director of international marketing for OmniSource Corp.

(Fort Wayne, Ind.), said Category 7 metals—including motors, meatballs, insulated

wire, and some mixed metal scrap—are still allowed into China now, but it’s

likely the country will ban that scrap by the end of 2018.

As recyclers who once relied on shipping to China scramble to

find alternative international markets, they also must deal with the often

higher shipping costs and difficult logistics associated with those markets,

said Chad

Hansen, national sales manager for Sealink International (Plano,

Texas), a logistics provider. “When new emerging markets come around, everyone

tries to move cargo there, and these vessels fill up and you can’t get space,”

he said. Those lucky enough to get bookings should plan to wait longer for

their booking to go through, he added.

Abandoned containers are another issue that can hit companies in the

pocketbook, Hansen said. Vietnamese ports, for example, are beginning to

require security deposits of up to $3,000 per container to return them clean

and undamaged, he said. “There are thousands [of containers] sitting at ports

right now, and the problem is people are not picking them up.”

Finding new opportunities globally. “If the Chinese scrap

market sneezes, we all get a cold,” said Surendra Borad Patawari,

chairman of Gemini Corp. (Antwerp, Belgium), during a session on opportunities

in global trade. Looking elsewhere for buyers can be disruptive in the near

term, but it could mean good future business, he said. India, for example,

imports $1 billion in scrap each year and has an economy predicted to grow by 7

or 8 percent in 2018, he said. If India truly wants to grow its reputation as a

major scrap recycler, however, it will have to relax some of its import

restrictions, he noted.

Meanwhile, the Middle East is learning to recycle domestically

the materials it once sent to China, said Salam Sharif, chairman of

Sharif Metals International (Sharjah, United Arab Emirates) and president of

the Bureau of Middle East Recycling (Dubai, UAE). Copper, aluminum, and other

materials can feed infrastructure in rapidly urbanizing Middle Eastern cities,

he said.

These changing markets also give Latin America a window to show

off its business-friendly assets, such as low costs and conveniently located

ports, which allow shipments “to get anywhere in 60 to 90 days,” said Enrique Acosta,

partner in BMB Metals (Miami). “South America is always seen as an export

opportunity, but we have considerable infrastructure for manufacturing and

processing” as well as readily available logistics and transportation

resources, he said.

In Europe, Jurgen Van Gorp, business development and area manager at

Metallo Group (Beerse, Belgium), said his company has survived intense

competition with China by creating a niche and sticking with it. “Europe has

had a longstanding history [and] reputation with manufacturing and recycling,

but today, the European markets try to lead by innovation,” he said.

The South Pacific had a competitive strategy before China’s major

market shake-up, said Korina Kirk, director of Metalcorp NZ (Christchurch, New

Zealand) and president of the Scrap Metal Recycling Association of New Zealand

(Hornby, New Zealand). Australia and New Zealand are “out of the way” of some

global markets and are export-dependent, “so it is all about the drive for

quality,” she said. “We’re known for it, and we’re fiercely committed to it.”

Think regionally, act cautiously. Former U.S. Secretary of

Commerce Carlos

Gutierrez gave scrap recyclers his perspective on trade issues at

the convention’s opening general session. Overall, the world isn’t globalizing

so much as it is “regionalizing,” he said.

Gutierrez said the United States’ decision to leave the

Trans-Pacific Partnership “was a strategic mistake” because Asia contains 60

percent of the world’s population and the fastest-growing economies. Our

leaving TPP left U.S. allies confused, he said, and it allowed China to form

more alliances with countries participating in the agreement.

With the current potential for near-term trade disruptions and

uncertainty, Gutierrez advised scrap recyclers to be cautious in their

decisionmaking, such as in locating facilities or making supply-chain changes.

“Don’t make a strategic decision if you don’t have to,” he said. Companies

should have their own foreign policy, he suggested. Know who your allies

are—and your adversaries—so you can separate yourself from the pack.

Gutierrez also cautioned that trade isn’t the only big issue

companies have to think about. Even more important, he said, are the new

technologies coming at us—such as artificial intelligence, robotics, the

Internet of Things, and blockchain—that could result in the potential loss of

millions of jobs. “Increase the digital IQ of your firm,” he advised.

The rise of the machines. ISRI2018’s closing general

session speaker, technology journalist David Pogue, continued the

technology conversation by predicting how the next wave of technology will

change the way we live. On the frontiers of technology are driverless cars,

delivery drones, and robots that can shut off nuclear reactors or perform other

complicated tasks on their own. “I always thought robots were cool,” Pogue

said, but the cool factor comes with important questions about how rapidly

improving technology will affect the economy and jobs. By one estimate, robots

could replace 47 percent of American jobs in the next 20 years, he said. But

don’t despair just yet. With the rise of such technology, humans may start

doing jobs that don’t yet exist, he added. “When you think of it, most of what

we do today barely existed 100 years ago.”

REMADE Institute advances recycling technologies. Launched

in January, the REMADE Institute (West Henrietta, N.Y.) aims to improve the

production and processing of materials, advance design-for-recycling

principles, create high-paying jobs, and enhance U.S. competitiveness, said David Wagger,

ISRI’s chief scientist and director of environmental management. REMADE, which

stands for Reducing Embodied-energy and Decreasing Emissions, is a network of

government, academic, and private-sector partners—including ISRI, which

represents the recycling industry in the REMADE leadership team.

The institute’s efforts to develop recycling technology will

focus on processing metals, polymers, electronics, and fiber, said Eric Peterson,

REMADE’s node leader for recycling and recovery. Leading initial projects in

these areas are Argonne National Laboratory (polymers), the University of Miami

(fiber), and the University of Utah (e-scrap). Researchers aim to develop

technologies for separating and cleaning materials and learning where energy

losses occur in the process.

The industry needs new sorting technologies, but it also needs to

consider the marketing side, said Philippe Blot, co-founder and

senior metallurgical engineer of EDX Magnetics (Salt Lake City). “Can we build

something industry can afford?” He described prototype technologies for sorting

aluminum alloys his team tested successfully, producing a No. 2–type of copper

product out of high-density mixed nonferrous red metals (ISRI specification

Zebra), but their work with shredded mixed nonferrous metals high in aluminum

(Zorba) so far has had mixed results, Blot reported. ReMA members can assist

projects such as his by providing samples of materials they are not currently

processing, he noted. “We want to test on a variety of samples to develop

standards,” he said. ReMA members can help REMADE “know what you know so we can

start investigating alternative methods to upgrade your products,” Peterson

added, with the goal being to keep embedded energy out of landfills.

Transportation faces safety, labor issues. A panel discussion

about challenges facing the trucking and rail industries focused on the need to

recruit the next generation of workers in both industries. Panelists were Bill Sullivan,

executive vice president of advocacy of the American Trucking Associations, and

Mike Peters,

senior vice president of real estate and industrial development of Genesee

& Wyoming railroad, with outgoing ReMA Chair Mark Lewon of Utah Metal Works

(Salt Lake City) serving as moderator. The trucking sector also now faces

hassles related to throughput rates at ports, as well as concerns regarding

future self-driving truck technology, the panelists noted. Both the trucking

and rail industries have also raised red flags about marijuana and its effects

on worker performance and safety.

