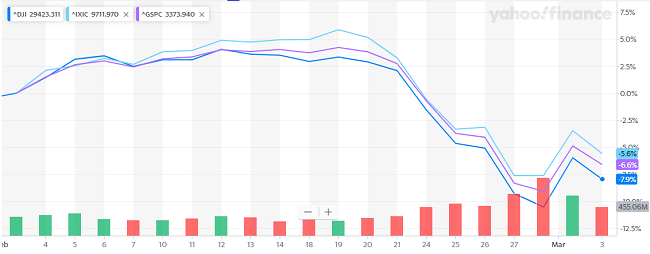

Suffice it to say that last week’s equity market sell-off was the major economic event of the week, with the major U.S. stock market indexes having their worst performance since 2008 as coronavirus worries took hold.

Here are the relative performances of the Dow Industrials, S&P 500, and the Nasdaq:

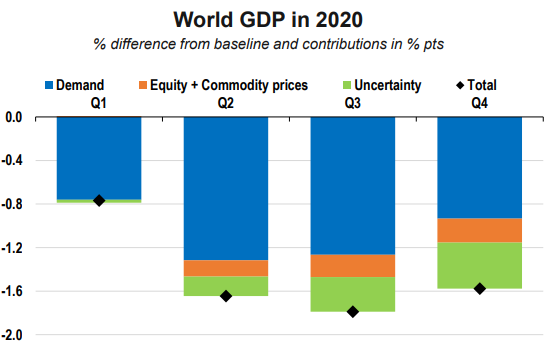

In response, the OECD downgraded their economic projections for 2020 on Monday. In their worst case scenario, they see a -1.5% full year impact on world GDP.

In their base scenario, the OECD sees a less pronounced impact. According their latest report, they see:

- “Severe, short-lived downturn in China, where GDP growth falls below 5% in 2020 after 6.1% in 2019, but recovering to 6.4% in 2021.

- In Japan, Korea, Australia, growth also hit hard then gradual recovery.

- Impact less severe in other economies but still hit by drop in confidence and supply chain disruption.”

Here’s a recap of some of the major economic reports from last week, which the markets largely ignored:

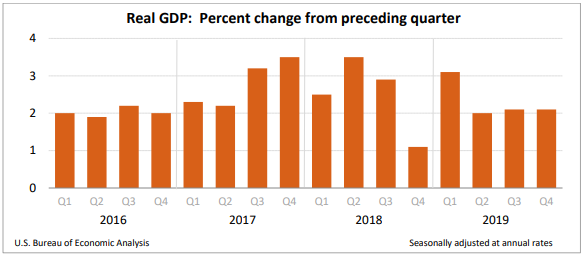

GDP

Real GDP growth for the fourth quarter of 2019 remained at 2.1 percent according to the Bureau of Economic Analysis’ second estimate. The advance estimate a month ago was also 2.1 percent.

Coincidentally, real GDP growth for the third quarter was also 2.1 percent.

For the year of 2019, real GDP was 2.3 percent, down from 2.9 percent in 2018. This reduction in growth is consistent with the forecasts by many economists and the National Association of Business Economists. In 2019, positive sources of growth came from personal consumption expenditures on durable and nondurable goods and services, residential fixed investment, exports of services, imports of goods, federal government spending, and state and local government spending. Negative growth pressures came from nonresidential fixed investment, exports of goods, imports of services, and change in private inventories.

Consumer indexes

Consumers reading of the current economy and the expected conditions remain very strong. Last week, two measures of consumer confidence were released, one from the Conference Board and the other from the University of Michigan, both of which include the time frame to account for the coronavirus impact. The Conference Board Index showed a slight increase in consumer confidence in February, rising very slightly to 130.7 from 130.4 in January (1985=100). Their other two indexes provide further context, the Present Situation Index and the Expectations Index. Showing consumers’ assessment of current business and labor market conditions, the Present Situation Index decreased in February to 165.1 from 173.9 in January. Consumers’ short-term outlook for income, business and labor market conditions, captured in the Expectations Index, improved to 107.8 in February, up from 101.4 in January.

The University of Michigan’s consumer sentiment index also rose in February, to 101.1 up from 99.8 in January. This is the highest level in about two years (March 2018). Consumers’ view of current conditions increased to 114.8 and consumers’ expectations also rose, to 92.6.

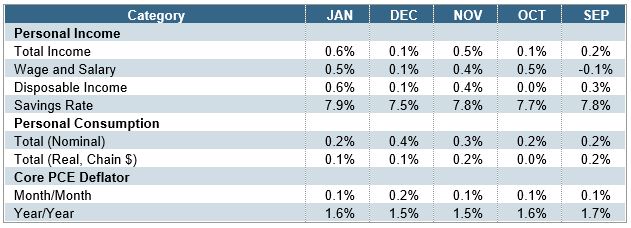

Personal Income and Spending

According to Briefing.com, “The key takeaway from the report is that it continues to show subdued inflation pressure, which might mean something for the Fed if it is worried about demand destruction in coming months, like the capital markets seem to be, due to the coronavirus.”

Durable Goods Orders

Chad Moutray at the National Association of Manufacturers writes: “New durable goods orders edged down 0.2% in January after jumping by 2.9% in December. The decline was led by a significant drop in sales for defense aircraft and parts, which can be highly volatile from month to month, with motor vehicles and parts orders also lower, down 0.8% in January. Excluding transportation equipment, new orders for durable goods rose 0.9% in January, accelerating from the 0.1% gain seen in December. Looking specifically at the latest data, new orders were higher for computers and electronic products, fabricated metal products, machinery and primary metals in January, but weaker for electrical equipment and appliances.

More importantly, new orders for core capital goods (or nondefense capital goods excluding aircraft)—a proxy for capital spending in the U.S. economy—increased 1.1% in January, with 0.9% growth seen over the past 12 months.”