In a surprise move last week, President Trump announced that new tariffs on imports from Mexico will go into effect starting on June 10 unless Mexico acts to stem the tide of illegal immigration into the U.S. According the President’s statement issued on May 30,

“To address the emergency at the Southern Border, I am invoking the authorities granted to me by the International Emergency Economic Powers Act. Accordingly, starting on June 10, 2019, the United States will impose a 5 percent Tariff on all goods imported from Mexico. If the illegal migration crisis is alleviated through effective actions taken by Mexico, to be determined in our sole discretion and judgment, the Tariffs will be removed. If the crisis persists, however, the Tariffs will be raised to 10 percent on July 1, 2019. Similarly, if Mexico still has not taken action to dramatically reduce or eliminate the number of illegal aliens crossing its territory into the United States, Tariffs will be increased to 15 percent on August 1, 2019, to 20 percent on September 1, 2019, and to 25 percent on October 1, 2019. Tariffs will permanently remain at the 25 percent level unless and until Mexico substantially stops the illegal inflow of aliens coming through its territory. Workers who come to our country through the legal admissions process, including those working on farms, ranches, and in other businesses, will be allowed easy passage.”

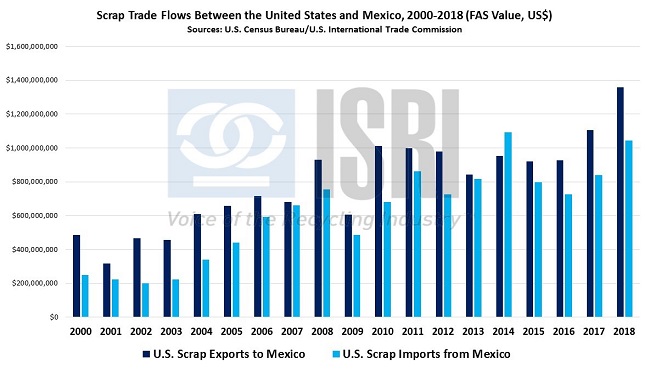

It would be fair to say that markets were rattled by the announcement. The Dow Industrials plunged nearly 355 points lower on Friday to finish the week at 24,815.04, the sixth consecutive losing week, while the yield on 10-year Treasury notes fell to 2.139%, the lowest close since September 2017. Commodities were not immune from the flight to safety as NYMEX crude oil futures declined 5.5 percent to close at $53.50 per barrel on Friday, a six-month low. For scrap market participants, trading with Mexico has taken on greater importance in recent years as the cross-border trade in scrap between the U.S. and Mexico reached just over $2.4 billion in 2018, with the U.S. enjoying a scrap trade surplus of $314 million:

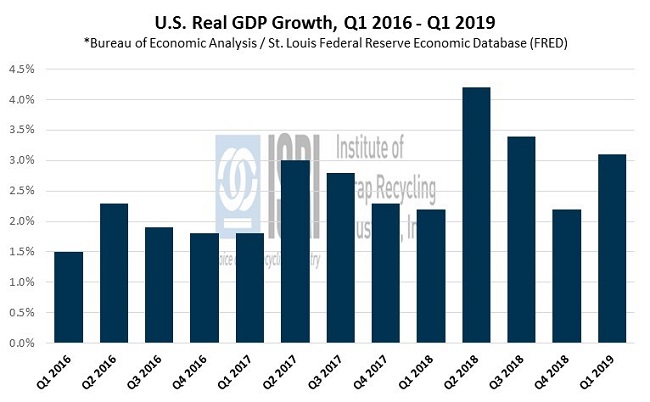

The elevated trade tensions with China and Mexico – our 1st and 4th largest scrap export markets last year, respectively – complicates the outlook for the U.S. economy, which by most measures continues to exhibit signs of growth even at this late stage in the economic expansion. Here’s recap of some of the key U.S. economic reports that have come out recently:

Real Gross Domestic Product. According to the latest estimates from the Bureau of Economic Analysis, real (adjusted for inflation) GDP increased at an annual rate of 3.1 percent in the first quarter of 2019. This is up from the previous quarter’s growth rate of 2.2 percent, but down slightly from the initial Q1 2019 estimate of 3.2 percent growth as downward revisions to nonresidential fixed investment and private inventory investment pulled the estimation lower. However, U.S. exports and personal consumption expenditures were revised upward, along with imports.

Income and Spending. According to the BEA, personal income in the United States increased by a better than expected $92.8 billion (0.5 percent) in April while personal spending was up $40.8 billion, or 0.3 percent. The WSJ reports that “U.S. households spent at a slower but still solid pace in April, suggesting consumers can help extend an already decade-long expansion amid signs economic momentum is easing.”

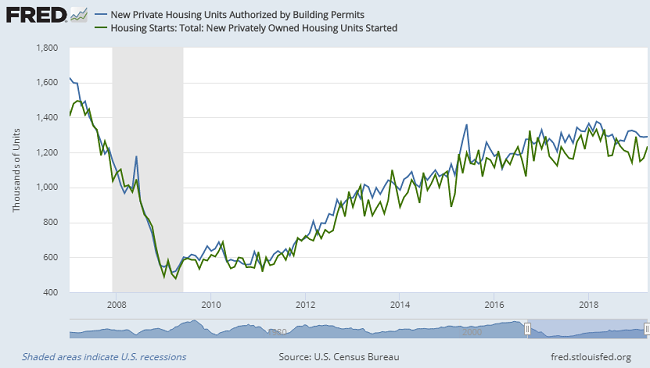

Housing Market. Both the Case-Shiller and the FHFA home price indexes came in below expectations in March. The year-on-year growth in the Case-Shiller index fell to 2.7 percent, which is a 7-year low. For the month of April new home sales declined 6.9% month-on-month to 673,000 SAAR, while pending home sales reportedly declined 1.5 percent. Here’s the recent trend in U.S. building permits and housing starts:

International Trade. The advanced reading on U.S. trade in goods and services shows the U.S. trade deficit widened from $71.9 billion in March to $72.1 billion in April. Capital goods, the largest category of U.S. exports, fell 6.5 percent from the previous month and are down 3.7 percent compared to the previous year. Automobile exports were down even further with a 7.2 percent month-to-month decline and 6.7 percent drop year-on-year. As Bloomberg reports, “The {April} figures precede this month’s escalation of the U.S.-China trade {war} as President Donald Trump increased tariffs on goods from the Asian nation. The U.S. is also threatening to add levies on most remaining imports from China. In prior rounds of tariffs, companies had front-loaded purchases and bulked up inventories, which helped buoy growth in prior quarters but may drag on the economy later in the year.”

Back to Main