Also at the transportation spotlight, Jack Van Steenburg, chief

safety officer of the Federal Motor Carrier Safety Administration, briefed

attendees on the latest safety statistics and federal rulemaking. The fatality

rate for large trucks and buses has risen for the past couple of years,

totaling 4,317 fatalities—including 722 truck driver deaths—in 2017, he said.

FMCSA’s goal is to have zero fatalities related to large trucks and buses

across the United States by 2050, he said. Encouraging signs toward that goal

include an 85-percent rate for seat-belt use among drivers of large trucks.

Scrap Metals in the Spotlight

The metals spotlight sessions and targeted education sessions

helped attendees dive more deeply into topics directly relevant to their

businesses.

Global economy, Chinese policies concern aluminum panelists. Macroeconomic

factors were weighing on the mind of Jason Schenker, president of

Prestige Economics (Austin, Texas), at the aluminum spotlight. “I’ve never seen

the kind of volatility, uncertainty, and risk as what’s going on right now,”

and not just in the metals market, he said.

“The global economy is what will drive prices” for metal

commodities, he said. Weighing on global growth are increasing labor costs,

which Schenker called “the camel’s nose under the tent. There’s more inflation

to come,” and it will likely result in higher interest rates.

Another concern, he said, is that “the tit-for-tat escalation in

tariff retaliations … could slow growth overall.” Tariffs, as well as supply

disruptions such as this spring’s U.S. sanctions on Russian aluminum producer

Rusol (Moscow), leave “the global economic outlook a bit more in doubt.”

Official GDP growth forecasts from the Federal Reserve and International

Monetary Fund don’t take into account trade risks, he cautioned.

A final macroeconomic factor Schenker noted was U.S. productivity

growth of zero in the fourth quarter of 2017. “Even if everything were perfect

with trade, companies are facing higher labor costs, no productivity gains,

higher interest rates, and higher materials costs,” he said. It’s hard for him

“to see the upside with so many cost pressures rising.”

Liu

Wei, director of industry research at the China Nonferrous Metals

Industry Association, Recycling Metals Branch (Beijing), speaking about China’s

implementation plan on “solid waste” imports, including scrap, confirmed that

China will ban imports of “Category 7” aluminum scrap by the end of the year.

This will affect an estimated half-million tons of material, he said. The

policy’s goal is “to stop the import of ‘solid waste’ which can be replaced by

domestic scrap by the end of 2019,” Liu said, but China’s domestic supply of

aluminum scrap can only fill 70 percent of its demand, and its aluminum

production is growing 7 percent a year. Thus, he said, “China will need to

import some aluminum scrap in the future.”

Liu also noted the confusion over the new policy’s limits on

“carried waste.” The definition in the plan is “not very detailed or specific,”

he said, but he explained the phrase means a “foreign substance introduced,

excluding packaging material.”

The 25-percent tariffs China imposed on imports of U.S. aluminum

scrap—in response to U.S. tariffs on Chinese steel and aluminum—are increasing

costs by about 3,000 RMB per container, Liu said, making it likely that U.S.

exports of aluminum scrap to China will decline. Chinese aluminum consumers are

looking for alternative suppliers and more domestic sources, he noted.

Moderator Matt Kripke, president of Kripke Enterprises (Toledo,

Ohio), also spoke about recyclers’ concerns about new alloys entering the

aluminum scrap stream from vehicle manufacturing that are finding few

interested buyers. (For more on this topic, read “Light Speed” on page 42.)

Ferrous focuses on technology and trade. Changes in

steelmaking are affecting the ferrous scrap market, as are shipping issues that

hamper trade, said panelists at the ferrous spotlight session.

U.S. steelmakers rely heavily on electric-arc furnace technology,

with almost two-thirds of the country’s steel made using EAFs, said Philip K. Bell,

president of the Steel Manufacturers Association (Washington, D.C.). Yet scrap’s

metallurgical chemistry can vary widely, and steelmakers are showing more

interest in other steel inputs, such as direct-reduced iron and hot briquetted

iron, to keep quality up. “Obsolete scrap is a growing percentage of overall

scrap, and that’s not a good thing” because it brings down the overall chemical

quality of ferrous scrap, he said. While that will be a challenge for

recyclers, Bell said growth in U.S. EAF capacity is likely to keep up the

demand for scrap. “Scrap is going to continue to be the primary raw material

for EAFs,” he said.

In the past year, the spread between the cost of finished steel

and the cost of ferrous scrap has been wider than usual, said Sean Davidson,

metal prices editor for Argus Media. Yet he noted that it was “a good year for

U.S. [ferrous] exports, having bounced back from a poor 2015.” That’s despite

the industry facing significant shipping woes such as canceled or rerouted

cargo ships. Nathan

Fruchter, CEO of Idoru Recycling Corp. (Lawrence, N.Y.), advised

the audience to look carefully at shipping contract language that could cost

them money if their shipments get delayed. Exporters should consider penning a

new clause for their contracts that can protect them from absorbing costs when

a shipping problem is outside their control. “It’s difficult to introduce a new

clause [during business transactions], but every seller should push for this

for their own protection,” Fruchter said.

Steel consumers set more specific quality demands. As steel

mills and foundries create more advanced, custom alloys for their customers,

they are demanding specific steel scrap chemistries, said speakers at “The

State of the Ferrous Industry: A View from the Mills.” At Neenah Foundry

(Neenah, Wis.), its products range from manhole covers to safety-critical parts

for military and commercial vehicles, said Brett Fisher, vice president of

operations. It makes 10 different grades of gray iron and 50 grades of ductile

iron, each with its own mechanical and heat-treatment properties. To achieve

those targeted chemistries, foundries want scrap with low residual alloys, good

density, and consistency of size, density, and chemistry, he said. The input

materials—steel scrap and pig iron as well as coke and limestone—must dilute

the residual element chemistries it creates for each customer, Fisher

explained, such as by reducing levels of phosphorus, manganese, boron, and tin.

He reviewed the positive and negative effects of a variety of residual metals,

noting that antimony, lead, and boron are especially problematic. “We need

scrap that doesn’t have high levels of those elements,” he said.

Steel mills are getting equally demanding in terms of wanting

specific chemistries, said Jim Wiseman, executive vice president of Smart Recycling

Management (Nicholasville, Ky.). “It’s complex. I’m not a metallurgist, but you

learn as you go,” he said. He predicts mills soon will “need to know

everything”—such as levels of residuals, the chemistry, and the

composition—about steel scrap supply shipments, whether shredded or plate and

structural. Scrap recyclers will find it difficult to provide that information,

however, due to the variability of input materials and environmental

conditions, he said.

When supplying steel to foundries and mills, “knowledge is going

to be power,” said moderator David Borsuk of Sadoff Iron & Metal Co. (Fond du Lac,

Wis.), and control of scrap chemistries is becoming more and more important.

Better source control and process control will be essential, he said. Wiseman

suggested scrap consumers could help educate processors and traders about what

they want and don’t want. Ultimately, the costs of greater scrap analysis and

testing “will have to be absorbed in how you buy [scrap],” Wiseman said.

Copper spotlight assesses China’s effects. China has a

sizable impact on U.S. scrap copper markets, panelists at the copper spotlight

session observed. That country consumed about 68 percent of U.S. scrap copper

exports last year, according to Joe Pickard, ISRI’s chief

economist and director of commodities. Shipments to China in January and

February 2018 were down nearly 27 percent compared with the same period in

2017, and that’s before China tightened contamination standards March 1.

Perhaps not surprisingly, while copper exports to China slipped, other export

markets showed growth, he said, with exports to Malaysia, Hong Kong, and Japan

experiencing the largest gains. Secondary refined copper production has been

increasing globally, rising 4.5 percent from 2016 to 2017.

The panelists discussed whether a new copper secondary smelter

will come online in the United States. “The costs of getting that going, and

the environmental and regulatory burdens, are quite high,” Pickard said.

“A secondary copper smelter is absolutely vital to the welfare of

the United States,” said Tim Strelitz, president of California Metal-X (Los

Angeles). There is “money to be had” in that business, he said, which is why it

exists in countries such as Germany, Spain, and Belgium—countries with

regulatory measures as tough as the United States.

U.S. technology for copper processing and refining lags other

countries, said Ed Meir, a consultant with INTL FCStone (New York). “The

Chinese have a big edge on very technologically advanced plants,” and they

don’t have same oversight burden, although that is changing, he said. Pickard

believes the United States will experience more investment in processing

technology. “We’re going to have to process this material to a higher grade

than we have before,” he said.

Electronics spotlight looks at precious metals. Mark Caffarey,

executive vice president of Umicore USA (Raleigh, N.C.), said he sees the China

situation creating opportunities to do more domestic processing and sorting of

electronic scrap, creating U.S. jobs.

Peter

Jegou, president of All Green Precious Metal Recovery (Charlotte,

N.C.), described his company’s hydrometallurgical technique for processing

circuitboards as a way to create “conflict-free” gold, palladium, silver, and

other precious metals. The company’s proprietary technology is modular and

scalable, he said.

Puneet

Shrivastava, regulatory engineering adviser for Dell, noted there

is 800 times more gold in circuitboards than in gold ore. Dell’s closed-loop

gold program mines its own manufacturing streams for raw materials. With

recycling partner Wistron GreenTech (Texas) Corp. (McKinney, Texas), it is

recycling the gold from recovered motherboards into its Latitude 5285 2-in-1

laptop/tablet computer. (ISRI also took note of the product’s recyclability and

presented Dell with its 2018 Design for Recycling® Award. See page

80.)

Processors fight for the right to repair.

The right to repair and resell electronic products is growing in importance as

more consumer goods contain electronics, said panelists at the session “The

Path Forward: Reuse.” The environmental benefits of reuse are greater than

those of recycling, noted Corey Dehmey, R2 director for Sustainable Electronics

Recycling International (Hastings, Minn.), and reuse could “unlock $4.5

trillion of economic growth and reduce the digital divide in the United States

and other countries.” The R2 standard, which SERI manages, requires

prioritizing reuse over recovery.

But in the United States, “technology is legally encumbered” by

trademark, copyright, and patent laws, all of which “put limits on what you can

do with a device,” said Jeff Pearlman, clinical supervising attorney and lecturer

in the Julesgaard Intellectual Property and Innovation Clinic at Stanford Law

School (Stanford, Calif.). “Today, everything has software and is connected to

the Internet,” he pointed out. Your phone, security system, car, tractor,

refrigerator, and GPS device are “all illegal, potentially, to modify.”

When Congress passed the 1998 Digital Millennium Copyright Act,

it created a process for receiving exemptions—which allow copyright protections

to be broken for specific products and uses—but they’re only good for three

years, and renewing is just as hard as getting the exemption in the first

place, Pearlman said. “It’s difficult to build standards and best practices

when things change every three years,” he added. ReMA worked to achieve an

exemption that allows cellphone “jailbreaking” for using phones with other

wireless providers. That exemption, first granted in 2006, now applies to

tablets, hotspots, and wearable devices, but only to used devices, he said.

Activists are promoting right-to-repair laws in states across the

country, said Kyle

Wiens, CEO of iFixit (San Luis Obispo, Calif.). Original

equipment manufacturers are fighting back, but Wiens noted a few recent court

and regulatory victories for the repair side. In addition to threatening

lawsuits against those who repair or modify devices or put repair manuals

online, OEMs are making repair more difficult through product design, he said.

For example, the iPhone X’s screen only works on its original device; the

screen from an end-of-life device can’t be reused as a replacement part.

OEMs’ concerns about third-party repairs and resale include

liability for unauthorized repairs or poor-quality replacement parts and the

absence of an electronics repair industry on par with the well-established auto

repair industry, said Walter Alcorn, vice president of environmental affairs and

industry sustainability at the Consumer Technology Association (Arlington,

Va.).

Manufacturers have worked to prevent the growth of such

businesses, Wiens said, such as by cutting off the supply of parts. The public

would benefit from competition in the electronics-repair market, Pearlman

added, because it could drive down costs. Alcorn cautioned, however, that if

right-to-repair laws become prevalent, “some manufacturers will change their

business model,” such as by leasing products instead of selling them.

Assessing lithium battery challenges and

opportunities. A session on lithium batteries addressed safety

hazards, proper handling, and the resale and recycling markets. Single-use

lithium primary batteries and rechargeable lithium-ion batteries are becoming

more prevalent, and higher energy densities will be coming, said Todd Ellis,

stewardship program director for Call2Recycle (Atlanta). He advised recyclers

to carefully vet downstream processors, designate proper storage areas, and train

employees in standard procedures for identifying and handling batteries.

Fire is the biggest hazard in lithium battery recovery and

recycling. Anyone who handles large volumes of these batteries “will have a

thermal event,” said Craig Boswell, president of HOBI International (Dallas).

These fires “burn really hot, [and] it’s easy to injure an employee.” Using a

putty knife or other metal tool to remove a glued-in battery can short-circuit

the battery or start a fire, the speakers warned. HOBI’s employees use a

plastic paddle to sweep a burning battery to the floor and let it burn out,

which happens very quickly, he said. Keep work areas free of combustible

materials such as paper, he added, to avoid a larger fire.

“Water is your friend” in extinguishing lithium battery fires,

said Todd Coy,

executive vice president of battery processor Kinsbursky Bros./Retriev

Technologies (Anaheim, Calif.). “If you don’t have sand available, use water,”

which has cooling properties that chemical fire suppressants do not.

Battery reuse is “where the big opportunity is,” Boswell said,

but testing is essential. “Just because it functions doesn’t mean it qualifies

for reuse.” HOBI only resells batteries with a state of health of 85 percent or

greater, he said. Follow safe practices when storing batteries in the testing

area, too, he added.

Kinsbursky’s facility in Brea, Calif., has provided collection,

remanufacturing, and fulfillment services for automakers’ electric and hybrid

vehicle batteries since 2015, Coy said. Its Trail, British Columbia, smelter

recycles 4 million pounds of lithium batteries a year, recovering lithium

carbonate, cobalt-containing products, and metals. It has created recovery and

disassembly guides, as well as cathode, anode, and recyclability reports, for

its OEM clients on more than 150 different batteries, he said.

Kinsbursky did not anticipate the dozen-plus EV battery

chemistries—with more to come—and the great variety in battery forms that would

enter the market, Coy said. Nor did it anticipate the growing interest in

reuse: EV batteries have a potential second life of about five to eight years,

he said, but damaged EV batteries introduce significant costs and risks to

recyclers. Markets for the recovered materials are growing, he added.

Robert

Kang, CEO of Blue Whale Materials (Washington, D.C.), also said

he expects dramatic growth in demand for battery materials and for closed-loop

recycling. His company wants to “establish a bridge between sources of material

and the South Korean lithium-ion battery market.” South Korean recovery

facilities’ operations—the mechanical processing of lithium batteries to a

“black sand” and hydrometallurgical recovery of metals—have a low environmental

impact and recover 95 percent of the metals, he said. Five companies, all based

in Northeast Asia, are 77 percent of the lithium battery market, Kang said, and

the manufacturing is concentrated in Asia as well, making the case for South

Korea as a destination for recovered batteries.

Quality and Markets Dominate Paper, Plastics Sessions

ISRI2018 offered strategies to help paper and plastic recyclers

affected by China’s import ban to improve the quality of their products and

find alternative markets.

Paper recyclers seek “non-China” solutions. Paper was among

the first scrap materials to feel the effects of China’s limiting scrap

imports, said panelists at the paper spotlight session. Paper recyclers have

had to rethink the way they do business, said moderator Leonard Zeid,

vice president of marketing for Midland Davis Corp. (Clayton, Mo.).

OCC prices in the United States have fallen by half since last

year, while prices for mixed paper have fallen about 90 percent in that same

time, said

Ketan Mamtora, vice president of BMO Capital Markets, and Greg Rudder,

lead editor for RISI. China’s ban on imports of “unsorted” recyclables means

almost no mixed paper from the United States, Europe, or Japan is being sold

into China. Instead, exporters are diverting mixed paper to other Asian ports,

the speakers noted.

Yet there are some areas to be optimistic about, such as a

growing “non-China” market for OCC, Mamtora said. India and Vietnam saw a

210-percent and 325-percent increase, respectively, in imports of OCC from the

United States in January and February 2018, and some in the industry have

called Vietnam “the new China,” he said.

Due to China’s new trade restrictions, RISI has made several

changes to its pricing index for China, the speakers said. It discontinued its

assessments of U.S. mixed-paper exports to China in March.

Plastics recyclers focus on demand, recyclability. One

priority for U.S. plastic recyclers and the Association of Plastic Recyclers

(Washington, D.C.) is encouraging brand owners and product designers to make

more of their plastic packaging recyclable, noted APR President Steve Alexander

at the plastics spotlight session. To facilitate that, the association has

introduced its APR Design Guide for Plastics Recyclability, which includes

protocols for testing a product’s sortability and recyclability.

Increasing demand for recovered plastics is another top priority

for the U.S. plastic recycling industry. “If you do that, you increase the

monetization of the product all the way back through the stream,” Alexander

said. APR’s Recycling Demand Champions program encourages manufacturers to

“expand the recycling paradigm” by using postconsumer recycled resin in

products such as pallets, dunnage crates, and shopping carts. “The potential

opportunities here are enormous,” he said. Another way to improve demand is to

reduce contamination in the recovered plastic stream, he said. APR is

addressing that point by offering customized training for brand owners whose

products are considered contaminants.

Additional demand potential also exists in traditional U.S.

plastic recycling markets, said Scott Saunders, general manager

of KW Plastics (Troy, Ala.), which recycles more than 500 million pounds a year

of HDPE and PP. The main “limiting factor for growth” for KW, in fact, is a

shortage of scrap. “We have capacity available,” he noted. “There is a ready,

willing, and able market for every pound that you can generate, and it’s at

good prices.” That’s why KW views China’s import bans on certain scrap plastics

as a “very large market opportunity,” he said.

Hefty has introduced its EnergyBag as one option for managing

hard-to-recycle plastics such as multilayer, multimaterial flexible packaging.

First Star Recycling (Omaha, Neb) implemented the program in 2016, said project

manager Danielle

Easdale. Consumers buy the bright orange Hefty EnergyBags, fill

them with plastics that their local curbside recycling program doesn’t accept,

and put the sealed bags in their recycling bins. The curbside hauler delivers

the material to First Star, which pulls the Hefty bags out of the stream at the

beginning of the recovery process. The diverted plastics then are available for

pyrolysis facilities for conversion to diesel fuel, use as a fuel alternative

to coal in cement kilns, and use in products such as fence posts or wallboard.

“We’re constantly looking at ways we can use these materials and convert them

into valuable resources,” she said. So far, First Star’s program has collected

more than 23,500 bags, equivalent to 13 tons of hard-to-recycle plastics.

Designing for recycling and for incorporating recycled material.

Companies constantly aim to create better, lighter plastic packaging, but “we

have to make sure that the resin … has a home” at its end of life, said Sunil Bagaria,

co-founder and president of GDB International (New Brunswick, N.J.), at a

session on increasing recycled resins in packaging. Another goal is to ensure

that “everybody who is involved in that chain—from the collector to the

processor and then the manufacturer—is able to make some money doing it.” Since

the 1950s, almost 5.6 billion mt of plastics have gone to landfill or habitats

such as the ocean instead of being recycled. “We cannot continue to do this,”

Bagaria said.

One solution is to incorporate more recycled materials into

packaging. Tamsin

Ettefagh, vice president of sales and purchasing at Envision

Plastics (Reidsville, N.C.), pointed out the need to educate both manufacturers

and the public to create and demand packaging that incorporates recycled

materials. For example, instead of producing packaging for items in the grocery

store’s dairy aisle from a variety of resins, “why not use the same resin

across the board and make it easy for the consumer?” Ettefagh asked. Using just

one resin and then telling consumers “to recycle anything in the dairy aisle”

would simplify the recycling process. “They get that. They don’t get No. 1s,

No. 2s, HDPE, [and] polypropylene,” she said.

MRFs seek better quality. More types of packaging are

finding their way into recycling bins than ever before while MRFs are

scrambling to improve the quality of their bales. Speakers at the session on

MRF collection and quality issues discussed the frustrations of reducing

contamination while handling the ever-changing recycling stream. With China’s

new threshold of no more than 0.5-percent prohibitives for paper and most other

scrap, MRFs are working harder than ever to keep their material clean,

panelists said.

Bob

Cappadona, vice president, recycling, for Casella Waste Systems

(Rutland, Vt.), said MRFs are slowing down sorting lines or adding labor in

order to get better quality. Contamination causes MRFs to shut down multiple

times a day so workers can clear out clogged sorting screens, which eats into

productivity time, he said. “When you have 25-percent contamination coming in

the door, and we’re trying to reduce it to less than 2 percent—that’s very,

very difficult,” he said.

At the same time, customers “want to recycle easily, efficiently,

and don’t want to spend a lot of money on it,” said Susan Robinson, senior public

affairs director for Waste Management (Houston). That’s why they love

single-stream recycling, which lowers collection costs but also reduces

material quality. Part of the problem is that MRFs haven’t done a good enough

job of educating the public about what should and should not go in the blue

bin, she said. Better consumer education can help bring in better-quality

materials, she said.

The How2Recycle product label can help, said Nina Goodrich,

executive director of GreenBlue and director of the Sustainable Packaging Coalition

(Charlottesville, Va.). The labels, which brand owners voluntarily place on

their products, offer specific instructions for preparing and recycling various

packaging. The labels “motivate and help brands understand packaging

sustainability … and empower consumers to know how to recycle it,” she said.

Felix

Hottenstein, sales director at optical sorting equipment

manufacturer MSS (Nashville, Tenn.), pointed out that processors can reduce

contamination and produce higher quality bales by optimizing existing

equipment, such as by regularly performing preventive maintenance and running

at recommended capacity, and by adding new sortation equipment. Hand-held

analyzers, antiwrapping and self-cleaning disc screens, and optical sorting

equipment all can improve quality, Hottenstein said.

When it comes to recycling plastic, “we have a lot of work to

do,” said Bill

Schreiber, technical director of plastics at Lehigh Technologies

(Tucker, Ga.) in a session on improving quality through proper plastic resin identification.

For example, only 19.5 percent of PET, the most recycled resin, is recycled, he

pointed out.

One of the “rules” of plastics recycling is that most resins are

incompatible with each other, he said. Even if you can make the incompatibles

work together, there might not be a market for the product. The highest value

that recyclers can achieve is by keeping the different types of plastics

separate from each other and to separate them if they’re mixed, he said. He

described the strengths and weaknesses of a range of analyzers available for

identifying resins.

Tire Recyclers Look at Changing Markets

More scrap tires are being generated in the United States, but

finding end users for recovered rubber continues to challenge recyclers.

Rubber recyclers assess market opportunities. Scrap tire

generation rates have increased and markets have declined over the last couple

of years, according to John Sheerin, director of end-of-life tire programs at the

U.S. Tire Manufacturers Association. “There’s always a need for more and better

markets,” he said.

The recently released 2017 USTMA Scrap Tire

Management Report shows a roughly 3-percent increase in scrap tire

generation from 2015 to 2017, which he attributed to more driving. “The

tendency to drive more has overcome the tendency for tires to last longer, so

we’re seeing a higher generation rate,” he said.

Tire-derived fuel remains the largest market for scrap tires, but

it’s down about 10 percent from 2015 to 2017, Sheerin said.

The three principal industries using TDF—cement, pulp and paper,

and utilities—have fluctuated in dominance over the years, with cement

currently in the lead, said Terry Gray, president of TAG Resource Recovery (Houston).

In 2015, the United States had 39 cement plants in 13 states using

TDF, consuming 46 million tons of tires. The pulp and paper industry had 21

plants in 15 states using TDF, consuming 37.6 million tires, and

power-generating utilities had 25 facilities in eight states using TDF,

consuming 33.7 million tires. State regulations have had major impacts on its

use, such as the loss of the former Exeter tire-to-energy facility in Sterling,

Conn., which used 10 million tires a year, he said. TDF use is likely to

decrease in biomass energy facilities and coal-fired power plants—and it’s

being “clobbered” where there are incentives to use solar and wind power, Gray

said. But TDF for power generation in municipal solid waste power plants could

increase if the capacity is available, he said.

The synthetic turf infill market fell about 20 percent during

that time, which Sheerin attributed largely to concerns about the material’s

health and environmental impact. “As more and more studies confirm no impact to

human health and the environment … we anticipate the sports turf market coming

back,” Sheerin said. “We hear very good things for 2018.”

Sheerin also said he anticipates an increase in scrap tires being

used in civil engineering, such as incorporating the rubber into asphalt.

Speakers at a session focused on emerging opportunities for crumb rubber

manufacturers concurred. Rubber-modified asphalt is less sensitive to

temperature, reduces traffic noise, and reduces surface rutting, said Barry Takallou,

president and CEO of CRM Co. (Newport Beach, Calif.). (See “Paving the Way for

Asphalt Rubber” on page 51 of this issue.)

Art

Dodge, CEO of Ecore International (Lancaster, Pa.), touted the

benefits of using crumb rubber as a flooring underlay to absorb shock and

sound. Hospitals and nursing homes can benefit from the shock-absorbing material

to cushion patient falls; the rubber underlay also makes the rooms quieter,

which can speed patient recovery, he said. Hotels can benefit from the sound

absorption as well, he said.

Tom

Redd, CEO of Pyrolyx USA (Terre Haute, Ind.), explained that pyrolysis

can separate the valuable carbon black from tires’ metal and rubber. Although

recovered carbon black might be a completely unknown commodity to most

recyclers, Redd suggested thinking of it as a commodity, “the same way you

think of something like recycled pulp or aluminum or steel.”

Culture, Technology Are Among Safety and Operations

Concerns

Safety remains a priority for the scrap recycling industry, and

safety professionals offered advice for making safety an integral part of scrap

facility operations.

Safe operations require a safety culture. ReMA Vice

President of Safety Terry Cirone pointed out that a safety culture is more than

having a safety program, it’s a “part of your overall business culture—it’s a

measurement of how well things are done in your business.” In a facility with a

good safety culture, a lower-level employee should feel free to call out

longtime workers who don’t have their PPE on, for example. “If you can trust

your employees to take care of each other, you have a safety culture … [you

can] build on,” she said.

Collecting and analyzing data from your operations is critical to

understanding workers’ behavior and not just their attitudes about safety.

Track near misses, Cirone said, and share them. “A near miss is a lagging

indicator; it’s luck,” she said. “But it’s a prime piece of data you can learn

from. Identify trends, and let employees know what to do to prevent [near-miss

incidents from] happening again.” Also let workers know when you’ve fixed a

problem based on their input, she added. “Then they’ll keep coming to you with

problems,” she said. “That’s a good thing.”

Tony

Smith, ISRI’s director of safety outreach, advised recyclers to

think beyond the safety culture to their overall business culture. “Everyone in

the company is equal in terms of safety compliance,” he said. Among his

recommendations were to have workers in the field conduct safety “toolbox

talks” and “tailgate meetings,” and to put them to work on safety committees

rather than just have complaint sessions. Also, get workers into the habit,

before they start working, of conducting two-minute hazard-assessment drills

where they look around for “what can hurt me? What can go wrong?”

MRFs tackle lithium-ion battery fires. More items than ever

have lithium batteries: digital cameras, cellphones, toys, and even power

tools. When consumers throw these devices away, they can end up at MRFs, where

the batteries can cause fires when crushed or bent.

Lithium batteries—both rechargeable lithium-ion batteries and

smaller, one-time-use lithium primary batteries—are beginning to replace

nickel-cadmium batteries on store shelves, said Todd Ellis, director of

stewardship programs for Call2Recycle (Atlanta), at a session on MRFs’ efforts

to keep these hazards “out of the bin.” Ellis recommends that MRFs work with

state or provincial officials, recycling organizations such as ISRI, and

Call2Recycle to spread the word that batteries don’t belong in the recycling

bin.

Some batteries inevitably will end up at a MRF, so train employees

to spot them and items that usually contain them, such as cellphones. Pull such

items off the line and set them aside until you can “find a recycler to partner

with” to pick them up. MRFs can participate in Call2Recycle’s program, which

provides collection boxes to safely store batteries for proper pickup and

disposal, but some use buckets or metal drums as a collection vessel to keep

the batteries away from flammable materials. Be sure to separate the batteries

in plastic zip bags, he warned, or securely tape the positive and negative

terminals. Otherwise, the terminals could rub against other batteries, causing

a spark that can ignite the whole bin. “Clear packing tape is good—Scotch tape

just doesn’t hold,” Ellis said. If a battery does ignite, the fire burns very

hot, he noted, and requires “lots and lots of water” to put out.

Technology aids worker safety, equipment performance.

Recyclers can leverage numerous technology tools to enhance worker safety and

improve the maintenance and performance of their mobile equipment.

Caterpillar (Peoria, Ill.) has introduced two products to

minimize fatigue-related risks, said Mark Dowsett, a Cat account

manager in Portland, Ore. The Smartband is a wrist-worn predictive tool that

monitors the quantity and quality of workers’ sleep to ensure they are fit for

duty. The Driver Safety System is a dashboard camera that monitors the driver’s

face for signs of nodding off. Customers who use the Smartband and Driver

Safety System have seen an 80-percent reduction in fatigue-related events,

Dowsett said. Cat also has a Detect for Personnel system that uses RFID chips

in safety gear such as reflective vests and hard hats that mobile equipment can

detect. Upon detection, the system sounds an alert to reduce the chance of the

equipment injuring workers on the ground.

Fleet management camera technology can monitor activities inside

and outside the truck to improve driver performance and address accidents and

other issues, noted Garry Mosier, vice president of national accounts for 3rd

Eye (Katy, Texas). The cameras record high-definition video continuously. If

the system detects a driver violation—such as running a stop sign—or if the

truck exceeds a specific G-force level, the camera records the event and

uploads it to 3rd Eye’s review center in Texas, which scores the incident and

uploads the footage to the customer’s portal.

Telematics can help recyclers monitor the operating health of

their equipment, conduct remote diagnostics, and use the collected data to

improve operator and machine performance, said Dave Adams, a manager at Volvo

Construction Equipment (Shippensburg, Pa.). Having different telematics systems

in fleets of mixed equipment can present problems, however, and the

“information overload” from the systems can be “a huge time and resource

constraint,” he added. Volvo CE’s ActiveCare Direct program has helped

customers lower their fuel use 10 to 15 percent, reduced their machine idle

time 7 percent, and increased machine use 5 to 10 percent, he said.

Certification programs keep pace with change. “Every

[recycling] standard known to man has undergone a revision in the last three

years,” said Darrell

Kendall, executive director of the Global Recycling Standards

Organization, which manages the Recycling Industry Operating Standard™.

As the recycling industry changes, so must the industry standards,

certification criteria, and auditing processes change to reflect conditions

recyclers are dealing with at their facilities. He pointed out that the changes

RIOS has adopted focus more on quality to meet certain requirements suppliers

and consumers seek in their vendor selections. Another addition is a

requirement for incident investigations: Near-miss reports now must trigger

root-cause investigations, he said. The revised standard also puts stronger

requirements on senior management to be involved in the program. The revised RIOS

Implementation Guide for RIOS members contains templates,

supplemental worksheets, policies, and procedures, all written clearly for

recyclers, not for “MIT rocket scientists,” he said.

The Responsible Recycling standard also is undergoing an upgrade,

according to Corey

Dehmey, R2 director at Sustainable Electronics Recycling

International (Hastings, Minn.). The group’s technical advisory committee revises

the standard on a five-year cycle to keep up with changes in the marketplace,

but the committee determined that the standard now needs a major restructuring

to meet the changing needs of the 768 facilities in 32 countries that have been

certified to date. The standard previously focused on collecting and processing

end-of-life equipment, but now manufacturers also want to certify their repair

facilities, he said. The committee is considering proposed changes and hopes to

have a draft of the revised standard by the end of the year, he said.

Tips and Tools for Running a Successful Business

Recycling businesses can benefit from best management practices

from experienced scrap professionals and leaders in other industries,

participants learned in varied business-management sessions.

Nonferrous traders offer advice for the novice. “No price,

deal, or sale matters when you’re selling scrap metal if you do not get paid,”

warned Eric

Zwilsky, vice president of Potomac Metals (Sterling, Va.), who

shared trading tips that have helped his company. “Bankruptcies happen,” he

said, and eventually every business will encounter a situation where a business

can’t pay its customers. He advised getting insurance on receivables when

selling scrap on terms or getting payment in advance—especially when exporting

material—and insuring the trucks going out. Zwilsky also offered advice on when

to lock in prices and when to ship. “Try to deal back to back,” he said,

ensuring each load you buy has someone ready to buy from you. And the time to

ship is “Now! If your payment is secure … and pricing is confirmed, there’s no

reason to hold the material back.”

Hedging is another valuable strategy for scrap traders, according

to Randy

Goodman, executive vice president of Greenland (America)

(Roswell, Ga.). You don’t need to have a commodities brokerage account to

hedge, he said; you can do it yourself on a small scale. For example, if you

have a load of scrap you know you’re going to generate soon, you can sell it

unpriced but locked to a price spread or differential. “Hedging is reducing

risk,” he stressed. “That’s the only thing it should be used for. It should

never be used as a tool to make money.”

Traders should visit processors to see the quality of the

material they’re buying and to make sure it’s what processors say they’re

making, advised Stephen Moss, vice president of Stanton A. Moss Inc. (Bryn

Mawr, Pa.). “The worst thing you can have in this business is rejections,” he

said. “Rejections don’t make anybody any money. All they do is cost you money

and time and your reputation.”

Learning the range of metals identification techniques.

It’s worth knowing the “classical” methods of identifying metals, though those

techniques are disappearing as hand-held metal analyzers have gotten faster,

said Jim

Pasmore, president of Analytical Sales/Training (Bend, Ore.).

No-tech ID methods include form factor, object recognition, color,

weight/volume/density, and magnetic response; low-tech approaches include spark

testing, chemical spot testing, and thermoelectric resistance testing.

Combining ID methods also can be useful, he said.

Pasmore described the characteristics and benefits of several

metal-sorting technologies available to scrap recyclers. On-site spectroscopy

works well for new and entry-level sorters, he said, and many consumers require

that capability. Costs of the equipment are dropping, and the investment in

that technology can pay for itself in just months, he said. X-ray fluorescence

is a mature technology, and laser-induced breakdown spectroscopy is becoming

mature. These technologies can replace some capabilities of optical emission

spectrometer instruments, with the exception of identifying carbon and tramp

elements, he said. LIBS works better than XRF for light elements, such as

aluminum and magnesium, but alloys are more complicated, he noted. He also

warned that, in general, an XRF instrument is less sturdy—so don’t drop it.

One of the challenges of metal identification is that there are

more than 100 grades of alloys out there, but perhaps only 30 percent are pure

metals or high alloys you can identify with XRF, LIBS, or OES, Pasmore said. He

advised using best practices for sample preparation and length of exposure to

the instruments.

Electronic payment systems offer benefits and challenges.

In an era of rapid electronic transactions, “sometimes you need to slow down”

because mistakes can happen fast, too, said Kevin Lamar, chief financial

officer of Dynamic Metal Services (Bedford Heights, Ohio). Your company’s

finance department needs technology to increase efficiency, but slowing down

the transaction approval process can help avoid mistakes. Work with your

bankers as experts and consultants, Lamar advised, because they have fraud

prevention tools, for instance, and they know the best processes available.

Different transaction systems are appropriate for payment flows

between different points in a scrap recycler’s value chain from supplier to

customer, noted Joe Casali, senior vice president, operations and IT, of

the New England Automated Clearing House Association. For instance, peddlers

often want to be paid in cash, but you could pay a commercial supplier using an

automated clearing house, with invoices and checks traveling electronically.

Businesses need accounting systems that can integrate the variety of payment

and settlement channels, he said, including cash, checks and ACH networks,

credit/debit/prepaid cards, electronic-fund transfer payments, and wire

transfer networks.

One advantage ACH transactions have over card and wire

transactions is that you can reverse them if you’ve made a mistake, pointed out

Stephanie

Prebish, a senior director of the National Automated Clearing

House Association. Card and wire transactions are immediate, but they cost more

and are irreversible. She also observed that new entrants to the “payments

ecosystem,” such as PayPal, Amazon.com, Apple Pay, and Zell, bring new risks.

Such technologies meant to facilitate transactions also require “changing

consumer behavior, and that’s not an easy thing to do,” she said.

Other challenges include keeping up with new laws covering check

processing and data privacy, as well as potential security and fraud problems,

Casali said. “Fraudsters are super creative,” he said. “It’s good to be a fast

follower” as technology changes, but businesses should understand their needs

and those of their customers.

Proactive measures can cut insurance costs.

“Don’t Get Eaten Alive” addressed cost-containment strategies for human

resources. To keep down your worker’s comp insurance costs, build a culture of

safety, said Steve

Fuoco and Jason Maslin of insurance and risk-management firm Bradley

& Parker (Melville, N.Y.). For example, have a safety committee meet

regularly to set rules and look for the root causes of near misses and

accidents. “Find out the why, not the who—don’t place blame,” said Maslin, an

insurance counselor for the firm.

Noting the prevalence of sexual-harassment claims in the past few

years, Maslin recommended making that training part of the safety program.

Airborne-hazard-related claims will soon be common, predicted Fuoco, senior

vice president. Conduct baseline tests of employees’ lung function—and their

hearing and vision—when you hire them, he said, so you can measure later claims

against that standard.

If you’ve got a good safety record, a captive insurance program

or a large-deductible program can save you money, Fuoco said. Also ask

insurance providers about potential cost-cutting changes to variables that can

affect your rate, such as the low-cost multiplier, premium discounts, scheduled

credits, and discounts based on your experience modification.

Human-resource software systems can manage payroll, health

insurance, retirement plans, performance reviews, and more, cutting the time

and money you spend on administering them, said Joe Applebaum, founder of

Potomac Cos. (Rockville, Md.). He reviewed large and small strategies for

reducing health-insurance costs, from switching to a high-deductible insurance

plan to teaching employees how to reduce prescription drug costs. Employee

benefits such as retirement plans, life and disability insurance, and wellness

plans can help with retention, he pointed out.

Hiring, inspiring, and retaining talented workers. “Human

capital is severely lacking in all businesses these days,” said Tannen Ellis-Graham,

co-founder of CareerKarma360 (Sandy, Utah), at the session on locating and

recruiting top talent. Sammy Holaschutz, a trader for W Silver Recycling (El Paso,

Texas), suggested one way to find employees is to mine prospects from other

industries and professions, then train them. Holaschutz was a tax accountant

whom W Silver recruited and trained to work as a nonferrous trader. “We’re

looking for people who are completely different, but who have the right skill sets,”

he said. “We do not shy away from diverse candidates. We’re a global industry,

so we need to take a global, diverse approach.”

Recycling companies must compete for talent by making it easy for

prospects to find them online and through social media and then by presenting a

compelling employer brand, Ellis-Graham said. The candidate experience starts

from the moment prospects find your company to the point you either accept or

reject them. It’s particularly important to make your application process easy

and tech savvy, she added. Candidates—especially millennials—expect to be able

to apply to your job on the phone, and they expect you to interact with them

promptly, or they’ll move on. “Speed is the new currency,” she said.

Employers in scrap recycling are engaged in a “war for talent,”

competing to retain employees in a tight market, according to Kimberly Jones,

CEO of talent-acquisition firm Kelton Legend. Employees might be actively or

passively job hunting and could be poached by competitors, but having a talent

strategy can help you keep the talent you already have, Jones said.

Company culture is a major factor that keeps or pushes away

employees. Leaders create a positive culture by engaging with employees and

encouraging a work–life balance—qualities especially important to millennials,

now the largest generation in the workforce. But millennials aren’t the only

employees who thrive from engagement; workplaces benefit when managers get to

know the various generations, understand generational differences in the

workforce, and identify generational gaps, according to Gary Hensley,

Southern region vice president of EMR (USA Holdings) (Bellmawr, N.J.). “If we

don’t understand their needs, we can’t effectively manage,” he said. Empowered

employees are more likely to stay with a company. Managers can foster

empowerment by assigning meaningful projects, updating employees on company

performance—even negative performance—and regularly conducting reviews in which

leaders explain how employees can add value.

“People who have been given a plan and know what’s expected of

them are more likely to hit performance goals,” Jones said.

A positive company culture is one where leaders make

communicating with employees a priority, according to panelists at a session on

ways leaders can support new ideas and innovation. It also requires taking

risks and allowing employees to do so as well, they said.

“Challenge everything, and give everybody the right to challenge

everything,” said Bruce Shapiro, president and CEO of Shapiro Metals (St.

Louis). “The more we challenge, the more we learn and the better we get.”

“Lead by example,” advised Mark Lasky, CEO of Sadoff Iron

& Metal Co. (Fond du Lac, Wis.). “Be accessible,” and create an environment

where employees feel comfortable and empowered to have tough conversations. “A

‘culture of fear’ leads to silence or violence,” he said.

Eliminating one-way, top-down communication and encouraging

two-way communication between leaders and employees “has helped us to seek

other people’s input” and implement new ideas, said Brandi Harleaux, chief

operating officer of South Post Oak Recycling Center (Houston).

Workplaces that discriminate on the basis of factors such as age,

race, sexual orientation, and gender will hurt workers and possibly cost their

company thousands of dollars, according to Joshua Treece and Michael Gardner,

principals of law firm Woods Rogers at a session on workforce compliance

issues. They gave many real-world examples of bungled workplace compliance

issues and how managers and companies faced consequences for violating Title

VII of the Civil Rights Act of 1964, which prohibits employment discrimination

based on race, color, religion, sex, and national origin.

The bottom line, Treece and Gardner said, is that workplaces must

have written policies in place that expressly forbid these types of

discrimination, and they must follow them. Having written policies not only

sets clear workplace behavior expectations but also is “critical in order to

defend yourself in court,” Gardner said.

Recyclers address intergenerational matters. Family

businesses abound in the scrap recycling industry, and transferring ownership

to subsequent generations is a significant concern, according to speakers at a

session on “keeping it in the family.” Being born into or marrying into a

business “creates a lot of complexities” that aren’t necessarily present when

consciously choosing business partners outside the family, said Dana Telford,

principal consultant of the Family Business Consulting Group. For example,

conflicts between family members at work can spill over to home life.

The prospect of keeping a business within the family when one or

more of the owners wishes to retire or leave the business also can create

conflicts, Telford said. In some cases, no family members are interested in

taking over the business, which can cause stress on the older generation. In

other instances, too many people are interested, creating stress among the

younger generation. Older generations also feel stress about letting go of the

business and about the subsequent generation’s capabilities.

Older generations should consider a business valuation to

determine a fair sale price, said Vince Pappalardo, managing

director for the metals and metals processing practice at Chicago-based

investment banker Brown Gibbons Lang & Co. He also recommended doing a

thorough assessment of whether selling to someone outside the family ultimately

would be better for the business. “If you sell it to somebody who doesn’t want

it, that’s going to be worse for everybody in the long run,” he said. Many

forms of business sales exist, he added, noting that owners do not have to sell

off an entire business all at once.

Whether members of the same family or not, industry veterans and

young recyclers can learn from each other, said panelists at the “Old School

Meets New School” session.

Younger recyclers have fresh ideas on how to make businesses

thrive, while the older generation has years of experience and wisdom to share,

said the panel, comprising two members of ISRI’s Century Club, for those with

100 years of combined age and experience, and two of ISRI’s Young Executives

group.

Dan

Garvin, president of Colorado Iron and Metal (Fort Collins,

Colo.) and a Young Executives member, said technology makes business more

efficient, but he appreciates the “lost art” of testing metals using acid or

spark tests, for example. Yet Barry Hunter, president of Hunter Alloys (Boca Raton, Fla.)

and Century Club co-chair, said new technology isn’t everything—sometimes years

of know-how are better.

Older generations take great pride in hard work, and younger

generations have built on that by prioritizing workplace initiatives where

employees feel appreciated, said South Post Oak Recycling Center’s Brandi

Harleaux. At South Post Oak, “the mantra in our yard has shifted from ‘a place

to work hard’ to ‘a fun place to work hard,’” she said.

Though the old and new schools may not see eye to eye on

everything, the four panelists agreed that safety should be the No. 1 priority

in every yard. “Our industry does not have a good safety record,” said Century

Club member Don

Lewon, CEO of Utah Metal Works (Salt Lake City), although he believes

safety has improved. For example, he noted that when he began in the business,

“the forklift didn’t have a seat belt … but now the guys are wearing them all

the time.” Garvin said the industry has improved its focus on safety, but it

can do a better job of making safety a habit instead of an obligation.

Kent Kiser, Rachel H. Pollack, Katie

Pyzyk, Megan Quinn, and Cynthia G. Wagner

(Sidebar Content)

Individuals, Companies

Honored With 2017 Vehicle Safety Awards

Joseph Cody

of Sims Metal Management (Sacramento, Calif.) received ISRI’s Safe Driver of

the Year Award recognizing his 44 years of safe driving. (See ScrapTV’s

interview with Cody at youtu.be/MfskePsz95w.) Armando

Ojeda, a diesel mechanic at Rocky Mountain Recycling (Commerce City,

Colo.), earned the Golden Wrench Award for outstanding achievement in vehicle

maintenance. ReMA recognized Cody and Ojeda April 18 during the Spotlight on

Transportation.

The association also recognized the following

companies for their fleet safety programs. The Best Fleet Award recognizes

companies with the lowest vehicle accident rate and the lowest U.S. Department

of Transportation recordable rate in the previous year. The Pacesetter Award

uses the same criteria but covers a three-year period, in this case Jan. 1,

2015–Dec. 31, 2017.

Best Fleet

Award

Small Class (300,000–500,000

miles): Shine Bros. Corp. (Spencer, Iowa), Berman Bros. (Jacksonville, Fla.),

General Metals of Tacoma (Schnitzer Steel Industries) (Tacoma, Wash.)

Intermediate Class (500,001–1 million miles): United Scrap Metal

(Cicero, Ill.), Rochester Iron and Metal (Rochester, Ind.), TJN Enterprises

(Spencer, Iowa)

Medium Class (1,000,001–5

million miles): Metal Exchange Corp. (St. Louis), Prolerized New England Co.

(Schnitzer Steel Industries) (Warwick, R.I.), LP Transport (LP PADNOS)

(Holland, Mich.)

Large Class (more than 5

million miles): OmniSource Transport (Fort Wayne, Ind.)

Pacesetter

Award

Small Class (300,000–500,000 miles): General Metals of Tacoma (Schnitzer

Steel Industries)

Intermediate Class (500,001–1 million miles): Consolidated Scrap

Resources (York, Pa.)

Medium Class (1,000,001–5 million miles): Prolerized New England Co.

(Schnitzer Steel Industries)

Large Class (more than 5 million miles): OmniSource Transport

ISRI Hosts Launch of MusicRecycle

MusicRecycle,

a new campaign using music to promote public education about recycling, brought

members of the recycling and entertainment industries together at a lively

reception during ISRI2018. Music can

reach billions of people in ways no other medium can, said Gemini Corp.

(Antwerp, Belgium) Chairman Surendra Borad Patawari, whose family is supporting

the initiative with ReMA and the Berklee College of Music. His daughter—singer,

songwriter, producer, and Berklee graduate Kanika Patawari (above

left)—reminded attendees of the power of music personified by such artists as

Joan Baez, George Harrison, and Ravi Shankar.

“So, what can music do for recycling?” Kanika asked.

It can help get youth interested, she said. “Make it uncool not to recycle.”

Recycling has a “strong industry, and [with the] association’s finesse we can

gather star power,” she said. She asked attendees to tap their contacts in the

music and recycling industries, noting that ISRI’s convention in Los Angeles

next year is an opportunity to promote the MusicRecycle project.

Veteran producer and songwriter Peter

Bunetta (above right) advocated using music videos to help educate young

people worldwide about recycling. “Kids remember the videos,” which bring

awareness about choices, he said. He also suggested the recycling industry

could brand its own music festival. Contact Kanika Patawari at

musicrecycleproject@gmail.